The Wise card, often referred to as a prepaid card, is a financial product offered by Wise (formerly TransferWise) that enables users to spend money internationally with minimal fees and favorable exchange rates. Unlike traditional prepaid cards that may impose high fees and unfavorable conversion rates, the Wise card stands out for its transparency and cost-effectiveness. It allows users to hold and convert multiple currencies at the mid-market exchange rate, making it particularly appealing for travelers and expatriates. This article delves into the various aspects of the Wise card, including its market position, implementation strategies, regulatory considerations, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Multi-Currency Functionality | The Wise card allows users to hold up to 40 currencies in one account, enabling seamless transactions without the need for currency exchanges or cash withdrawals. |

| Low Fees | Wise charges minimal fees for currency conversion (typically between 0.35% and 1%) compared to traditional banks that often charge 2% to 3%. |

| Real-Time Exchange Rates | The card utilizes mid-market exchange rates for conversions, avoiding hidden fees associated with traditional banking services. |

| Global Acceptance | Wise cards are accepted in over 170 countries, providing flexibility for international spending. |

| User-Friendly App | The Wise app offers real-time notifications, easy balance management, and currency conversion features, enhancing user experience. |

| Regulatory Compliance | Wise is regulated by financial authorities in multiple jurisdictions, ensuring user funds are protected and transactions are secure. |

Market Analysis and Trends

The prepaid card market has seen significant growth in recent years, driven by changing consumer behaviors and preferences. According to industry reports, the global prepaid card market is projected to grow from $21.98 billion in 2023 to $25.12 billion in 2024 at a compound annual growth rate (CAGR) of 14.3%. This growth is attributed to factors such as increased e-commerce activity, the demand for financial inclusion, and the rise of digital wallets.

Wise has positioned itself effectively within this expanding market by offering a product that meets the needs of modern consumers who prioritize low fees and transparency. The company’s user base has surged by 29% year-over-year, reaching approximately 12.8 million active customers as of April 2024. This growth reflects a broader trend towards digital finance solutions that facilitate cross-border transactions without excessive costs.

Implementation Strategies

To maximize the benefits of using the Wise card, users should consider the following strategies:

- Currency Management: Users should actively manage their currency balances within the Wise account. By holding multiple currencies, they can avoid unnecessary conversion fees when making international purchases.

- Utilizing the App: The Wise app provides tools for tracking expenses and managing balances in real-time. Users can convert currencies instantly at favorable rates through the app.

- Understanding Fees: Familiarizing oneself with Wise’s fee structure is crucial. While the card has no monthly fees, users should be aware of limits on free ATM withdrawals and potential charges after exceeding those limits.

- Security Practices: Given that the Wise card is linked to an online account, users should implement strong security practices such as enabling two-factor authentication and regularly monitoring account activity.

Risk Considerations

While the Wise card offers numerous benefits, there are inherent risks that users should be aware of:

- Currency Fluctuations: Holding multiple currencies exposes users to exchange rate volatility. While Wise offers competitive rates, fluctuations can still impact purchasing power.

- Dependence on Technology: The reliance on digital platforms means that any technical issues or outages could hinder access to funds or transaction capabilities.

- Regulatory Changes: As financial regulations evolve globally, changes could affect how prepaid cards operate or the fees associated with them.

- Limited Customer Support: Although Wise provides customer support during business hours, users may experience delays in response times compared to traditional banks with more extensive support networks.

Regulatory Aspects

Wise operates under strict regulatory frameworks established by financial authorities in various countries. These regulations ensure that user funds are protected and that transactions comply with anti-money laundering (AML) and know your customer (KYC) requirements. In regions like Europe and North America, Wise is fully compliant with local laws governing electronic money institutions.

The company’s commitment to transparency extends to its fee structure and operations. Users can easily access information about fees associated with currency conversions and withdrawals through the Wise website or app. This level of transparency not only builds trust but also aligns with global trends towards stricter financial regulations aimed at protecting consumers.

Future Outlook

The future of the Wise card appears promising as consumer demand for low-cost international payment solutions continues to rise. Key factors influencing this outlook include:

- Expansion into New Markets: Wise has plans for further geographical expansion, including partnerships with local financial institutions in emerging markets. This will broaden its user base and enhance service availability.

- Technological Advancements: Continuous improvements in technology will likely enhance user experience through better app functionalities and security features.

- Sustainability Initiatives: As consumers become more environmentally conscious, Wise’s efforts towards sustainable practices may resonate well with its target demographic.

