The RSA-1 (Retirement Systems of Alabama) is a deferred compensation plan designed for public employees in Alabama, allowing participants to save and invest extra money for retirement on a tax-deferred basis. As with any investment option, evaluating whether RSA-1 is a good investment involves examining its structure, performance, market trends, and associated risks. This article provides a comprehensive analysis of the RSA-1 investment plan, including its features, market performance, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Tax Advantages | Contributions to RSA-1 are tax-deferred, meaning taxes are paid upon withdrawal during retirement, potentially lowering the overall tax burden. |

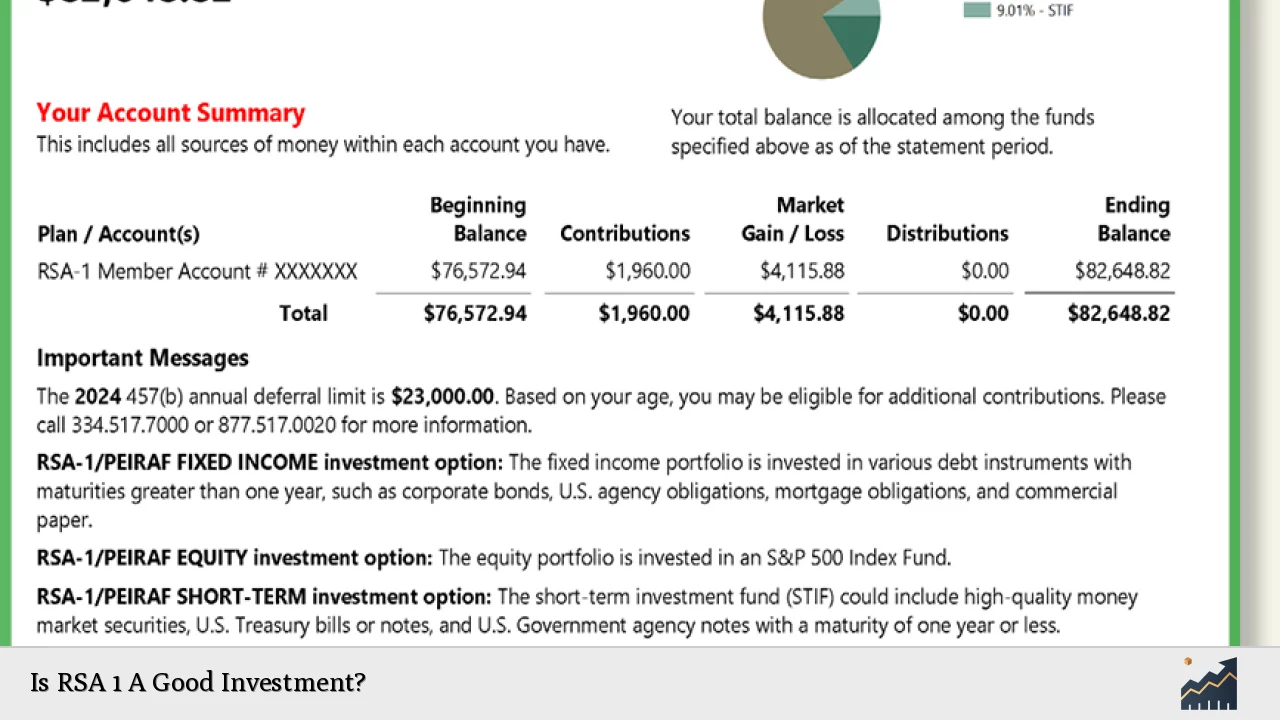

| Investment Options | The plan primarily invests in an S&P 500 index fund for equities and various fixed-income instruments, providing a balanced approach to growth and stability. |

| Performance History | RSA-1 has shown strong historical returns, with recent reports indicating significant gains in the last fiscal year. |

| Fees | One of the advantages of RSA-1 is that it typically has no management fees, which can enhance overall returns compared to other investment vehicles. |

| Risk Factors | Despite its benefits, RSA-1 investments are subject to market risks inherent in equity and fixed-income markets. |

| Regulatory Compliance | As a Section 457 plan, RSA-1 adheres to specific IRS regulations that govern deferred compensation plans. |

| Future Outlook | The investment landscape may be influenced by economic conditions, interest rates, and regulatory changes affecting public employee retirement systems. |

Market Analysis and Trends

The current economic environment significantly impacts investment decisions. The RSA-1 plan’s equity portion is primarily invested in an S&P 500 index fund, which has historically provided robust long-term returns. Recent trends indicate that the U.S. stock market remains volatile due to economic uncertainties, including inflationary pressures and interest rate fluctuations. However, the S&P 500 has shown resilience, with annualized returns over the past decade averaging around 14%, making it an attractive option for long-term investors.

