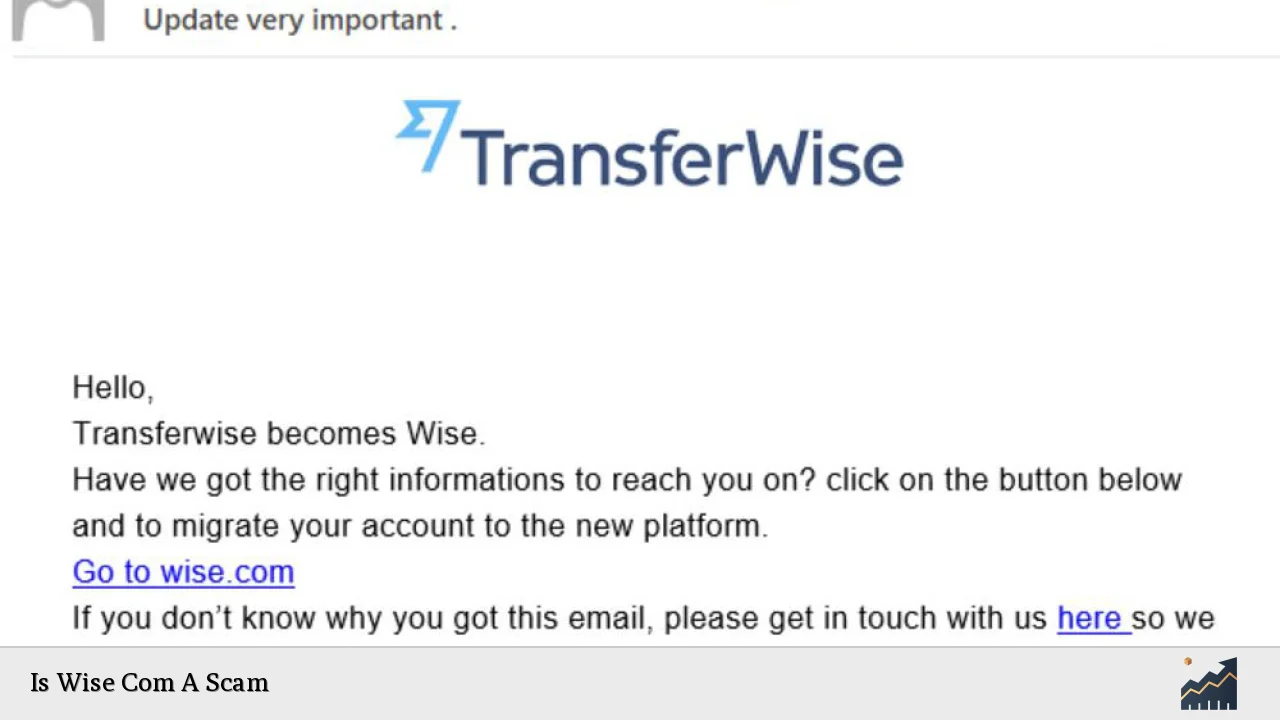

The question of whether Wise (formerly known as TransferWise) is a scam has become increasingly relevant as more individuals and businesses seek reliable methods for international money transfers. While Wise has gained significant popularity for its low fees and user-friendly platform, a growing number of customer complaints have raised concerns about its reliability and customer service practices. This article aims to provide a comprehensive analysis of Wise’s operations, market position, and the legitimacy of the claims surrounding it.

| Key Concept | Description/Impact |

|---|---|

| Customer Complaints | Numerous reviews highlight issues with account closures, delayed transfers, and poor customer service. |

| Regulatory Compliance | Wise is regulated in multiple jurisdictions, which adds a layer of security but also leads to strict compliance checks. |

| Market Position | Wise has established itself as a leading player in the fintech space for cross-border payments, processing over £118 billion in transactions in FY2024. |

| Customer Satisfaction Ratings | Despite some negative reviews, Wise maintains a high average rating on platforms like Trustpilot (4.3/5) based on over 220,000 reviews. |

| Financial Performance | Wise reported significant growth in revenue and profit, indicating a strong business model despite customer service criticisms. |

Market Analysis and Trends

The global remittance market is evolving rapidly, fueled by technological advancements and increasing demand for cost-effective solutions. Wise has positioned itself as a frontrunner in this market by offering competitive exchange rates and low transfer fees compared to traditional banks. In FY2024, Wise processed £118.5 billion in transactions, reflecting a 13% year-on-year growth.

