Tykr is an investment research platform designed to simplify stock analysis for individual investors. With its AI-powered tools, Tykr enables users to screen, analyze, and track stocks based on various metrics, making it particularly appealing to both novice and experienced investors. This article explores the effectiveness of Tykr in the current investment landscape, evaluating its features, benefits, and potential drawbacks.

| Key Concept | Description/Impact |

|---|---|

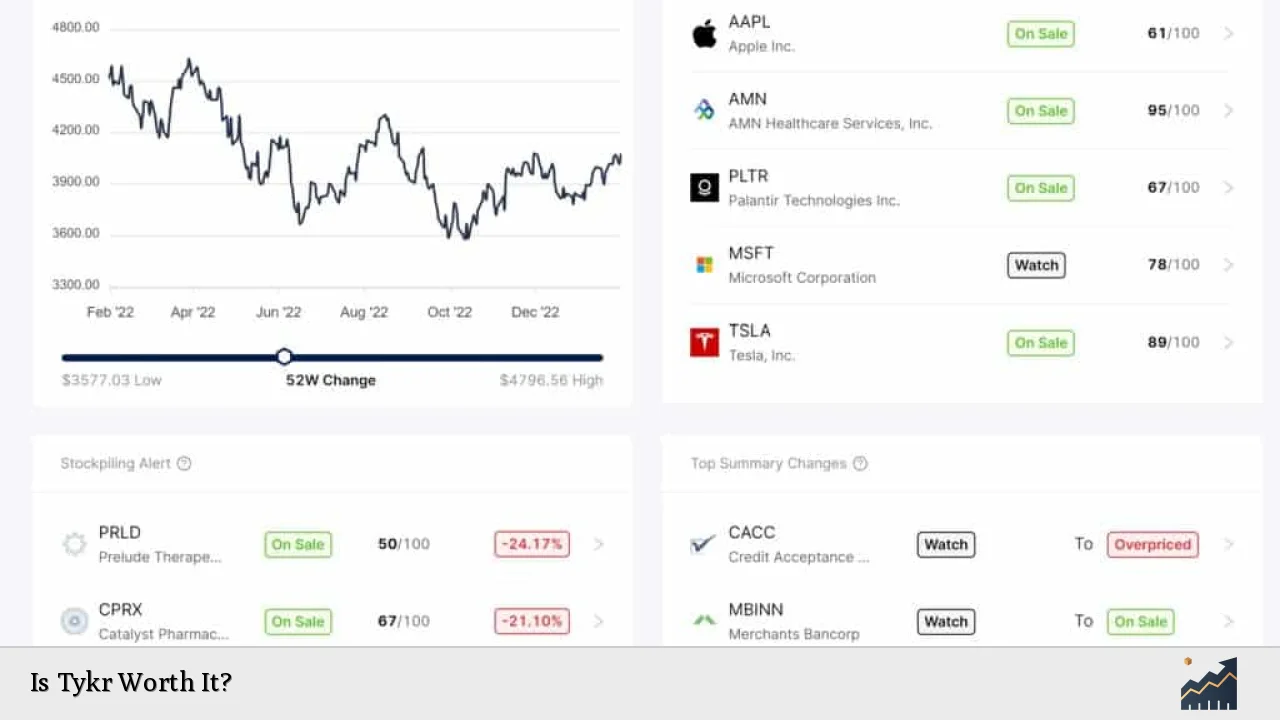

| Stock Screener | Tykr’s stock screener allows users to filter thousands of stocks based on valuation metrics, growth prospects, and financial health. This feature helps investors identify potentially undervalued stocks. |

| Fair Value Estimates | The platform provides proprietary fair value estimates for stocks, categorizing them as “On Sale,” “Fairly Valued,” or “Overvalued,” assisting investors in making informed decisions. |

| User-Friendly Interface | Tykr is designed for ease of use, featuring simple visuals and educational resources that cater to beginners and help demystify investing concepts. |

| Portfolio Tracking | The platform allows users to track their investments and monitor overall portfolio performance, providing a comprehensive view of their financial health. |

| Cost-Effectiveness | Tykr is priced competitively compared to traditional investment research platforms, making it accessible for individual investors looking for quality analysis without high costs. |

Market Analysis and Trends

The investment landscape has evolved significantly in recent years. With increasing volatility in global markets and a growing emphasis on data-driven decision-making, tools like Tykr are becoming essential for individual investors.