In the fiscal year ending September 30, 2023, the RSA funds reported record returns:

- Teachers’ Retirement System: 21%

- Employees’ Retirement System: 21.21%

- Judicial Retirement Fund: 22.21%

These figures place RSA among the top performers in its peer group. Such strong performance can enhance the attractiveness of investing in RSA-1 as part of a diversified retirement strategy.

Implementation Strategies

Investing in RSA-1 should be aligned with individual financial goals and risk tolerance. Here are some strategies for effective implementation:

- Diversification: While the equity portion is concentrated in large-cap U.S. stocks via the S&P 500 index fund, participants can consider allocating their contributions between equity and fixed income based on their risk profile.

- Regular Contributions: Consistent contributions can take advantage of dollar-cost averaging, mitigating the impact of market volatility over time.

- Rebalancing: Periodic review and rebalancing of asset allocation can help maintain alignment with retirement goals as market conditions change.

- Long-Term Focus: Given that RSA-1 is designed for retirement savings, investors should adopt a long-term perspective to weather short-term market fluctuations.

Risk Considerations

While RSA-1 offers several advantages, it is essential to understand the associated risks:

- Market Risk: The equity investments are subject to market volatility; significant downturns can impact account balances.

- Interest Rate Risk: Fixed-income investments may be negatively affected by rising interest rates, which can lead to lower bond prices.

- Inflation Risk: If inflation outpaces investment returns, purchasing power may erode over time.

- Lack of Flexibility: Unlike other investment accounts that may offer a broader range of options (e.g., mutual funds), RSA-1 has limited choices primarily focused on large-cap U.S. equities and fixed income.

Regulatory Aspects

RSA-1 operates under Section 457 of the Internal Revenue Code, which provides specific tax advantages for public employees:

- Tax Deferral: Contributions reduce taxable income in the year they are made; taxes are deferred until withdrawal during retirement.

- Contribution Limits: For 2024, the contribution limit for 457 plans is set at $22,500 per year (with an additional catch-up contribution available for those aged 50 or older).

Participants should also be aware that while funds are not insured by the FDIC or any government agency, they are managed under strict regulatory guidelines designed to protect investors.

Future Outlook

The future performance of RSA-1 will depend on various factors:

- Economic Conditions: Continued economic recovery post-pandemic could lead to improved market conditions; however, inflation and geopolitical tensions pose risks.

- Interest Rate Movements: The Federal Reserve’s policies regarding interest rates will significantly impact both equity and fixed-income markets.

- Legislative Changes: Potential changes in tax laws or retirement regulations could affect contributions or withdrawals from plans like RSA-1.

Given these factors, maintaining a flexible investment strategy that can adapt to changing conditions will be crucial for maximizing returns from RSA-1 investments.

Frequently Asked Questions About Is RSA 1 A Good Investment?

- What is RSA-1?

RSA-1 is a deferred compensation plan for public employees in Alabama that allows tax-deferred contributions towards retirement savings. - How does RSA-1 perform compared to other retirement accounts?

RSA-1 typically offers competitive returns due to its focus on an S&P 500 index fund with no management fees. - Are there any fees associated with investing in RSA-1?

No management fees are charged on RSA-1 investments, making it cost-effective compared to many other retirement accounts. - What risks should I consider when investing in RSA-1?

The primary risks include market volatility affecting equity investments and interest rate risk impacting fixed-income securities. - Can I change my investment choices within RSA-1?

Participants can adjust their contributions between equity and fixed-income options based on their financial goals and risk tolerance. - What happens if I leave my job?

If you leave your job as a public employee in Alabama, you can roll over your RSA-1 account into another qualified retirement account or withdraw funds subject to taxes. - How does tax deferral work with RSA-1?

Contributions reduce your taxable income when made; taxes are only paid upon withdrawal during retirement. - Is my investment guaranteed?

No investments in RSA-1 are guaranteed by the FDIC or any government agency; they are subject to market risks.

In conclusion, whether RSA-1 is a good investment depends on individual financial circumstances and goals. Its strong historical performance coupled with tax advantages makes it an appealing option for many public employees looking to enhance their retirement savings. However, potential investors should carefully consider their risk tolerance and consult with financial advisors when necessary.