Robinhood has emerged as a popular investment platform, particularly among younger investors. Founded in 2013 with the mission to democratize finance, it offers commission-free trading for stocks, ETFs, options, and cryptocurrencies. The platform has attracted millions of users by removing traditional barriers to entry, such as account minimums and trading fees. However, potential investors must consider various factors before deciding if Robinhood is the right choice for their financial goals.

The user-friendly interface and mobile-first design make Robinhood appealing to novice investors. With features like fractional shares and no minimum deposits, it allows individuals to start investing with minimal capital. Despite its advantages, Robinhood has faced criticism regarding its customer service and the gamification of trading, which may lead inexperienced users to make impulsive decisions.

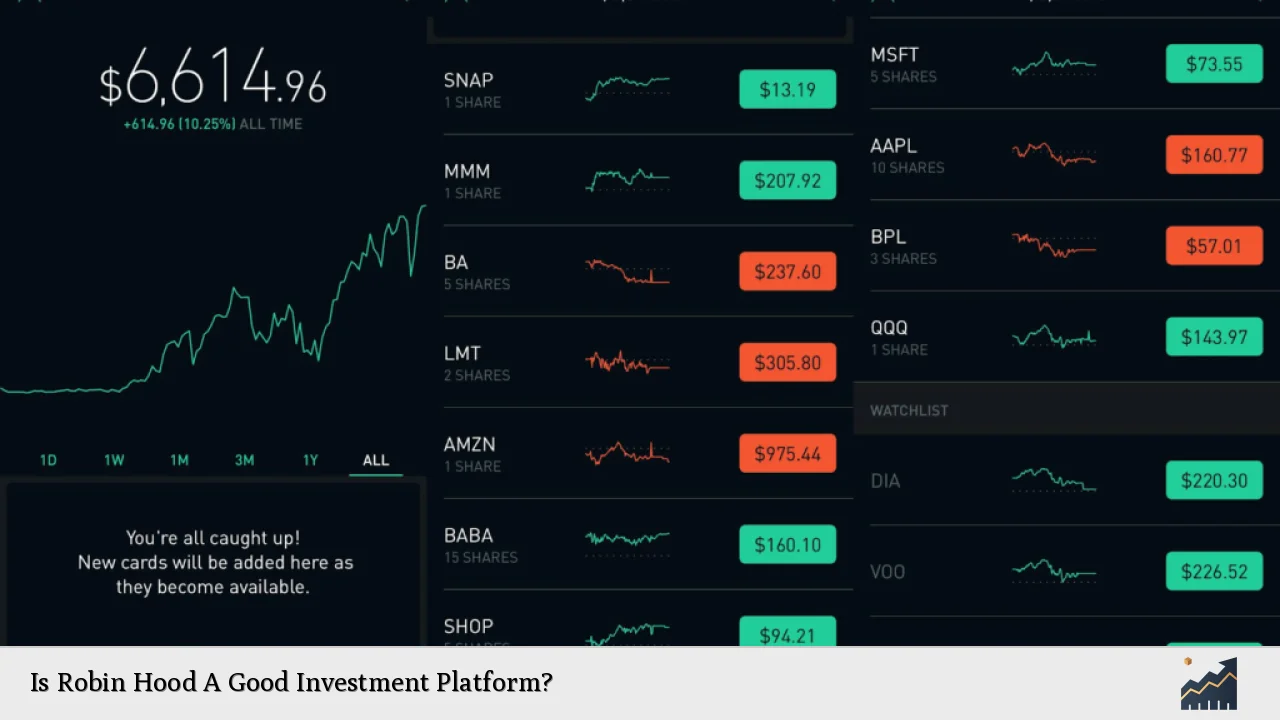

To provide a clearer understanding of Robinhood’s offerings and limitations, the following table summarizes key features of the platform:

| Feature | Description |

|---|---|

| Commission-Free Trading | No fees for buying or selling stocks and ETFs. |

| Fractional Shares | Invest in portions of shares with as little as $1. |

| User Demographics | Primarily targets millennials and Gen Z investors. |

| Educational Resources | Offers content to help users understand investing. |

| Customer Service Issues | Reported difficulties in reaching support for account issues. |

Advantages of Using Robinhood

Robinhood offers several important advantages that make it an attractive platform for many investors.

- No Commission Fees: One of the most significant benefits is the absence of commission fees on trades. This feature allows users to buy and sell stocks without worrying about incurring additional costs, making it easier for beginners to experiment with investing.

