The Vanguard Total Stock Market ETF (VTI) is a popular investment choice among those seeking broad exposure to the U.S. equity market. By tracking the CRSP U.S. Total Market Index, VTI encompasses a wide range of stocks, including large-, mid-, and small-cap companies. This makes it an attractive option for investors looking for diversification within a single fund. With its low expense ratio and historical performance, many wonder if VTI is a good investment for their portfolios.

Investing in VTI allows individuals to gain exposure to thousands of stocks, which can help mitigate risks associated with individual stock investments. As of late 2024, VTI has shown strong historical returns, making it a reliable choice for long-term investors. However, like any investment, it comes with its own set of risks and considerations that potential investors should evaluate carefully.

| Feature | Details |

|---|---|

| Expense Ratio | 0.03% |

| Dividend Yield | 1.27% |

| Inception Date | May 24, 2001 |

| Average Annual Return | 8.8% since inception |

Understanding VTI’s Structure and Performance

VTI operates as an exchange-traded fund (ETF), which means it can be traded on stock exchanges like individual stocks. This structure allows for high liquidity, enabling investors to buy and sell shares without significantly impacting the market price. VTI holds over 3,600 stocks, providing extensive diversification across various sectors.

The fund has historically delivered solid returns, averaging 8.8% annually since its inception in 2001. In recent years, particularly during market recoveries, VTI has performed exceptionally well. For instance, it recorded a 37.85% return over the past year leading up to November 2024. This performance is indicative of its ability to track the broader market effectively.

Investors should note that while VTI offers broad market exposure, it is also subject to market volatility. The fund’s beta is approximately 1, meaning it tends to move in line with the overall market. Therefore, during market downturns, investors may experience declines in their investments.

Benefits of Investing in VTI

Investing in VTI comes with numerous advantages:

- Diversification: By holding thousands of stocks across various sectors, VTI minimizes the risk associated with investing in individual companies.

- Low Costs: With an expense ratio of just 0.03%, VTI is one of the most cost-effective ways to gain exposure to the U.S. stock market.

- Consistent Returns: Historically, VTI has provided consistent returns that align closely with the overall U.S. market performance.

- Liquidity: The ETF structure allows for easy buying and selling without significant price fluctuations.

- Dividend Payments: VTI pays dividends quarterly, offering investors a source of income alongside capital appreciation.

These benefits make VTI an appealing option for both novice and experienced investors looking to build a diversified portfolio.

Risks and Considerations

While VTI presents many advantages, potential investors must also consider its risks:

- Market Risk: As a total market fund, VTI is susceptible to overall market fluctuations. Economic downturns can lead to significant losses.

- Concentration Risk: A substantial portion of VTI’s holdings is concentrated in large-cap stocks like Apple and Microsoft. This concentration can increase volatility during market corrections.

- Drawdowns: Historical data indicates that VTI has experienced maximum drawdowns of around 50%, which could be concerning for risk-averse investors.

- Interest Rate Sensitivity: Changes in interest rates can affect stock prices broadly; thus, rising rates may negatively impact VTI’s performance.

Understanding these risks is crucial for making informed investment decisions regarding VTI.

Who Should Invest in VTI?

VTI is suitable for various types of investors:

- Long-term Investors: Those looking for steady growth over time may find VTI aligns well with their investment goals.

- New Investors: Beginners seeking a simple way to invest in the entire U.S. stock market can benefit from the diversification offered by VTI.

- Retirement Accounts: Investors looking to build wealth for retirement can use VTI as a core holding due to its historical performance and low fees.

- Passive Investors: Individuals who prefer a hands-off approach will appreciate the passive management style of this ETF.

However, it’s essential for all investors to assess their risk tolerance and investment objectives before committing funds to VTI.