- Increased Adoption of Digital Finance: The ongoing shift towards digital finance solutions suggests a growing acceptance of products like the Wise card among both individual consumers and businesses.

Frequently Asked Questions About Is Wise A Prepaid Card

- What is the primary function of the Wise card?

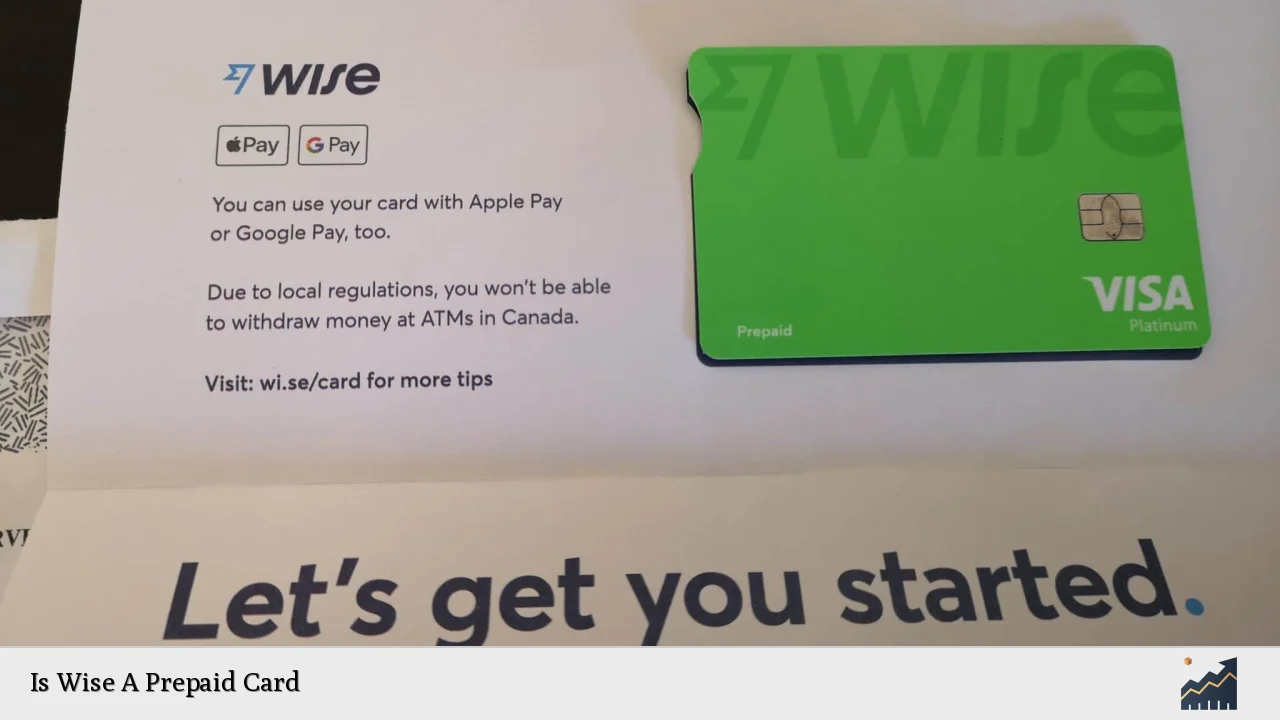

The primary function of the Wise card is to allow users to spend money internationally without incurring high fees associated with traditional banks. - Are there any monthly fees associated with using the Wise card?

No, there are no monthly fees; however, there is a one-time fee for issuing the card. - How does Wise handle currency conversions?

Wise uses mid-market exchange rates for currency conversions, which are generally more favorable than those offered by banks. - Can I withdraw cash using my Wise card?

Yes, you can withdraw cash from ATMs globally; however, there are limits on free withdrawals per month. - Is my money safe with Wise?

Yes, Wise is regulated by financial authorities in multiple jurisdictions which helps ensure that user funds are protected. - Can I use my Wise card for online purchases?

Yes, the Wise card can be used for online purchases wherever Mastercard is accepted. - What happens if I lose my Wise card?

You can freeze your card instantly via the app to prevent unauthorized transactions until you report it lost or stolen. - Does Wise offer customer support?

Yes, customer support is available via email and phone during business hours.

In conclusion, the Wise card represents a significant advancement in how individuals manage their finances internationally. With its focus on low fees and user-friendly features, it caters effectively to a growing market segment looking for efficient ways to conduct cross-border transactions. As trends continue toward digital finance solutions and consumer demand grows for transparency and accessibility in financial products, the future looks bright for both Wise and its innovative offerings like the prepaid card.