The Amplify High Income ETF (YYY) has garnered attention for its promise of high yields, appealing to income-focused investors. However, potential investors must critically assess whether YYY is indeed a good investment. This analysis delves into the ETF’s structure, performance history, risks, and market position to provide a comprehensive understanding of its investment viability.

| Aspect | Details |

|---|---|

| Launch Date | June 12, 2013 |

| Expense Ratio | 4.60% |

| Dividend Yield | 12.27% |

| AUM (Assets Under Management) | $554 million |

Overview of YYY

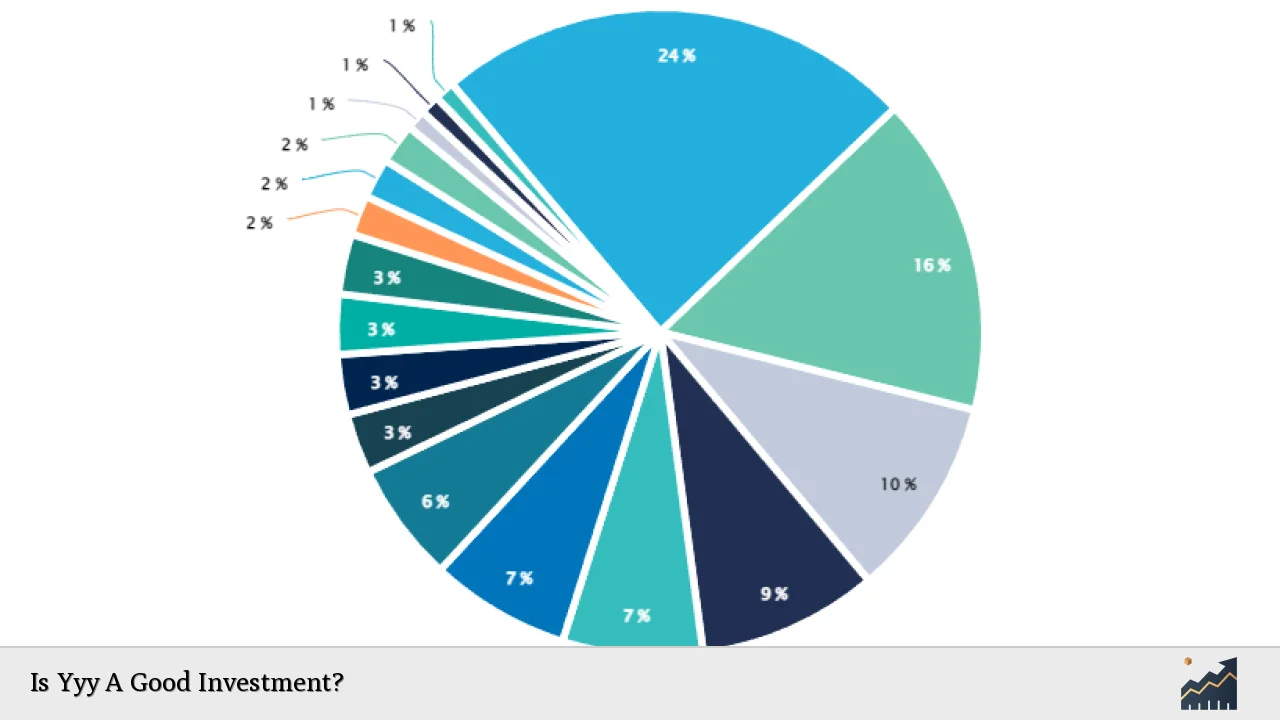

YYY is an exchange-traded fund designed to deliver high income through investments in closed-end funds (CEFs). It primarily focuses on generating monthly income distributions by investing at least 80% of its assets in securities that comprise the ISE High Income Index. This index includes a selection of high-yield CEFs that are weighted based on yield, discount to net asset value (NAV), and trading volume.