Current Market Trends

- Growth in Digital Payments: The shift towards digital payment solutions continues to rise, with consumers favoring platforms that offer transparency and lower costs.

- Regulatory Scrutiny: As fintech companies grow, they face increased regulatory scrutiny aimed at preventing fraud and ensuring compliance with anti-money laundering (AML) laws. This can lead to delays in transactions and account verifications.

- Customer Experience Focus: Companies like Wise are investing heavily in improving user experience through technological enhancements while grappling with the challenges of maintaining high customer service standards.

Implementation Strategies

For individual investors or businesses considering using Wise for international transactions, understanding the operational strategies can help mitigate risks:

- Diversify Payment Methods: Use Wise alongside other payment services to ensure flexibility and reduce dependency on one platform.

- Monitor Transactions Closely: Regularly check transaction statuses and maintain clear records of communications with customer support to address any issues promptly.

- Stay Informed on Regulatory Changes: Be aware of the regulations applicable to your transactions as they may affect processing times and requirements.

Risk Considerations

While Wise offers several advantages, potential users should be aware of various risks associated with its services:

- Account Closures: Reports indicate that accounts can be closed without warning due to compliance issues or failure to meet verification requirements. This has led to significant financial distress for some users.

- Delayed Transfers: Some customers have experienced prolonged delays in fund transfers, raising concerns about the reliability of the service.

- Customer Service Challenges: Negative feedback often centers around inadequate customer support responses during critical situations.

Regulatory Aspects

Wise operates under strict regulatory frameworks across different jurisdictions:

- United Kingdom: Authorized by the Financial Conduct Authority (FCA) as an Electronic Money Institution.

- United States: Registered with the Financial Crimes Enforcement Network (FinCEN) and licensed as a money transmitter in 48 states.

- Global Compliance: Wise adheres to various international regulations aimed at preventing money laundering and ensuring safe financial transactions.

These regulations are crucial for maintaining trust but can also lead to operational challenges such as increased scrutiny on transactions.

Future Outlook

The outlook for Wise remains positive despite current challenges. The company is expected to continue expanding its customer base and enhancing its services:

- Technological Advancements: Investment in technology will likely improve transaction speeds and customer service capabilities.

- Market Expansion: As global demand for cross-border payments grows, Wise is well-positioned to capture a larger share of this market.

- Sustainability Goals: With ongoing efforts to reduce fees further while maintaining profitability, Wise aims to enhance its competitive edge against traditional banks.

Frequently Asked Questions About Is Wise Com A Scam

- Is Wise safe to use?

Yes, Wise is regulated in multiple countries, which helps ensure the safety of funds. However, users should be cautious about compliance-related account closures. - What are common complaints about Wise?

Common issues include account deactivations without clear reasons, delayed transfers, and inadequate customer support responses. - How does Wise compare to traditional banks?

Wise typically offers lower fees and better exchange rates than traditional banks for international transfers. - Can I trust customer reviews about Wise?

The majority of reviews are positive; however, there is a notable number of negative experiences that should be considered when evaluating their services. - What should I do if my account is closed?

If your account is closed unexpectedly, contact customer support immediately for clarification and keep records of all communications. - Are there alternatives to Wise?

Yes, alternatives include Revolut, PayPal, and traditional banks. Each has its own set of features and fees that may suit different needs. - How does Wise handle large transactions?

Wise can process large transactions but may require additional documentation or verification due to regulatory compliance measures. - What are the fees associated with using Wise?

Fees vary depending on the currency pair but generally range from 0.22% to 1% of the transaction amount.

In conclusion, while there are valid concerns regarding customer experiences with Wise, labeling it outright as a scam overlooks its regulatory compliance and overall market performance. Users should weigh both positive aspects—such as competitive pricing and strong financial growth—against potential risks like account management issues. As always, exercising caution and staying informed will help mitigate risks associated with using any financial service provider.