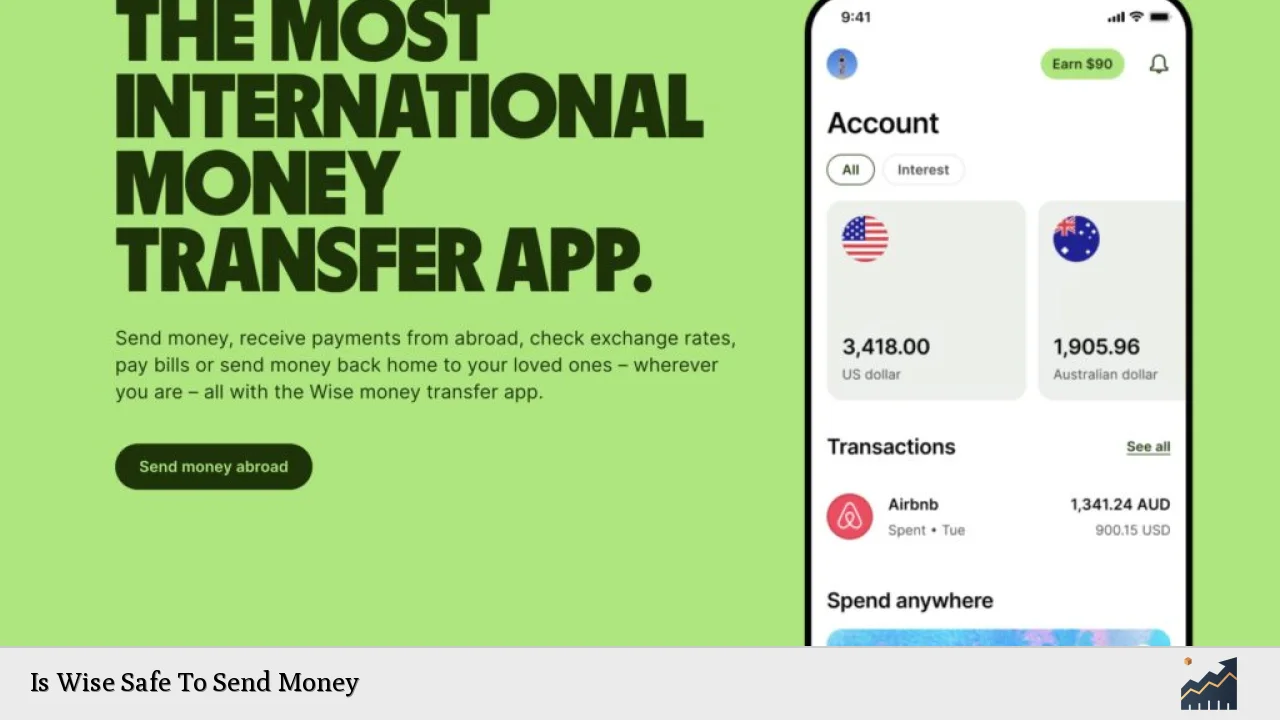

Wise, formerly known as TransferWise, has become a prominent player in the international money transfer market, known for its transparent fee structure and competitive exchange rates. As with any financial service, potential users often question the safety and security of using Wise to send money. This article delves into the safety measures Wise employs, regulatory compliance, market trends, and future outlooks to provide a comprehensive understanding of whether Wise is a safe choice for sending money.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Compliance | Wise is regulated by multiple authorities globally, including FinCEN in the US and the Financial Conduct Authority (FCA) in the UK, ensuring adherence to strict financial laws. |

| Security Measures | Wise employs advanced security protocols such as two-factor authentication (2FA), data encryption, and ongoing fraud monitoring to protect user accounts and transactions. |

| Customer Trust | With over 16 million customers and a strong reputation for reliability, Wise has established itself as a trusted platform for international money transfers. |

| Market Growth | The global money transfer market is projected to grow significantly, with Wise positioned well to capitalize on this trend due to its innovative services and customer-centric approach. |

| Future Outlook | Wise continues to expand its services and improve its infrastructure, aiming for sustainable growth while maintaining high safety standards. |

Market Analysis and Trends

The global money transfer services market is experiencing rapid growth, projected to increase from $31.41 billion in 2023 to $36.49 billion in 2024 at a compound annual growth rate (CAGR) of 16.2%. This growth is driven by several factors:

- Increased Globalization: More individuals are working abroad or sending remittances back home, leading to higher demand for international money transfer services.