The fund’s strategy aims to attract investors looking for consistent income while maintaining a diversified portfolio. However, the high yield comes with inherent risks and challenges that need careful consideration.

Performance Analysis

When evaluating YYY’s performance, it’s important to look at both short-term and long-term results. Over the past year, YYY has provided a return of approximately 12.3%, which is relatively attractive compared to many fixed-income alternatives. However, this performance must be contextualized within a broader timeframe.

Historical Returns

- 1-Year Return: 12.3%

- 3-Year Return: 0.1%

- 5-Year Return: 2.5%

- 10-Year Return: 3.7%

Despite the appealing recent yield, the long-term performance reveals a concerning trend with minimal growth over extended periods. The ETF has struggled to outperform market indices significantly since its inception, with a share price decline of about 42% since launch.

Expense Structure

A critical factor influencing YYY’s attractiveness as an investment is its expense ratio, which stands at 4.60%. This is considerably higher than many other ETFs and mutual funds in the market. The high expenses can erode returns over time, particularly for an investment vehicle that already shows signs of underperformance.

Comparison with Peers

When comparing YYY with similar funds, it becomes evident that while it offers high yields, the associated costs may not justify the returns:

| Fund Name | Expense Ratio |

|---|---|

| YYY | 4.60% |

| Peer Fund A | 0.75% |

| Peer Fund B | 1.00% |

Investors should be wary of how much they are paying relative to the returns generated by YYY compared to lower-cost alternatives.

Risks Involved

Investing in YYY comes with several risks that potential investors must consider:

- Market Risk: Like any equity-related investment, YYY is subject to market volatility which can affect its NAV and overall performance.

- Credit Risk: Given its focus on high-yield bonds and CEFs, there is a risk of defaults or downgrades among underlying securities.

- Duration Risk: As interest rates fluctuate, bond prices typically move inversely; thus, rising rates can negatively impact YYY’s value.

- High Expense Ratio: As previously mentioned, the elevated fees can significantly reduce net returns over time.

Current Market Conditions

The current economic climate also plays a crucial role in determining whether YYY is a good investment now. As interest rates rise due to inflationary pressures, bond prices tend to fall, which could adversely affect YYY’s performance.

Economic Indicators

- Current Interest Rate: Approximately 4.5% for 10-year U.S. Treasuries.

- Inflation Trends: Persistent inflation may lead to further interest rate hikes.

In such an environment, caution is warranted when considering bond-heavy investments like YYY.

Investor Sentiment and Future Outlook

Investor sentiment towards YYY has been mixed recently. While some see the high yield as an attractive feature, others are concerned about the fund’s long-term viability given its historical underperformance and high costs.

Analysts’ Ratings

Recent analyses have indicated a cautious outlook for YYY:

- Some analysts have rated it as a “Sell” based on its inability to consistently outperform benchmarks.

- The AI-powered analysis suggests that it has a low probability of beating market averages in the near term.

This sentiment underscores the need for potential investors to conduct thorough due diligence before committing capital to YYY.

Conclusion

In conclusion, whether YYY is a good investment depends largely on individual financial goals and risk tolerance. While it offers an attractive yield of approximately 12%, the accompanying risks and costs present significant challenges.

Investors seeking short-term income may find some appeal in YYY; however, those focused on long-term growth or lower-cost options might want to explore alternative investments that offer better performance without such high fees.

FAQs About Is Yyy A Good Investment?

- What is Amplify High Income ETF (YYY)?

YYY is an ETF focused on providing high income through investments in closed-end funds. - What is the current yield of YYY?

The current yield of YYY is approximately 12.27%. - What are the risks associated with investing in YYY?

The main risks include market risk, credit risk, duration risk, and a high expense ratio. - How has YYY performed historically?

Historically, YYY has shown minimal long-term growth with significant declines since its inception. - Is now a good time to invest in YYY?

Caution is advised due to rising interest rates and economic uncertainties affecting bond markets.