Wise, formerly known as TransferWise, has emerged as a leading player in the international money transfer market, offering a cost-effective and user-friendly alternative to traditional banks. As more individuals and businesses turn to digital platforms for their financial transactions, questions about safety and reliability become paramount. This article delves into the safety of using Wise for money transfers, supported by current market statistics, regulatory insights, and user experiences.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Compliance | Wise is regulated by multiple financial authorities globally, including FinCEN in the US, ensuring adherence to strict financial regulations. |

| Security Features | Utilizes advanced security measures such as two-factor authentication (2FA) and encryption to protect user accounts and transactions. |

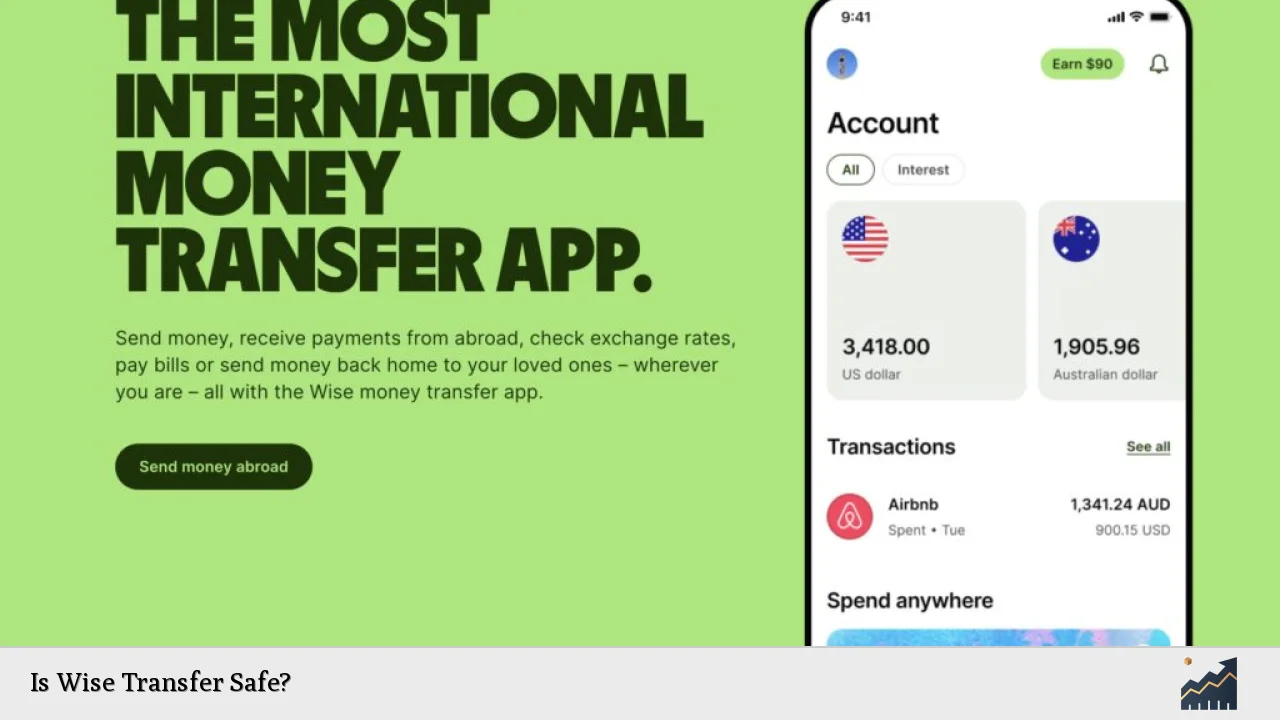

| User Experience | Highly rated for its ease of use, with features that allow users to track transactions in real-time and manage multiple currencies efficiently. |

| Customer Trust | Wise has gained the trust of over 16 million customers worldwide, processing billions in transactions monthly. |

| Risk Management | In-house fraud prevention teams monitor transactions continuously to detect and prevent fraudulent activities. |

| Market Growth | Wise has seen significant growth, with a reported 25% increase in active customers in 2024 alone, indicating rising confidence among users. |

Market Analysis and Trends

The international money transfer market has experienced substantial growth over recent years, driven by globalization and increased mobility of individuals. According to Wise’s latest reports, the company processed £118.5 billion in transactions during the fiscal year 2024, marking a 13.4% increase from the previous year. This growth reflects a broader trend where consumers prefer digital solutions over traditional banking methods due to lower fees and faster service.