- Growth of Retail Investing: The rise of retail investing has been fueled by technological advancements and increased access to financial markets. Platforms like Tykr cater to this trend by providing user-friendly tools that simplify stock analysis.

- AI Integration: The integration of artificial intelligence in investment platforms is a key trend. Tykr utilizes machine learning algorithms to analyze stock data, offering insights that were previously available only through complex financial models.

- Focus on Value Investing: There has been a renewed interest in value investing strategies, particularly following market corrections that have left many stocks undervalued. Tykr aligns with this trend by helping users identify undervalued stocks based on fundamental analysis.

Implementation Strategies

To maximize the benefits of using Tykr, investors should consider the following strategies:

- Regularly Update Watchlists: Investors should use Tykr’s stock screener to regularly update their watchlists based on changing market conditions and personal investment goals.

- Utilize Educational Resources: Tykr offers a range of educational materials that can help users understand investment principles better. Engaging with these resources can enhance an investor’s ability to make informed decisions.

- Diversify Portfolios: While Tykr provides valuable insights into individual stocks, it’s crucial for investors to maintain diversified portfolios to mitigate risk.

- Monitor Market Trends: Keeping an eye on broader market trends and economic indicators can help investors contextualize their stock selections within the larger economic landscape.

Risk Considerations

Investing always involves risks, and while Tykr provides tools to help mitigate these risks, users should be aware of the following:

- Market Volatility: The stock market can be unpredictable. Even with thorough analysis, external factors such as economic downturns or geopolitical events can affect stock performance.

- Dependence on Data Accuracy: Tykr relies on data analytics; therefore, any inaccuracies in data can lead to poor investment decisions. Users should cross-reference information when necessary.

- Limited Real-Time Data: Some users have reported that Tykr lacks real-time data capabilities, which may hinder decision-making for active traders who rely on up-to-the-minute information.

Regulatory Aspects

Understanding regulatory requirements is essential for any investor:

- Compliance with SEC Regulations: As an investment tool, Tykr must comply with regulations set forth by the Securities and Exchange Commission (SEC). This includes ensuring that all information provided is accurate and not misleading.

- Data Privacy Regulations: With increasing scrutiny over data privacy, Tykr must adhere to regulations that protect user data while providing personalized investment advice.

Future Outlook

The future of platforms like Tykr looks promising as they adapt to changing investor needs:

- Expansion of Features: As technology evolves, Tykr is likely to expand its features to include more advanced analytics tools and real-time data capabilities.

- Increased User Base: With more individuals entering the investing space, platforms that simplify stock analysis will continue to gain traction among retail investors.

- Integration with Other Financial Tools: Future developments may include integrations with other financial management tools, allowing users a more holistic view of their finances.

Frequently Asked Questions About Is Tykr Worth It?

- What is Tykr?

Tykr is an AI-powered stock analysis platform that helps investors screen and analyze stocks based on various financial metrics. - How does Tykr determine if a stock is undervalued?

Tykr uses proprietary algorithms to calculate fair value estimates for stocks and categorizes them as “On Sale,” “Fairly Valued,” or “Overvalued.” - Is Tykr suitable for beginners?

Yes, Tykr is designed with a user-friendly interface and educational resources that make it accessible for novice investors. - What are the main benefits of using Tykr?

The main benefits include time savings in stock analysis, unbiased quantitative evaluations, cost-effectiveness compared to traditional platforms, and portfolio tracking capabilities. - Are there any drawbacks to using Tykr?

Some users have noted limitations such as lack of real-time data and potential inaccuracies in data analysis. - Can I use Tykr for active trading?

While Tykr is primarily focused on long-term investing strategies rather than active trading, it can still provide valuable insights for making informed decisions. - What type of investor would benefit most from using Tykr?

Tykr is particularly beneficial for long-term value investors who prefer a systematic approach to analyzing stocks based on fundamentals. - Does Tykr provide customer support?

Yes, Tykr offers customer support through various channels including email and community forums where users can share experiences and ask questions.

In conclusion, whether or not Tykr is worth it largely depends on individual investment styles and needs. For those focused on value investing who appreciate a structured approach backed by data analytics, Tykr presents a compelling option. Its affordability combined with robust analytical capabilities makes it an attractive tool in the evolving landscape of retail investing. However, potential users should consider their specific requirements and possibly test the platform before fully committing.