- Accessibility: Robinhood has eliminated the minimum balance requirement typically found in traditional brokerage accounts. This accessibility allows individuals from various financial backgrounds to start investing without needing substantial initial capital.

- Fractional Shares: The ability to purchase fractional shares means that users can invest smaller amounts in high-priced stocks. This feature democratizes access to expensive equities that might otherwise be out of reach for many investors.

- User-Friendly Interface: The platform is designed with simplicity in mind, making it easy for new investors to navigate. Its mobile application is particularly appealing for those who prefer managing their investments on-the-go.

- Educational Resources: Robinhood has invested in educational content aimed at helping users understand investing concepts better. This focus on education can empower users to make informed decisions about their investments.

These advantages have contributed to Robinhood’s rapid growth and popularity among retail investors.

Drawbacks of Using Robinhood

While Robinhood has many appealing features, there are also significant drawbacks that potential users should consider.

- Customer Service Challenges: Numerous reviews highlight issues with customer service. Users have reported long wait times and difficulty reaching support when problems arise, which can be particularly concerning during critical financial situations.

- Gamification Concerns: Critics argue that Robinhood’s design elements gamify trading, potentially leading inexperienced investors to make impulsive decisions based on trends rather than sound financial principles. This approach can encourage risky behavior that may result in significant losses.

- Limited Research Tools: Compared to more established brokerage firms, Robinhood offers limited research tools and resources. Investors seeking comprehensive analysis and detailed market insights may find the platform lacking in this regard.

- Withdrawal Restrictions: Some users have experienced difficulties withdrawing funds from their accounts or faced unexpected restrictions on trading certain stocks. These issues can create frustration and mistrust among users.

- Market Volatility Risks: As with any investment platform, users are exposed to market volatility risks. The ease of trading on Robinhood may lead some investors to engage in high-frequency trading without fully understanding the associated risks.

Understanding these drawbacks is essential for anyone considering using Robinhood as their investment platform.

Who Should Use Robinhood?

Robinhood is particularly suitable for certain types of investors due to its unique features and offerings.

- Beginner Investors: Those new to investing will find Robinhood’s straightforward interface and educational resources helpful as they learn the basics of stock trading.

- Young Investors: The platform primarily targets millennials and Gen Z individuals who may not have significant capital but wish to start investing early in their financial journey.

- Casual Traders: Investors looking for a simple way to buy and sell stocks without engaging in complex trading strategies may appreciate Robinhood’s ease of use.

- Cost-Conscious Individuals: Those who want to avoid commission fees while still participating in the stock market will benefit from Robinhood’s no-fee structure.

However, more experienced traders or those requiring advanced tools may find better alternatives among traditional brokerage firms or platforms designed for active traders.

Alternatives to Robinhood

For those considering alternatives to Robinhood, several platforms offer different features that might better suit individual needs.

| Platform | Key Features |

|---|---|

| E*TRADE | Robust research tools, educational resources, extensive investment options. |

| Fidelity | No commission fees, excellent customer service, comprehensive research tools. |

| Charles Schwab | No minimum balance requirement, extensive investment options, strong customer support. |

Each alternative provides unique benefits that cater to different types of investors. Evaluating these options can help individuals find a platform that aligns with their specific investment goals and preferences.

Conclusion

In summary, whether or not Robinhood is a good investment platform depends largely on individual circumstances and preferences. Its commission-free trading model and user-friendly design make it an attractive choice for beginner investors looking to enter the stock market without significant barriers. However, potential users should be aware of its limitations regarding customer service and research tools.

Investors must carefully consider their financial goals and risk tolerance before choosing any investment platform. While Robinhood offers several advantages that appeal to new traders, those seeking a more comprehensive suite of tools or requiring robust support might want to explore other options available in the market.

FAQs About Is Robin Hood A Good Investment Platform?

- Is Robinhood safe for investing?

While Robinhood employs security measures like two-factor authentication, users should be aware of potential risks associated with online trading platforms. - What types of investments can I make on Robinhood?

You can trade stocks, ETFs, options, and cryptocurrencies on the platform. - Are there any fees associated with using Robinhood?

Robinhood does not charge commissions on trades but generates revenue through other means like payment for order flow. - Can I withdraw my money easily from Robinhood?

Many users have reported challenges with withdrawing funds promptly from their accounts. - Is there educational content available on Robinhood?

The platform offers educational resources aimed at helping users understand investing better.