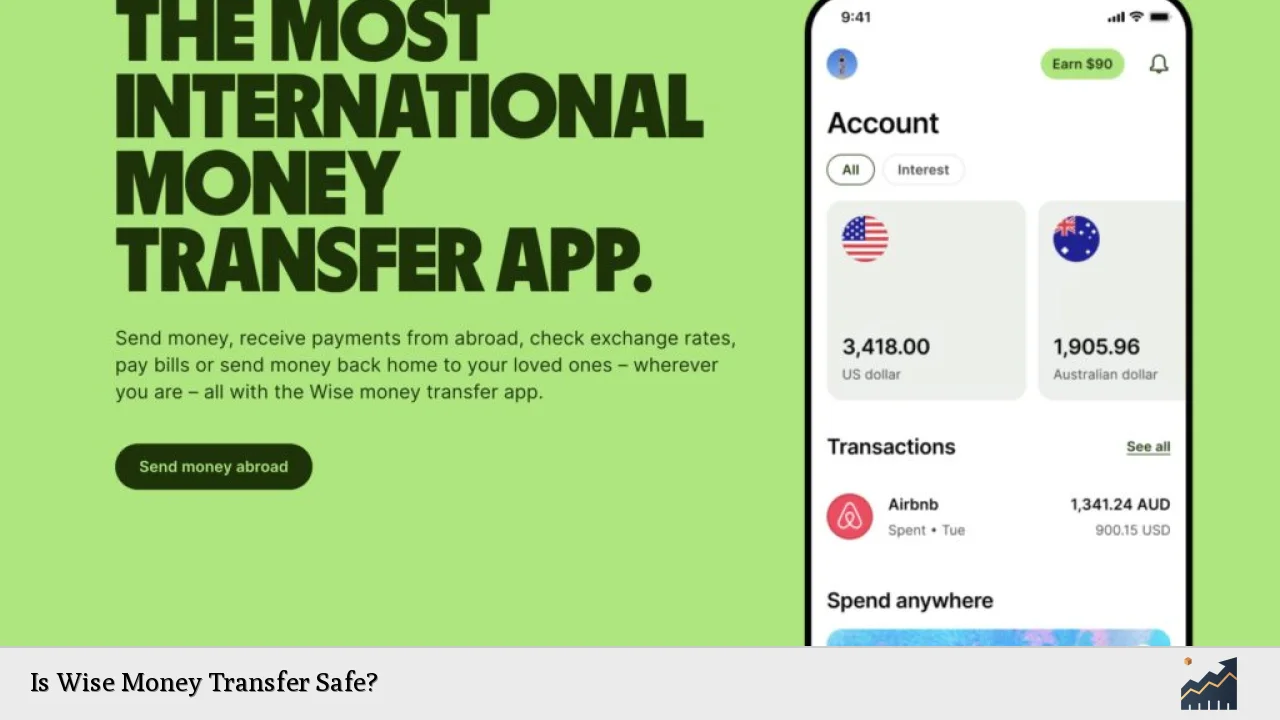

Wise, formerly known as TransferWise, has become a prominent player in the international money transfer landscape, attracting millions of users with its promise of low fees and transparent pricing. However, as with any financial service, potential users often wonder about the safety and security of using Wise for their transactions. This comprehensive analysis will delve into various aspects of Wise’s operations, including market trends, risk considerations, regulatory compliance, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Compliance | Wise is regulated in multiple jurisdictions worldwide, including the U.S. (FinCEN), U.K. (FCA), and Australia (ASIC), ensuring adherence to strict financial regulations. |

| Customer Security Measures | Wise employs robust security protocols, including two-factor authentication (2FA), encryption, and regular audits to protect customer data and funds. |

| Customer Satisfaction | With an average Trustpilot rating of 4.5 out of 5 from over 183,000 reviews, Wise is recognized for its reliability and user-friendly interface. |

| Transfer Speed | Over 50% of Wise’s international transfers are completed in under 20 seconds, with 90% arriving within 24 hours. |

| Financial Safeguarding | Customer funds are safeguarded by being held in top-tier banks or liquid assets, separate from Wise’s operating capital. |

| Market Growth | Wise has seen a 25% increase in active customers recently, highlighting its growing popularity and market share in international transfers. |

