The Wise Travel Card has gained popularity among travelers for its ability to facilitate easy and cost-effective transactions in multiple currencies. As an innovative financial tool, it allows users to hold and manage funds in over 40 currencies, making it a compelling choice for international travelers. This article delves into the various aspects of the Wise Travel Card, evaluating its benefits, market trends, implementation strategies, risks, regulatory considerations, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Multi-Currency Support | The Wise Travel Card allows users to hold and convert funds in over 40 currencies, providing flexibility and convenience while traveling. |

| Low Fees | Wise charges minimal fees for currency conversion (typically between 0.35% and 1%), which is significantly lower than traditional banks. |

| Real-Time Notifications | The card provides instant notifications for transactions, enhancing security and user control over expenditures. |

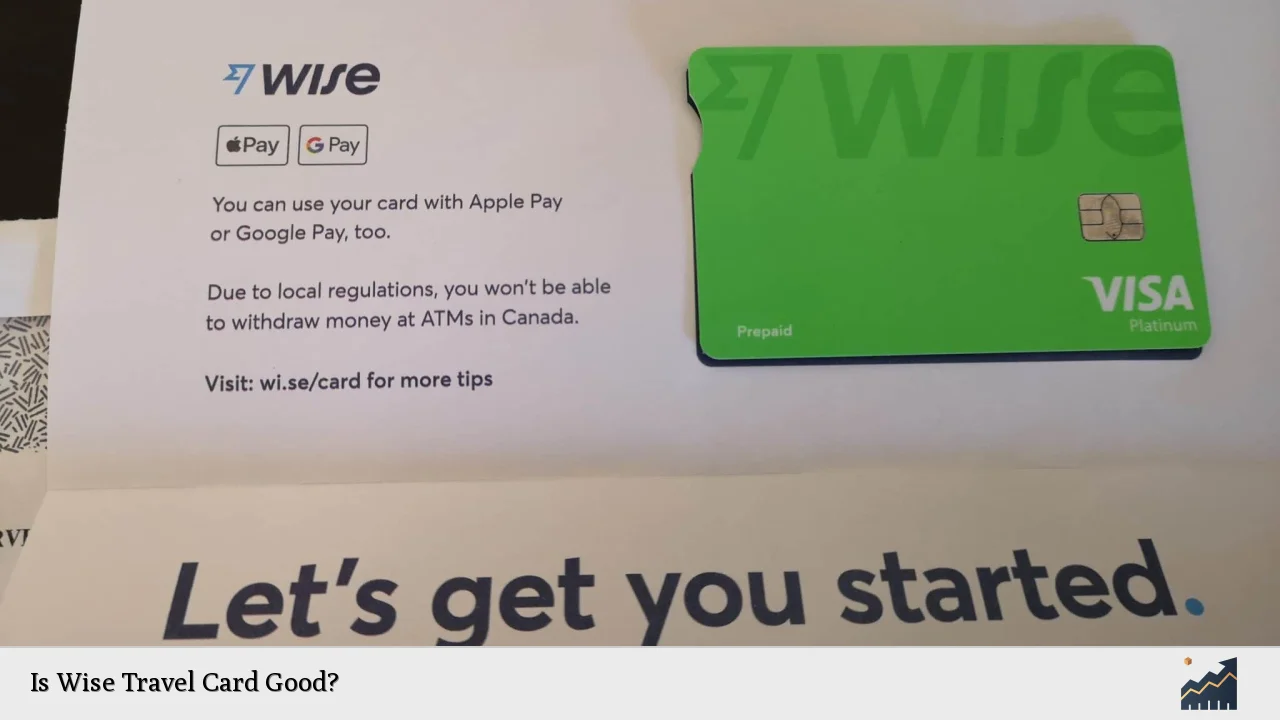

| Global Acceptance | The card is accepted in over 150 countries, making it versatile for various travel scenarios. |

| No Foreign Transaction Fees | Users can spend in any currency they hold without incurring foreign transaction fees. |

| User-Friendly App | The Wise app offers a seamless interface for managing funds, tracking spending, and converting currencies on-the-go. |

Market Analysis and Trends

The global travel card market is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2032. This growth is fueled by an increase in international travel and a rising demand for convenient payment solutions that minimize transaction costs. The expansion of the middle class in emerging economies is also contributing to this trend as more individuals seek to travel abroad for leisure and business purposes.