Key Statistics

- Customer Base: As of late 2024, Wise boasts over 11.4 million active customers.

- Transaction Volume: The company facilitated £68.4 billion in transactions in just six months leading up to September 2024.

- Revenue Growth: Wise reported revenues of £1.05 billion in fiscal year 2024, up 24% from the previous year.

These figures underscore Wise’s position as a trusted player in the fintech space, appealing particularly to expatriates, freelancers, and businesses needing efficient cross-border payment solutions.

Implementation Strategies

To ensure safe use of Wise for money transfers, users should follow these implementation strategies:

- Account Verification: Complete all required identity verification steps when setting up an account. This typically includes submitting identification documents and proof of address.

- Enable Security Features: Activate two-factor authentication (2FA) for added security during logins and transactions.

- Monitor Transactions: Regularly check transaction notifications via the Wise app to stay informed about all account activities.

- Use Multi-Currency Accounts: Take advantage of Wise’s multi-currency accounts to manage different currencies efficiently without incurring excessive conversion fees.

Risk Considerations

While Wise has established itself as a reliable platform for money transfers, potential risks should still be acknowledged:

- Regulatory Scrutiny: Wise faced regulatory challenges regarding its anti-money laundering (AML) practices in Europe. In 2022, Belgian regulators identified gaps in compliance that led to a remediation plan being implemented. Although Wise has taken steps to address these issues by bolstering its compliance teams and processes, ongoing scrutiny remains a factor for users to consider.

- Fraud Risks: Like any online service, users are at risk of phishing attacks or fraud attempts. It is crucial for users to verify recipient details before initiating transfers.

- Transfer Limits: While Wise allows substantial transfer limits (up to $1 million per transaction), there are daily limits depending on the payment method used. Users should be aware of these limits when planning large transfers.

Regulatory Aspects

Wise operates under stringent regulatory frameworks across multiple jurisdictions:

- FinCEN Registration: In the United States, Wise is registered with the Financial Crimes Enforcement Network (FinCEN) and complies with state-level money transmitter laws.

- Global Regulation: The company holds over 65 regulatory licenses worldwide, ensuring that it adheres to local laws and international standards for financial services.

- Consumer Protection Laws: Transfers are protected under various consumer protection laws that mandate transparency in fees and exchange rates.

These regulations help ensure that customer funds are safeguarded against misuse or fraud while providing recourse options for consumers if issues arise.

Future Outlook

The future looks promising for Wise as it continues to expand its services globally. With increasing customer adoption rates and ongoing enhancements in technology and security measures, Wise is well-positioned to maintain its competitive edge in the fintech landscape.

Key Predictions

- Continued Growth: As more individuals shift towards digital banking solutions, Wise is expected to see further increases in its customer base and transaction volumes.

- Innovation in Services: The company is likely to introduce new features aimed at improving user experience and expanding its service offerings beyond simple money transfers.

- Enhanced Compliance Measures: Following past regulatory challenges, Wise will likely continue investing heavily in compliance infrastructure to mitigate risks associated with financial crime.

Frequently Asked Questions About Is Wise Transfer Safe?

- Is my money safe with Wise?

Yes, Wise employs advanced security measures including encryption and two-factor authentication to protect your funds. - How does Wise ensure compliance with regulations?

Wise is regulated by multiple authorities worldwide and adheres strictly to local laws regarding money transfers. - What should I do if I encounter an issue?

You can contact Wise’s customer support through their app or website for assistance with any problems. - Are there any transfer limits?

Yes, while you can send large amounts (up to $1 million per transaction), there are daily limits based on your payment method. - Can I trust user reviews about Wise?

User reviews generally reflect high satisfaction levels; however, it’s wise to consider both positive and negative feedback. - What happens if my transfer is delayed?

If your transfer is delayed, you can track its status through the app or contact customer support for updates. - Does Wise charge hidden fees?

No, Wise is known for its transparency regarding fees; all costs are disclosed upfront before completing a transaction. - Is there insurance on my deposits?

While customer funds are held securely at top-tier banks or invested in liquid assets like government bonds, they may not be insured like traditional bank deposits.

In conclusion, using Wise for international money transfers is generally safe due to its robust regulatory compliance framework and advanced security measures. However, potential users should remain vigilant about their own security practices and stay informed about any regulatory updates that may impact their transactions.