- Digital Transformation: The rise of digital banking and mobile payment solutions has made it easier for consumers to send money internationally.

- Competitive Pricing: Companies like Wise offer competitive fees compared to traditional banks, attracting cost-conscious consumers.

Wise has effectively leveraged these trends by providing a platform that emphasizes transparency in fees and exchange rates. Their use of the mid-market exchange rate ensures customers know exactly what they are paying without hidden costs.

Implementation Strategies

To ensure safety while using Wise for money transfers, users should consider the following strategies:

- Account Verification: Upon signing up, users must complete a verification process that includes providing identification and proof of address. This step enhances security by ensuring that all users are legitimate.

- Enable Security Features: Users should activate two-factor authentication (2FA) for an added layer of security. This requires not only a password but also a code sent to the user’s mobile device during login or transaction processes.

- Stay Informed: Keeping abreast of Wise’s updates regarding security measures and regulatory compliance can help users make informed decisions about their transactions.

Risk Considerations

While Wise has established itself as a safe platform for sending money internationally, potential users should be aware of certain risks:

- Regulatory Scrutiny: Recent reports indicate that Wise has faced regulatory scrutiny regarding its anti-money laundering (AML) practices. Although the company has implemented remediation plans approved by regulators, ongoing compliance remains critical.

- Fraud Risks: As with any online financial service, there is always a risk of fraud. Users must be vigilant about phishing attempts and ensure they are sending money to verified recipients.

- Account Limitations: Users may encounter limitations on transfer amounts based on their account type or verification status. Understanding these limits can prevent unexpected issues during transactions.

Regulatory Aspects

Wise operates under stringent regulatory frameworks across various jurisdictions:

- United States: In the US, Wise is registered with the Financial Crimes Enforcement Network (FinCEN) and complies with regulations set forth by state regulators. This includes safeguarding customer funds by keeping them separate from operational funds.

- United Kingdom: In the UK, Wise is regulated by the FCA, which requires adherence to high standards of financial conduct and consumer protection.

- Global Compliance: Wise maintains licenses in multiple countries, ensuring that it meets local regulatory requirements. This commitment to compliance helps build trust among users.

Future Outlook

The outlook for Wise remains positive as it continues to innovate within the financial technology sector:

- Expansion Plans: Wise is actively expanding its services into new markets while enhancing existing offerings. This includes integrating with local payment systems and launching new features that cater to diverse customer needs.

- Investment in Technology: Continuous investment in technology will enable Wise to improve transaction speeds and reduce costs further, making it an attractive option for consumers looking for efficient money transfer solutions.

- Sustainability Initiatives: As part of its long-term strategy, Wise is also focusing on sustainability initiatives that align with evolving regulatory expectations regarding environmental impact.

Frequently Asked Questions About Is Wise Safe To Send Money

- Is my money secure with Wise?

Yes, Wise employs robust security measures including encryption and two-factor authentication to protect your funds. - What regulatory bodies oversee Wise?

Wise is regulated by various authorities including FinCEN in the US and FCA in the UK. - Can I send large amounts of money using Wise?

Yes, but there are limits based on account type; personal accounts can send up to $1 million per transfer. - What happens if there’s an issue with my transfer?

Wise has dedicated support teams available to assist with any issues that may arise during transactions. - How does Wise handle anti-money laundering compliance?

Wise follows strict AML protocols and regularly audits its practices to ensure compliance with regulations. - Are there any hidden fees when using Wise?

No, Wise uses transparent pricing models based on mid-market exchange rates without hidden fees. - How can I protect my account from fraud?

Enable two-factor authentication and regularly monitor your account activity for any unauthorized transactions. - What should I do if I suspect fraud?

If you suspect fraud or unauthorized access to your account, contact Wise support immediately for assistance.

In conclusion, sending money through Wise is generally safe due to its robust security measures, regulatory compliance, and transparent pricing model. However, users should remain vigilant about potential risks associated with online financial transactions. By understanding these elements and implementing recommended strategies, individuals can confidently use Wise for their international money transfer needs.