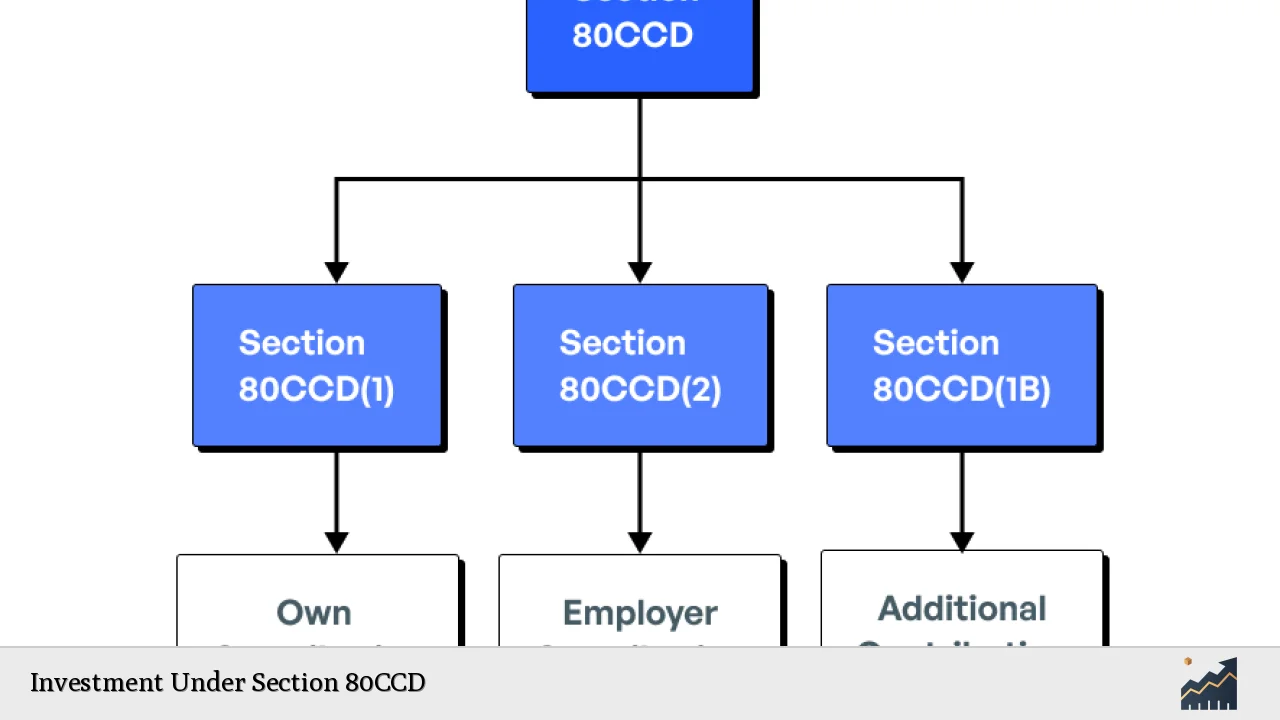

Investment Under Section 80CCD?

Section 80CCD of the Income Tax Act, 1961, provides significant tax benefits for individuals investing in specific retirement savings plans. This section is primarily aimed at encouraging long-term savings for retirement through contributions to pension schemes such as the National Pension System (NPS) and the Atal Pension Yojana (APY). Understanding the nuances of this section … Read more