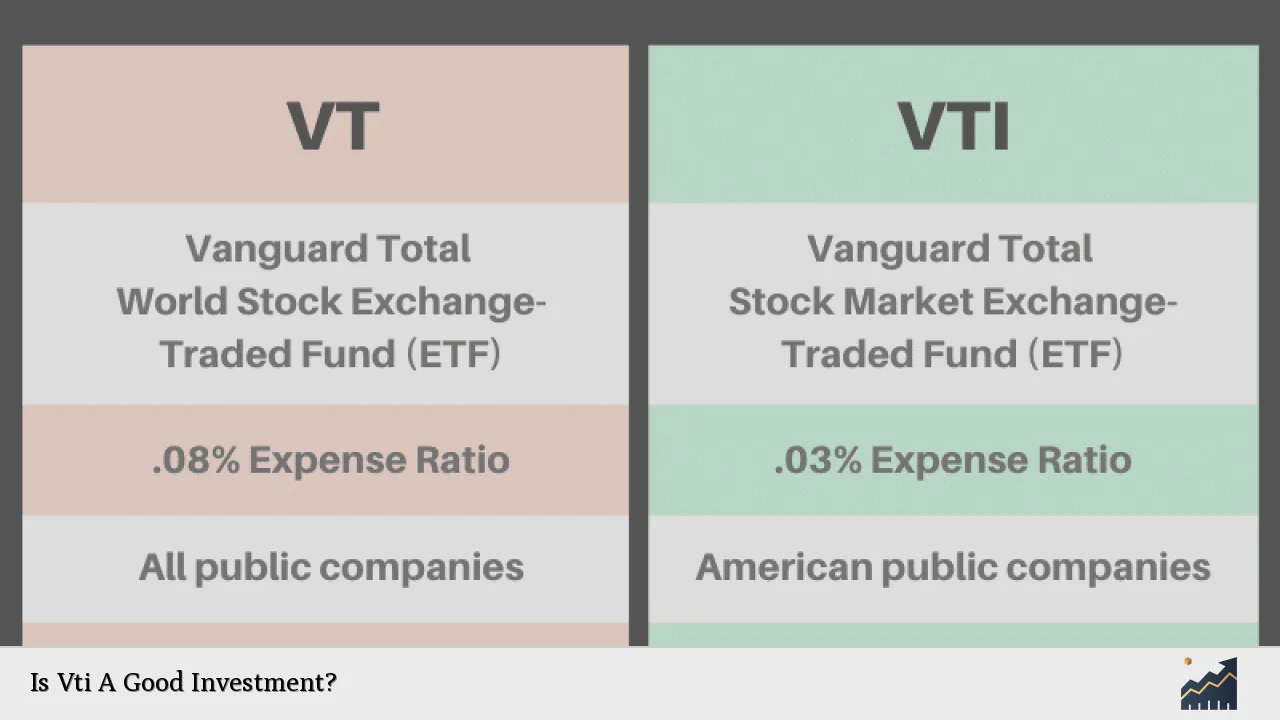

Comparing VTI with Other Investment Options

When considering an investment in VTI, it’s helpful to compare it with other popular ETFs or investment strategies:

| Investment Option | Expense Ratio |

|---|---|

| Vanguard S&P 500 ETF (VOO) | 0.03% |

| iShares Russell 2000 ETF (IWM) | 0.19% |

| SPDR Dow Jones Industrial Average ETF (DIA) | 0.16% |

While all these options provide exposure to different segments of the U.S. stock market, they differ in terms of focus and potential returns. For instance:

- VOO focuses solely on large-cap companies within the S&P 500 index.

- IWM targets small-cap stocks which can be more volatile but may offer higher growth potential.

- DIA represents only 30 large companies within the Dow Jones index.

Investors should choose based on their specific goals and risk tolerance levels.

Future Outlook for VTI

Looking ahead, analysts have mixed predictions regarding the future performance of VTI:

- Some forecasts suggest that while short-term volatility may persist due to economic uncertainties, long-term growth remains plausible given historical trends.

- Analysts predict that by 2025, the average price target for VTI could be around $261, indicating potential downside from current levels but also highlighting long-term growth opportunities beyond that horizon.

Investors should remain aware of macroeconomic factors such as inflation rates and interest rate changes that could impact overall market performance and subsequently affect ETFs like VTI.

Conclusion

In summary, whether or not VTI is a good investment largely depends on individual financial goals and risk tolerance levels. Its low expense ratio, broad diversification across thousands of stocks, and historical performance make it an attractive option for many investors seeking exposure to the U.S. equity market.

However, potential investors must weigh these benefits against inherent risks such as market volatility and concentration issues within the fund’s holdings. For those who align with its characteristics and are comfortable navigating its risks, investing in Vanguard Total Stock Market ETF could be a prudent choice for long-term wealth accumulation.

FAQs About Is Vti A Good Investment?

- What is Vanguard Total Stock Market ETF (VTI)?

It is an ETF that tracks the performance of the CRSP U.S. Total Market Index. - How much does it cost to invest in VTI?

The expense ratio is only 0.03%, making it very cost-effective. - What are the historical returns of VTI?

The average annual return since inception is approximately 8.8%. - Is VTI suitable for beginners?

Yes, it offers broad exposure and diversification ideal for new investors. - What are the risks associated with investing in VTI?

The primary risks include market volatility and concentration risk among top holdings.