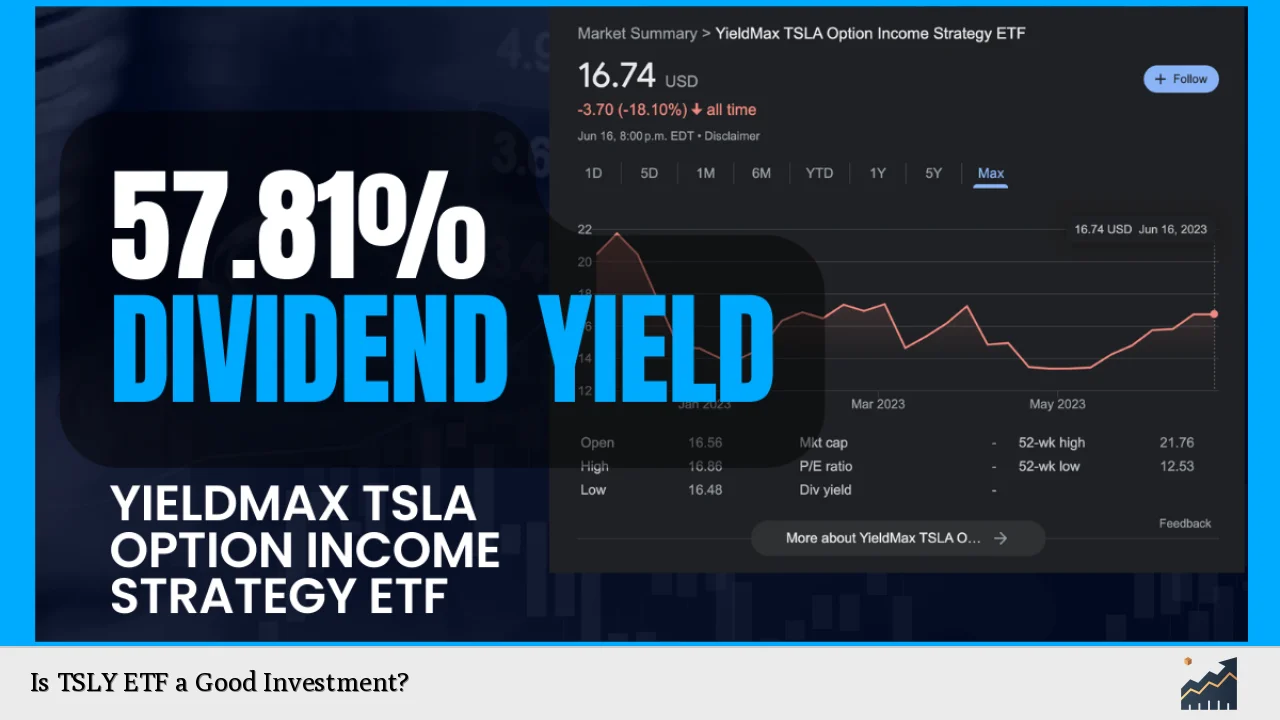

The YieldMax TSLA Option Income Strategy ETF (TSLY) has emerged as a notable player in the investment landscape, particularly for income-seeking investors. Launched in late 2022, TSLY employs a unique strategy centered around options trading on Tesla Inc. (TSLA) stock, aiming to deliver high yields. However, potential investors must carefully evaluate the fund’s structure, risks, and market conditions before making an investment decision.

| Key Concept | Description/Impact |

|---|---|

| Investment Strategy | TSLY primarily generates income by writing call options on Tesla stock while holding U.S. Treasuries as collateral. This strategy allows for high yield but caps upside potential. |

| Yield Performance | While TSLY boasts a headline yield exceeding 90%, much of this yield is funded through returns of capital rather than sustainable income, raising concerns about long-term viability. |

| Market Volatility | The fund’s performance is closely tied to Tesla’s stock volatility; significant price fluctuations can impact both income generation and principal value. |

| Risk Factors | Investors face risks associated with single-stock exposure, high volatility, and the potential for reduced or unpredictable distributions. |

| Historical Performance | Since its inception, TSLY has experienced negative returns when excluding distributions, indicating challenges in capital preservation. |

Market Analysis and Trends

The current financial landscape showcases a growing interest in high-yield investment vehicles, particularly among retail investors seeking immediate income. TSLY has positioned itself within this niche by leveraging the popularity of Tesla stock.