Wise has positioned itself strategically within this expanding market by offering a product that addresses common pain points associated with traditional banking methods. The demand for low-cost international spending options has never been higher, particularly as travelers seek to avoid high fees often associated with credit cards issued by banks.

Recent data indicates that approximately 5% of cross-border money transfers are processed through Wise, with the company saving its customers around £1.5 billion in fees compared to traditional banks over the past year. This competitive edge highlights the growing preference for Wise’s services among travelers looking for cost-effective solutions.

Implementation Strategies

To effectively utilize the Wise Travel Card, users should consider the following strategies:

- Preload Funds: Users can load their Wise card with their home currency before traveling. This allows them to lock in favorable exchange rates and budget effectively.

- Currency Conversion: Take advantage of the card’s auto-convert feature which ensures that users always pay with the optimal currency balance available on their card.

- Multiple Cards: It is advisable to carry more than one payment method while traveling. Having a backup card can prevent issues if one card is lost or blocked.

- Utilize the App: Regularly check transaction notifications through the Wise app to monitor spending and ensure security.

- Plan Withdrawals: Be aware of ATM withdrawal limits and fees; plan how much cash you might need to minimize unnecessary charges.

Risk Considerations

While the Wise Travel Card offers numerous benefits, potential users should be aware of certain risks:

- Currency Fluctuations: Exchange rates can fluctuate significantly; while Wise offers competitive rates, there is still a risk involved when converting currencies at different times.

- ATM Fees: Although Wise has low fees for transactions, withdrawing cash from ATMs may incur additional charges depending on the ATM operator.

- Limited Insurance: Unlike some credit cards that offer travel insurance or perks like lounge access, the Wise card does not include these benefits; users may need separate insurance coverage for their travels.

- Technical Issues: As with any digital service, there is a risk of technical glitches or outages that could affect access to funds or transaction capabilities.

Regulatory Aspects

Wise operates under strict regulatory frameworks in various jurisdictions where it provides services. It holds licenses from financial authorities in multiple countries, ensuring compliance with local laws regarding money transfer and financial services. Users should be aware of these regulations as they can impact transaction limits, fees, and the overall service experience.

Additionally, regulatory changes regarding digital banking and cryptocurrency could influence how products like the Wise Travel Card evolve in response to new compliance requirements or consumer protections.

Future Outlook

The future of the Wise Travel Card appears promising as global travel continues to rebound post-pandemic. With increasing consumer awareness about financial products that reduce costs associated with foreign transactions, Wise is well-positioned to capture greater market share.

Technological advancements may enhance user experiences further; potential developments could include:

- Enhanced Security Features: Continued improvements in security protocols will likely be a focus area as digital fraud becomes more sophisticated.

- Integration with Other Financial Services: Partnerships with other financial institutions could expand service offerings beyond just currency conversion and spending.

- Broader Acceptance: As Wise continues to grow its network of partnerships globally, increased acceptance at merchants and ATMs will further solidify its position as a leading travel payment solution.

Frequently Asked Questions About Is Wise Travel Card Good?

- What currencies can I hold in my Wise Travel Card?

Wise allows you to hold over 40 different currencies in your account. - Are there any monthly fees associated with using the Wise Travel Card?

No, there are no monthly fees; however, there may be small charges for currency conversions. - Can I withdraw cash using my Wise card?

Yes, you can withdraw cash at ATMs worldwide; be mindful of potential ATM operator fees. - How does Wise compare to traditional bank cards?

Wise typically offers better exchange rates and lower fees compared to traditional bank cards. - Is there a limit on how much I can spend or withdraw?

Yes, there are limits based on your account settings and local regulations; check your account for specific details. - Can I use my Wise card for online purchases?

Yes, you can use your Wise card for online purchases wherever Visa or Mastercard is accepted. - What happens if I lose my Wise card while traveling?

You can freeze your card instantly through the app and report it lost or stolen to protect your funds. - Is customer support available if I encounter issues?

Yes, Wise offers customer support through various channels including their website and app.

In conclusion, the Wise Travel Card presents a compelling option for travelers seeking flexibility, low fees, and ease of use when managing finances abroad. By understanding its features and potential risks, users can make informed decisions that enhance their travel experiences while minimizing costs.