Investing is a critical component of financial planning, and determining the right time to invest can significantly impact long-term wealth accumulation. In the current economic landscape, characterized by fluctuating interest rates, inflation concerns, and geopolitical tensions, many investors are asking whether now is an opportune moment to enter the market. This article delves into the current market conditions, potential investment strategies, risk considerations, regulatory aspects, and future outlooks to provide a comprehensive analysis for individual investors and finance professionals.

| Key Concept | Description/Impact |

|---|---|

| Market Conditions | The U.S. economy is experiencing strong GDP growth and low unemployment, with inflation showing signs of stabilization. This environment is generally favorable for long-term investments. |

| Investment Strategies | Strategies such as dollar-cost averaging and diversification are recommended to mitigate risks associated with market volatility. |

| Risk Management | Understanding personal risk tolerance and market risks is crucial in making informed investment decisions. |

| Regulatory Environment | The SEC has increased scrutiny on investment practices, emphasizing the need for compliance among investment managers. |

| Future Outlook | Analysts predict continued economic growth with potential challenges from geopolitical events and inflationary pressures. |

Market Analysis and Trends

The current investment landscape reflects a complex interplay of economic factors. As of December 2024, the U.S. economy has shown resilience, with GDP growth projected at approximately 3.0% for the year. Unemployment remains low at around 4.1%, and consumer spending has been robust, contributing positively to economic indicators. Recent data indicates that inflation is stabilizing, with core inflation expected to fall to around 2.5% by the end of 2025.

Key Market Indicators

- S&P 500 Performance: The S&P 500 index has experienced significant gains, reflecting investor optimism post-election and strong corporate earnings.

- Interest Rates: The Federal Reserve’s recent decision to lower interest rates by 0.25% signals a supportive monetary policy aimed at sustaining economic growth.

- Sector Performance: Cyclical sectors like consumer discretionary and financials have outperformed due to favorable economic conditions, while defensive sectors have lagged.

Implementation Strategies

Investors should consider various strategies when deciding to invest in the current market:

