The iShares 20+ Year Treasury Bond ETF (TLT) has been a topic of intense debate among investors, especially in the current economic climate characterized by inflation concerns, interest rate uncertainties, and geopolitical tensions. As we navigate through 2024, the question of whether TLT is a good investment now requires a nuanced analysis of various factors, including market trends, economic indicators, and potential risks.

| Key Concept | Description/Impact |

|---|---|

| Interest Rate Sensitivity | TLT is highly sensitive to interest rate changes; falling rates typically boost TLT’s price |

| Economic Indicator | TLT’s performance can signal economic expectations; rising prices may indicate economic concerns |

| Portfolio Diversification | TLT can serve as a hedge against stock market volatility in a diversified portfolio |

| Yield Considerations | Current yield of approximately 4.5% may be attractive in certain investment strategies |

Market Analysis and Trends

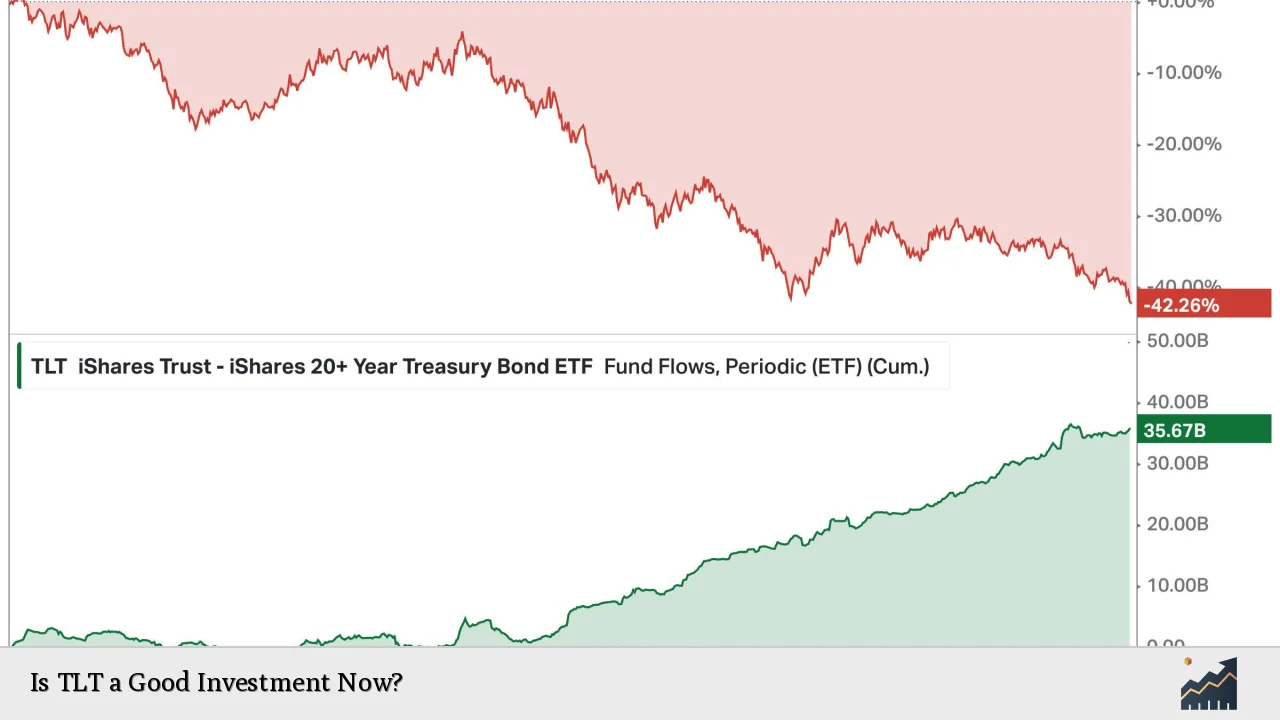

The bond market, particularly long-term Treasury bonds, has experienced significant volatility in recent years. As of 2024, TLT has shown a mixed performance, with periods of both gains and losses. The ETF’s price movements are closely tied to macroeconomic factors, especially Federal Reserve policies and inflation expectations.

Recent data indicates that TLT experienced a notable pullback of about 6% from its 2024 high in September, following stronger-than-expected job data that priced in a “soft landing” scenario. This economic resilience has led to a reassessment of interest rate expectations, with the market now anticipating fewer rate cuts than previously projected.

Despite this pullback, TLT has attracted significant investor interest. In October 2024 alone, the fund saw inflows of $1.1 billion, bringing its total inflows for the year to $11.5 billion. This suggests that many investors view the current price levels as an attractive entry point, anticipating potential gains if economic conditions deteriorate or if the Federal Reserve pivots to a more dovish stance.

The yield on 30-year Treasury bonds, which TLT tracks, has recently traded around 4.49%, marking its highest point since July. This yield increase reflects the market’s evolving expectations about inflation, economic growth, and future Fed policy.