Current Market Statistics

- Current Price: Approximately $15.20

- Annual Yield: Over 90%, with monthly distributions that have fluctuated significantly.

- Expense Ratio: 1.01%, which is relatively high for an ETF focused on options trading.

- Performance Since Inception: Cumulative loss of about 5.7% without accounting for distributions.

Tesla Stock Dynamics

Tesla’s stock has been volatile, impacting TSLY’s performance directly. The stock’s price movements influence the effectiveness of the options strategy employed by TSLY:

- 2023 Performance: Tesla shares saw a substantial increase of over 100% at one point but have since faced downward pressure.

- Market Sentiment: Investor sentiment around Tesla remains mixed due to competitive pressures from other electric vehicle manufacturers and broader economic factors.

Implementation Strategies

Investors considering TSLY should adopt specific strategies to mitigate risks and enhance potential returns:

- Income Focus: Prioritize TSLY for generating immediate cash flow rather than long-term capital appreciation.

- Diversification: Consider using TSLY as part of a broader portfolio that includes more stable investments to balance risk exposure.

- Monitoring Volatility: Keep a close eye on Tesla’s stock performance and market conditions, as these will directly affect TSLY’s income generation capabilities.

Risk Considerations

Investing in TSLY involves several inherent risks that potential investors must understand:

- Single Stock Risk: The fund’s reliance on Tesla exposes investors to risks associated with the company’s performance and market perception.

- Income Variability: Distributions are not guaranteed and can fluctuate based on market conditions and the fund’s underlying option strategies.

- High Volatility: The ETF’s performance can be significantly affected by sudden changes in Tesla’s stock price, leading to unpredictable returns.

Regulatory Aspects

As an actively managed ETF, TSLY is subject to regulations set forth by the Securities and Exchange Commission (SEC). This includes:

- Disclosure Requirements: The fund must provide regular updates on its holdings, performance metrics, and risk factors to maintain transparency with investors.

- Tax Implications: Investors should be aware that distributions may include returns of capital, which can have different tax implications compared to qualified dividends.

Future Outlook

The outlook for TSLY remains uncertain due to several factors:

- Market Conditions: Continued volatility in the technology sector and specifically in Tesla’s stock could impact future distributions and overall fund performance.

- Investor Sentiment: If investor appetite for high-yield products remains strong, TSLY could attract more capital; however, sustainability of its yield will be questioned if market conditions deteriorate.

- Performance Comparisons: Investors may find better alternatives that offer lower risk with more sustainable yields as they assess their portfolios moving forward.

Frequently Asked Questions About Is TSLY ETF a Good Investment?

- What is TSLY?

TSLY is an actively managed ETF that seeks to generate monthly income by writing call options on Tesla Inc. (TSLA) while holding U.S. Treasuries as collateral. - How does TSLY generate income?

TSLY generates income primarily through premiums collected from writing call options on TSLA stock. - What are the main risks associated with investing in TSLY?

The main risks include single-stock exposure to Tesla, high volatility in returns, and the potential for unpredictable distributions. - Is TSLY suitable for long-term growth investors?

No, TSLY is primarily designed for income-focused investors rather than those seeking long-term capital appreciation. - What should I consider before investing in TSLY?

Consider your risk tolerance, investment goals focused on income versus growth, and the current market conditions affecting Tesla’s stock. - How has TSLY performed since its inception?

Since its inception in late 2022, TSLY has experienced negative total returns when excluding distributions but has provided high yield payouts. - Can I expect consistent monthly payouts from TSLY?

While TSLY aims for monthly payouts, these can fluctuate significantly based on market conditions and option strategies employed. - Should I consult a financial advisor before investing in TSLY?

Yes, consulting a financial advisor is recommended to ensure that your investment aligns with your overall financial strategy and risk tolerance.

In conclusion, while the YieldMax TSLA Option Income Strategy ETF (TSLY) offers an attractive yield for income-focused investors, it carries significant risks associated with its reliance on Tesla’s stock performance. Potential investors should weigh these risks against their investment goals and consider diversifying their portfolios to mitigate exposure to this high-risk asset class.