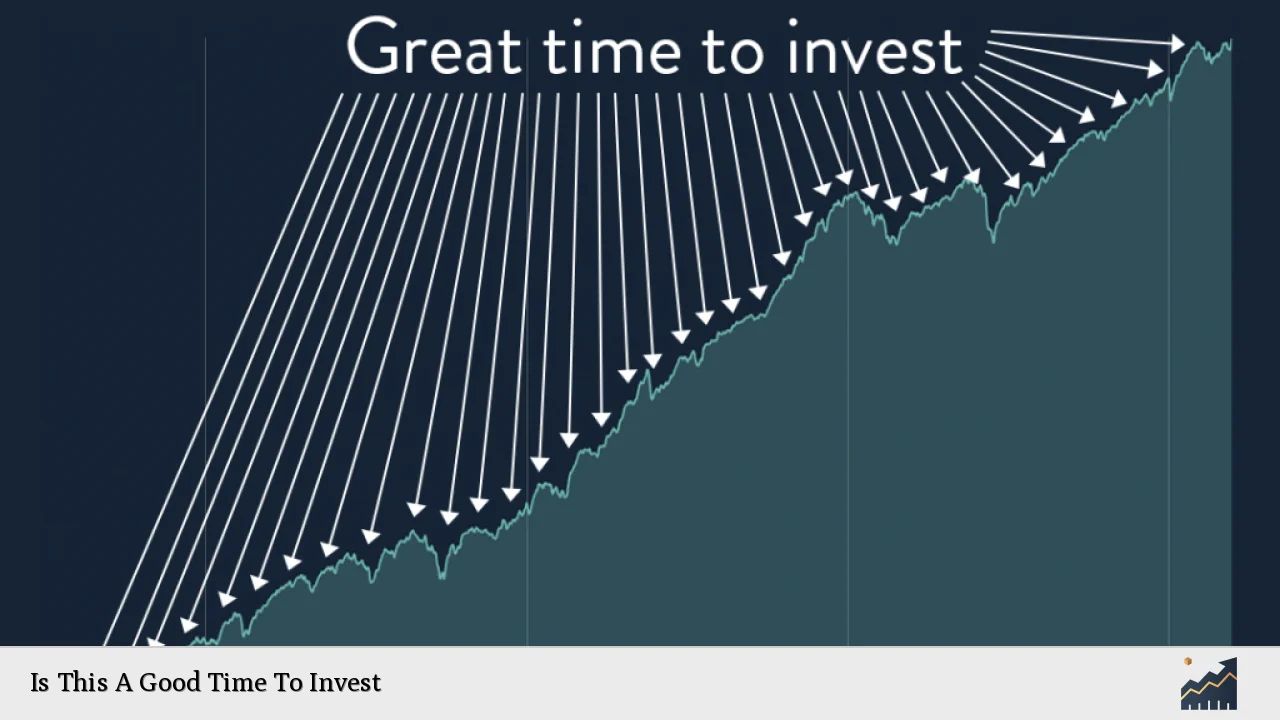

- Dollar-Cost Averaging: This strategy involves consistently investing a fixed amount regardless of market conditions, which can reduce the impact of volatility.

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) can help mitigate risks associated with market fluctuations.

- Long-Term Focus: Historically, markets tend to recover from downturns over time. A long-term investment horizon can help investors ride out short-term volatility.

- Alternative Investments: Exploring alternative asset classes such as real estate or private equity can provide additional diversification benefits.

Risk Considerations

While investing now may present opportunities, it is essential to consider associated risks:

- Market Volatility: Economic uncertainties and geopolitical tensions can lead to significant market fluctuations.

- Interest Rate Risks: Changes in interest rates can affect bond prices and overall market performance.

- Regulatory Risks: Increased scrutiny from regulatory bodies like the SEC may impact investment strategies and compliance requirements.

Investors should assess their risk tolerance before making significant investment decisions.

Regulatory Aspects

The regulatory landscape for investments is evolving:

- The SEC has intensified its focus on compliance among investment firms, particularly regarding transparency and risk management practices.

- New regulations may require firms to enhance their operational frameworks to adapt to changing compliance demands.

Investors should stay informed about these regulatory changes as they may influence investment strategies and market dynamics.

Future Outlook

Looking ahead, analysts project a cautiously optimistic outlook for the markets:

- Continued economic growth is expected, driven by consumer spending and business investments.

- However, potential challenges from inflationary pressures and global geopolitical events could create headwinds for sustained growth.

Investors are encouraged to remain vigilant and adaptable in their strategies as market conditions evolve.

Frequently Asked Questions About Is This A Good Time To Invest

- Is it wise to invest during economic uncertainty?

Yes, investing during uncertain times can be beneficial if approached with a long-term perspective and sound strategies like dollar-cost averaging. - What are some safe investment options right now?

Diversified mutual funds or ETFs that focus on stable sectors may offer safer options during volatile times. - How can I manage risks when investing?

Diversification across asset classes and understanding your risk tolerance are key strategies for managing investment risks. - What role does inflation play in my investment decisions?

Inflation affects purchasing power; thus, considering assets that traditionally outperform during inflationary periods (like real estate) can be beneficial. - Should I wait for a market dip before investing?

While waiting for dips can be tempting, consistent investing over time often yields better results than trying to time the market. - How do I know if I’m ready to invest?

If you have a solid understanding of your financial situation, clear goals, and an emergency fund in place, you may be ready to start investing. - What are alternative investments?

Alternative investments include assets like real estate, private equity, hedge funds, or commodities that provide diversification beyond traditional stocks and bonds. - Can I invest if I have debt?

It’s generally advisable to manage high-interest debt before investing; however, contributing small amounts towards investments while paying off debt can also be beneficial.

In conclusion, while there are inherent risks in any investment environment, the current economic indicators suggest that now could be a favorable time for investors willing to adopt strategic approaches tailored to their financial goals. By staying informed about market trends and regulatory changes, investors can navigate this landscape effectively.