Implementation Strategies

Incorporating TLT into an investment portfolio requires careful consideration of one’s overall financial goals, risk tolerance, and market outlook. Here are some strategies investors might consider:

Hedging Against Stock Market Volatility

TLT can serve as a defensive play in a diversified portfolio. Historically, when the stock market experiences significant downturns, investors often flock to the perceived safety of Treasury bonds, potentially boosting TLT’s price. This negative correlation with equities can help smooth out portfolio returns during turbulent market periods.

Income Generation

With a current yield of around 4.5%, TLT can be an attractive option for income-focused investors, especially in a low-yield environment. However, it’s important to weigh this yield against the fund’s interest rate risk and potential for price volatility.

Tactical Asset Allocation

Investors with a bearish economic outlook might consider overweighting TLT in their portfolios. If recession fears materialize or inflation cools more rapidly than expected, TLT could see significant price appreciation as interest rates potentially decline.

Dollar-Cost Averaging

Given the current market uncertainties, a dollar-cost averaging approach to building a position in TLT could be prudent. This strategy involves regularly investing a fixed amount, which can help mitigate the impact of short-term price volatility.

Risk Considerations

While TLT offers potential benefits, it’s crucial to understand and evaluate the associated risks:

Interest Rate Risk

TLT’s long duration makes it particularly sensitive to interest rate changes. If rates rise unexpectedly or remain higher for longer than anticipated, TLT’s price could experience significant downward pressure.

Inflation Risk

Persistent inflation can erode the real value of the fixed income payments from the underlying Treasury bonds, potentially leading to underperformance of TLT relative to other assets.

Opportunity Cost

In a rising rate environment or during periods of strong economic growth, TLT may underperform other asset classes, such as stocks or shorter-duration bonds.

Liquidity Risk

While TLT is generally highly liquid, extreme market conditions could potentially impact the ETF’s ability to closely track its underlying index or maintain tight bid-ask spreads.

Regulatory Aspects

TLT, as an ETF tracking U.S. Treasury bonds, operates within a well-regulated framework. The fund is subject to oversight by the Securities and Exchange Commission (SEC) and must comply with various reporting and transparency requirements.

Investors should be aware of potential regulatory changes that could impact the Treasury bond market or ETF structures. For instance, discussions around Treasury market reforms or changes to ETF regulations could influence TLT’s operations or market dynamics.

Future Outlook

The outlook for TLT in the near to medium term is closely tied to several key factors:

Federal Reserve Policy

The Fed’s decisions on interest rates and its balance sheet management will be crucial. Current market expectations suggest potential rate cuts in 2025, which could be supportive of TLT’s price.

Economic Indicators

Continued monitoring of inflation, employment data, and GDP growth will be essential. Any signs of economic weakening could increase TLT’s attractiveness as a safe-haven asset.

Geopolitical Developments

Global events, such as trade tensions or geopolitical conflicts, can influence investor sentiment towards U.S. Treasuries and, by extension, TLT.

Fiscal Policy

Government spending and deficit levels can impact the supply of Treasury bonds and influence their yields, potentially affecting TLT’s performance.

In conclusion, whether TLT is a good investment now depends on an investor’s specific circumstances, market outlook, and portfolio strategy. While TLT offers potential benefits in terms of diversification and income, it also carries significant interest rate and inflation risks. Investors should carefully consider their risk tolerance and investment horizon before making a decision.

As with any investment decision, it’s advisable to consult with a financial professional who can provide personalized advice based on your individual financial situation and goals.

Frequently Asked Questions About Is TLT a Good Investment Now

- How does TLT perform during economic recessions?

TLT typically performs well during recessions as investors seek safe-haven assets and the Federal Reserve often lowers interest rates, which can boost bond prices. - What is the expense ratio of TLT?

TLT has a low expense ratio of 0.15%, making it a cost-effective option for gaining exposure to long-term Treasury bonds. - How does TLT compare to other bond ETFs?

TLT focuses on long-term Treasury bonds, making it more sensitive to interest rate changes compared to ETFs with shorter durations. It may offer higher potential returns but also comes with higher volatility. - Can TLT be used as a short-term trading vehicle?

While TLT is primarily designed for longer-term holdings, its high liquidity and options availability make it suitable for short-term trading strategies as well. - How might changes in the Federal Reserve’s policies affect TLT?

Fed policy changes, particularly regarding interest rates and quantitative easing/tightening, can significantly impact TLT’s performance. Rate cuts typically benefit TLT, while rate hikes may negatively affect its price. - What role can TLT play in a diversified portfolio?

TLT can serve as a portfolio diversifier, potentially offsetting stock market volatility and providing a steady income stream. However, its allocation should be balanced against other assets based on individual risk tolerance and investment goals.