The BMO Covered Call Utilities ETF (ZWU) is an investment vehicle that aims to provide income and capital appreciation through a portfolio of utility stocks, enhanced by a covered call strategy. This ETF is designed for investors seeking stable returns and regular income, primarily through dividends. As a covered call ETF, ZWU generates additional income by selling call options on its underlying holdings, which can be beneficial in flat or slightly bullish markets. However, potential investors need to assess both the risks and rewards associated with this investment.

The utility sector is generally considered a defensive investment, characterized by lower volatility compared to other sectors. This makes ZWU appealing during uncertain economic times. However, the performance of utility stocks can be sensitive to interest rate fluctuations. As interest rates rise, utility stocks may underperform due to their perceived lower growth potential compared to other sectors. Therefore, understanding the current economic climate and interest rate trends is crucial for evaluating ZWU as an investment.

| Feature | Details |

|---|---|

| Dividend Yield | ~7.96% |

| Expense Ratio | 0.94% |

Performance Overview

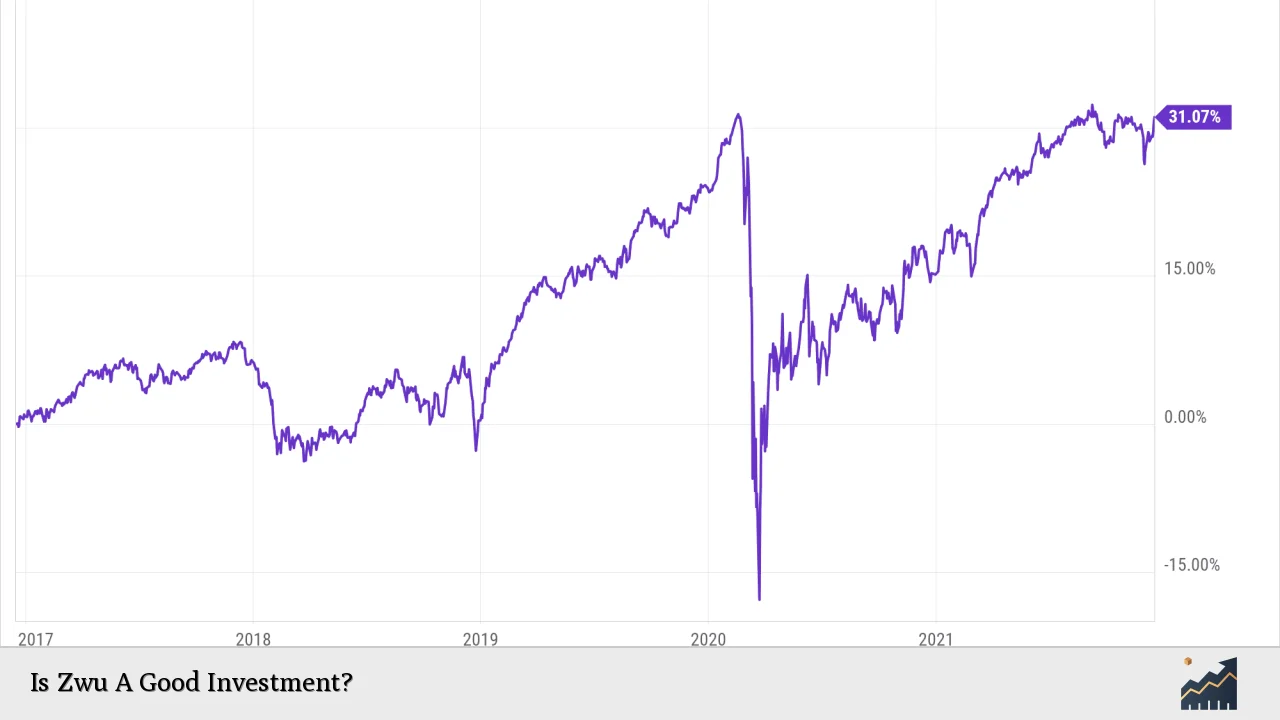

ZWU has shown a total return of approximately 9.55% over the past year, which includes both capital appreciation and dividends. Since its inception in 2011, the average annual return has been around 4.20%. This performance indicates that while ZWU may not provide explosive growth, it offers a reliable income stream through dividends, making it suitable for income-focused investors.

The ETF’s price has fluctuated between $9.67 and $11.42 over the past year, reflecting typical volatility in the utilities sector. The current price of ZWU is around $10.54, which suggests it is trading within its historical range but still below its recent highs.

ZWU’s dividend payout ratio stands at approximately 143.93%, indicating that the fund pays out more in dividends than it earns in net income from its investments. This could raise concerns about the sustainability of its dividend payments in the long run.

Investment Strategy

ZWU employs a covered call strategy, which involves holding utility stocks while simultaneously selling call options on those stocks to generate additional income. This strategy can enhance returns in sideways or slightly bullish markets but may limit upside potential during strong bull markets since the ETF must sell its stocks if they exceed the strike price of the sold calls.

Investors should consider their market outlook when investing in ZWU:

- If you anticipate a stable or slightly rising market, ZWU could be a good investment for generating income.

- If you expect significant market growth, you might prefer traditional utility ETFs without a covered call strategy to capture greater capital appreciation.

Risks and Considerations

Investing in ZWU comes with certain risks:

- Interest Rate Sensitivity: Utilities are often viewed as bond proxies; therefore, rising interest rates can negatively impact their stock prices.

- Limited Growth Potential: The covered call strategy can cap potential gains if the underlying stocks perform exceptionally well.

- Dividend Sustainability: The high payout ratio raises questions about whether dividends can be maintained if earnings do not improve.

Investors should weigh these risks against their financial goals and risk tolerance before investing in ZWU.

Market Outlook

The current economic environment plays a significant role in determining whether ZWU is a good investment at this time. Analysts have mixed opinions on future performance:

- Some predict that ZWU could experience modest growth due to its defensive nature during economic slowdowns.

- Others caution that as interest rates rise, utility stocks may face headwinds, potentially leading to decreased stock prices.

Analyst Ratings

Analysts have rated ZWU with a consensus of “Moderate Buy,” suggesting that while there are some concerns, many believe it still holds value as an investment option for income-seeking investors.

The average price target set by analysts for ZWU is approximately C$12.20, indicating an upside potential from its current trading price.

Conclusion

In summary, ZWU presents itself as a viable investment option for those looking for steady income through dividends while accepting limited growth potential. Its covered call strategy may benefit investors in stable market conditions but could underperform during strong bull markets due to capped gains.

Investors should consider their individual financial goals and market outlook when deciding whether to invest in ZWU. It may serve well as part of a diversified portfolio focused on income generation, particularly for those who prioritize stability over aggressive growth.

FAQs About Zwu

- What is the current dividend yield of ZWU?

The current dividend yield of ZWU is approximately 7.96%. - How has ZWU performed over the past year?

ZWU has shown a total return of about 9.55% over the past year. - What are the main risks associated with investing in ZWU?

The main risks include interest rate sensitivity and limited growth potential due to its covered call strategy. - What is the expense ratio for ZWU?

The expense ratio for ZWU is 0.94%. - Is ZWU suitable for long-term investment?

ZWU can be suitable for long-term investment for those seeking regular income but may not provide significant capital appreciation.