Market Analysis and Trends

The international money transfer market has evolved significantly over the past decade. Wise has positioned itself as a leader by offering competitive fees and favorable exchange rates compared to traditional banks. Recent data indicates that Wise processed £118.5 billion in transactions during the fiscal year 2024, reflecting a 13.4% increase from the previous year. This growth is indicative of a broader trend where consumers increasingly prefer digital solutions for cross-border payments.

Current Market Statistics

- Active Customers: As of September 2024, Wise reported 12.8 million active customers.

- Transaction Volume: The company facilitated £68.4 billion in transactions over six months.

- Fee Structure: The average fee charged by Wise decreased to 62 basis points, making it one of the most cost-effective options available.

Implementation Strategies

To maximize the benefits of using Wise for international money transfers, users should consider the following strategies:

- Utilize Multi-Currency Accounts: Holding multiple currencies can help avoid conversion fees when transferring funds.

- Leverage Instant Transfers: For urgent transactions, users can take advantage of Wise’s instant transfer capabilities.

- Monitor Exchange Rates: Using Wise’s tools to track exchange rates can help users make informed decisions about when to transfer money.

Risk Considerations

While Wise offers numerous advantages, potential users should be aware of certain risks:

- Regulatory Scrutiny: In late 2024, Wise faced scrutiny from European regulators regarding its anti-money laundering (AML) practices. Although the company has implemented a remediation plan, ongoing compliance will be critical to maintaining its operational integrity.

- Technical Glitches: Some users have reported delays in transfers due to technical issues or verification checks. While these incidents are not widespread, they highlight the importance of having contingency plans for urgent transactions.

- Customer Service Challenges: Instances of slow customer support responses have been noted by users experiencing issues with their transfers.

Regulatory Aspects

Wise operates under stringent regulatory frameworks across various countries:

- United States: Registered with FinCEN and licensed as a money transmitter in multiple states.

- United Kingdom: Authorized as an Electronic Money Institution by the FCA.

- Australia: Regulated by ASIC with an Australian Financial Services License.

These regulatory measures are designed to protect consumers and ensure that financial institutions operate transparently and securely.

Future Outlook

The future for Wise appears promising as it continues to expand its services globally. The company aims to reduce transaction costs further while enhancing its infrastructure to facilitate faster payments. With plans to integrate directly with domestic payment systems in more countries, Wise is poised to capture an even larger share of the market.

Key Future Developments

- Expansion into New Markets: Continued efforts to enter new geographical markets will likely increase user adoption.

- Technological Advancements: Investing in technology will enhance security measures and improve user experience.

Frequently Asked Questions About Is Wise Money Transfer Safe?

- Is my money safe with Wise?

Yes, Wise employs bank-grade security measures and is regulated globally to ensure customer funds are safeguarded. - How does Wise protect my personal information?

Wise uses encryption and two-factor authentication to protect user data from unauthorized access. - What happens if there’s an issue with my transfer?

If you encounter issues with your transfer, you can contact customer support for assistance; however, response times may vary. - Are there any hidden fees when using Wise?

No, Wise is known for its transparent fee structure; all fees are clearly displayed before completing a transaction. - How long does it take for my money to arrive?

Most transfers are completed within 24 hours; over 50% are instant. - Can I use Wise for large transactions?

Yes, Wise supports large transactions up to $1 million per transfer. - What should I do if my account gets frozen?

If your account is frozen due to regulatory checks, follow the instructions provided by Wise customer support for resolution. - Is there a limit on how much I can hold in my Wise account?

No specific limit exists; however, regulatory limits may apply based on your country’s laws.

In conclusion, Wise presents a safe and efficient option for international money transfers. Its robust security measures and regulatory compliance make it a trustworthy choice for individuals and businesses alike. However, potential users should remain aware of the risks associated with digital financial services and stay informed about ongoing developments within the company.