Wise, formerly known as TransferWise, is a financial technology company that has transformed the landscape of international money transfers. Founded in 2011, Wise has grown to serve over 12.8 million customers globally, providing a range of services typically associated with traditional banks, but it is crucial to clarify that Wise is not a bank. Instead, it operates as a regulated money services business, focusing primarily on cross-border payments and currency exchange. This article delves into the various aspects of Wise’s operations, comparing its offerings to traditional banking services and exploring its market position.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Status | Wise is regulated as a money transmitter in multiple jurisdictions but does not hold a banking license. |

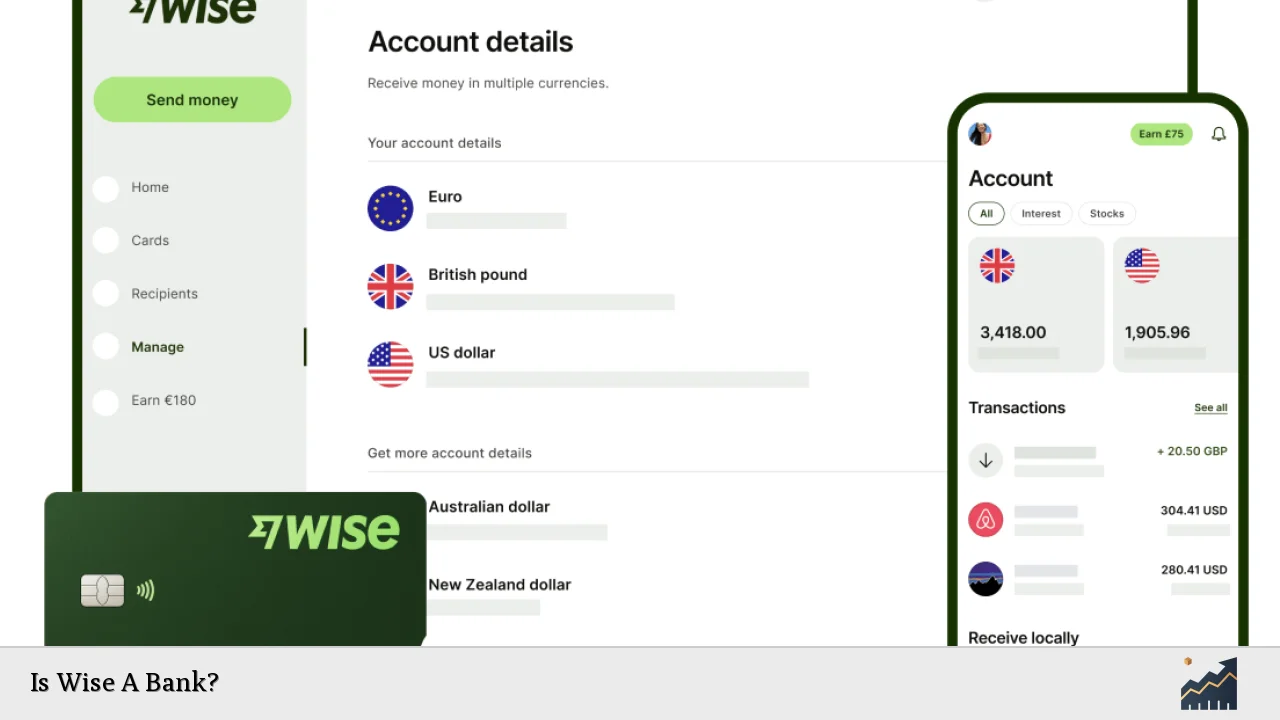

| Core Services | Offers multi-currency accounts, international transfers, and a debit card for spending in various currencies. |

| Market Position | Significant player in the fintech space, known for low fees and transparent pricing compared to traditional banks. |

| Customer Base Growth | Rapid growth with 12.8 million customers as of March 2024, reflecting a 29% increase year-over-year. |

| Financial Performance | Reported £1.2 billion in underlying income for FY2024, with a profit before tax of £481 million. |

| Technological Edge | Utilizes advanced technology for instant payments and currency conversion at mid-market rates. |

| Future Outlook | Forecasted customer growth to reach 17.7 million by 2025, driven by expanding service offerings and partnerships. |

Market Analysis and Trends

Wise operates in the rapidly evolving fintech sector, which has seen significant growth due to increasing demand for cost-effective and efficient financial services. The global cross-border payment market is projected to grow substantially, driven by globalization and the rise of digital nomadism.

Current Market Statistics

- Customer Growth: Wise’s customer base reached 12.8 million by March 2024, up from 10 million in March 2023.

- Revenue Growth: The company reported an underlying income increase of 31% year-over-year for FY2024, totaling £1.2 billion.

- Transaction Volume: Wise facilitated £118.5 billion in cross-border transactions in FY2024, marking a 13% increase from the previous year.

Trends Impacting Wise

- Increased Demand for Transparency: Consumers are increasingly seeking financial services that offer clear pricing structures without hidden fees.

- Digital Transformation: The shift towards online banking solutions has accelerated post-pandemic, with more users opting for digital-first financial services.

- Regulatory Changes: As regulations evolve globally, Wise is adapting its compliance strategies to meet new requirements while maintaining operational efficiency.

Implementation Strategies

To capitalize on market opportunities, Wise employs several strategic initiatives:

- Expansion of Services: Wise continues to enhance its product offerings beyond money transfers to include features like interest-bearing accounts and investment options.

- Technological Investment: The company invests heavily in technology to improve user experience and transaction speed, with 62% of payments processed instantly.

- Partnerships: Collaborations with major banks and fintech companies expand Wise’s reach and enhance service capabilities through the Wise Platform.

Risk Considerations

While Wise presents numerous advantages over traditional banks, potential risks must be acknowledged:

- Regulatory Risks: As a non-bank entity operating under various regulatory frameworks, changes in financial regulations could impact Wise’s operations.

- Market Competition: The fintech space is highly competitive, with numerous players offering similar services. Maintaining a competitive edge is crucial for continued growth.

- Operational Risks: As Wise expands its infrastructure globally, operational challenges may arise related to compliance and service delivery across different markets.

Regulatory Aspects

Wise operates under strict regulatory oversight as a money transmitter rather than a bank. In the U.S., it holds licenses in all 48 states where it operates. This regulatory framework allows Wise to offer services similar to those of banks while ensuring customer funds are safeguarded through partnerships with established financial institutions.

Key Regulatory Compliance Measures

- Customer Fund Safeguarding: Funds are held separately from Wise’s operational funds to protect customer assets.

- Licensing Requirements: Compliance with local regulations ensures that Wise can operate legally across various jurisdictions.

Future Outlook

The future looks promising for Wise as it continues to innovate and adapt to changing market dynamics:

- Projected Growth: Analysts forecast that Wise’s customer base could grow to approximately 17.7 million by the end of 2025 based on current trends.

- Service Expansion: The introduction of new features such as interest-bearing accounts and enhanced business services will likely attract more users.

- Market Leadership: With ongoing investments in technology and customer experience improvements, Wise is poised to strengthen its position as a leader in the global payments market.

Frequently Asked Questions About Is Wise A Bank?

- Is Wise considered a bank?

No, Wise is not a bank; it is a regulated money transmitter offering bank-like services such as multi-currency accounts. - What services does Wise provide?

Wise offers international money transfers, multi-currency accounts, debit cards for spending abroad, and interest-bearing accounts through partnerships. - How does Wise ensure my money is safe?

Customer funds are safeguarded through regulatory compliance and partnerships with licensed banks; funds are held separately from operational funds. - What are the fees associated with using Wise?

Fees are transparent and typically lower than traditional banks; users can expect mid-market exchange rates without hidden charges. - Can I use Wise for business transactions?

Yes, Wise offers specific products tailored for businesses that facilitate cross-border payments efficiently. - How quickly can I transfer money using Wise?

Many transactions are processed instantly; about 62% of payments arrive within 20 seconds. - What currencies can I hold in my Wise account?

Users can hold balances in over 40 currencies within their Wise account. - Is there an interest rate on deposits held with Wise?

Yes, customers can earn interest on their deposits through specific features available in select regions.

Wise represents an innovative alternative to traditional banking services by leveraging technology to provide cost-effective solutions for international money transfers and currency management. While it lacks some features typically associated with banks—such as loans or credit products—it excels in transparency and efficiency. As digital finance continues to evolve, companies like Wise will play an increasingly vital role in shaping how individuals manage their finances globally.