Investing in exchange-traded funds (ETFs) has become increasingly popular, especially among those looking for diversified exposure to the stock market. One such ETF is the Invesco NASDAQ 100 ETF, commonly referred to by its ticker symbol QQQM. This fund aims to track the performance of the NASDAQ-100 Index, which includes 100 of the largest non-financial companies listed on the NASDAQ stock exchange. Given its focus on technology and growth-oriented stocks, many investors are curious about whether QQQM is a good investment choice.

QQQM was launched on October 13, 2020, and has quickly gained attention due to its lower expense ratio compared to similar funds. With an expense ratio of 0.15%, it offers a cost-effective way for investors to gain exposure to high-growth sectors. This article will explore the key features of QQQM, compare it with other similar ETFs, and evaluate its potential as an investment option.

| Feature | Details |

|---|---|

| Expense Ratio | 0.15% |

| Launch Date | October 13, 2020 |

| Index Tracked | NASDAQ-100 Index |

Understanding QQQM

QQQM is designed to provide investors with a simple way to invest in a diversified portfolio of large-cap growth stocks. The ETF invests at least 90% of its total assets in the securities that comprise the NASDAQ-100 Index. This index includes major players in technology, consumer services, healthcare, and other sectors, making it heavily weighted towards tech stocks.

The fund’s top holdings include well-known companies such as Apple Inc., Microsoft Corp., and NVIDIA Corp. These companies are leaders in their respective industries and have shown strong growth potential over the years. By investing in QQQM, investors gain exposure to these high-growth stocks without having to purchase each one individually.

The ETF is rebalanced quarterly, ensuring that it reflects any changes in the underlying index. This rebalancing helps maintain an accurate representation of the market segment it tracks.

Performance Analysis

When considering an investment in QQQM, it’s essential to look at its historical performance. Since its inception, QQQM has delivered impressive returns that align closely with those of the NASDAQ-100 Index.

Historical Returns

- Year-to-Date (YTD) Return: Approximately 26.76%

- 1-Year Return: Approximately 32.06%

- 3-Year Return: Approximately 9.83%

These figures indicate that QQQM has performed well relative to other investments during a period marked by significant market volatility.

Comparison with Other ETFs

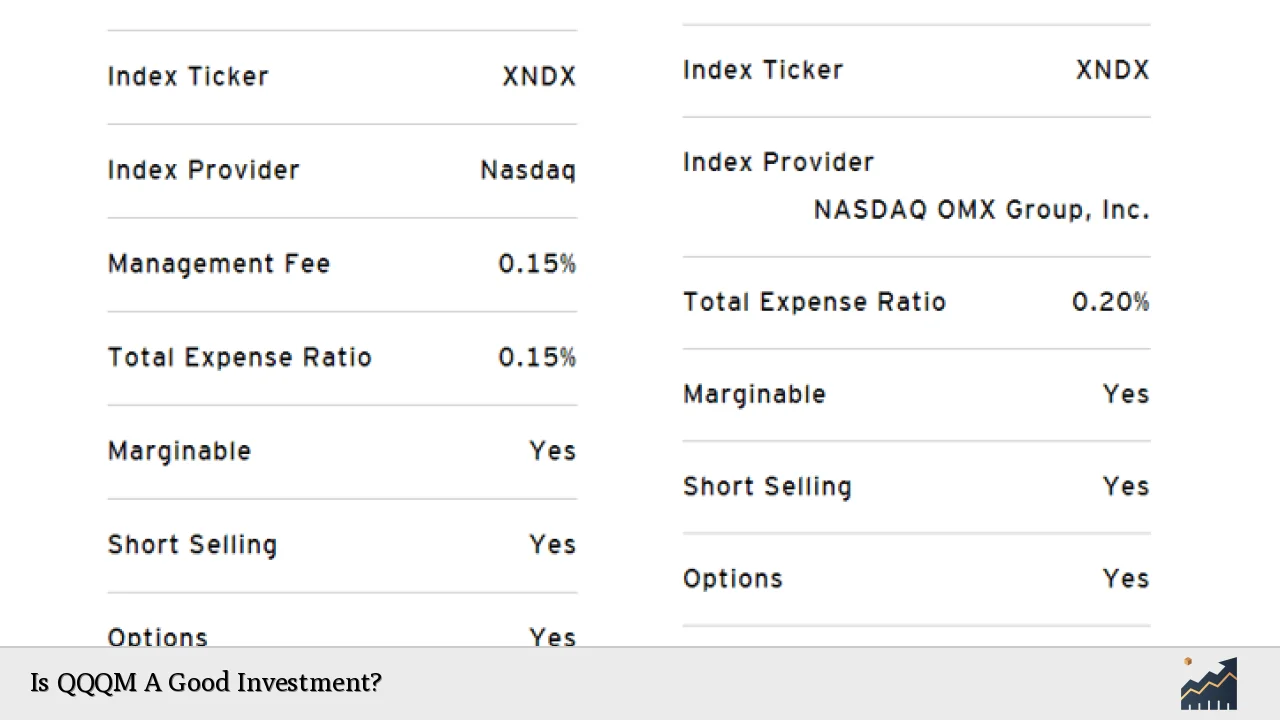

To better understand QQQM’s performance, it’s useful to compare it with other ETFs that track similar indices. For instance, QQQ (another Invesco product) has been a long-standing favorite among investors but comes with a slightly higher expense ratio of 0.20%.

| ETF | Expense Ratio |

|---|---|

| QQQ | 0.20% |

| QQQM | 0.15% |

The lower expense ratio of QQQM means that over time, investors can retain more of their returns compared to those invested in QQQ. For long-term investors, even small differences in expense ratios can lead to significant differences in overall returns due to the effects of compounding.

Investment Strategy Considerations

When evaluating whether QQQM is a good investment for you, consider your investment strategy and goals:

- Long-Term vs Short-Term: QQQM is particularly suited for long-term investors who prefer a buy-and-hold strategy. Its lower expense ratio can lead to better net returns over time compared to higher-cost alternatives.

- Risk Tolerance: The technology sector can be volatile; therefore, potential investors should assess their risk tolerance before committing funds to QQQM. While past performance has been strong, future results can vary significantly based on market conditions.

- Portfolio Diversification: Including QQQM in a diversified portfolio can help balance exposure across different sectors while still benefiting from growth opportunities in technology.

Tax Efficiency

One significant advantage of investing in ETFs like QQQM is their inherent tax efficiency compared to mutual funds. Because of their structure, ETFs typically distribute fewer capital gains than mutual funds. This characteristic makes them more appealing for tax-sensitive investors looking to minimize taxable events.

For example, since QQQM does not distribute capital gains annually like some mutual funds do, investors may find they owe less tax when holding this ETF over time.

Who Should Invest in QQQM?

Investors who might consider adding QQQM to their portfolios include:

- Young Investors: Those looking for long-term growth potential may find QQQM appealing due to its focus on high-growth technology stocks.

- Cost-Conscious Investors: With its lower expense ratio compared to other similar ETFs, cost-sensitive investors can maximize their returns while minimizing fees.

- Investors Seeking Diversification: Those wanting exposure specifically to large-cap growth stocks without having to manage multiple individual stock investments may benefit from adding QQQM.

Potential Drawbacks

While there are many positives associated with investing in QQQM, there are also some drawbacks:

- Market Volatility: As mentioned earlier, technology stocks can be volatile; thus, investments in QQQM may experience significant price fluctuations.

- Limited Historical Data: Since QQQM was launched recently compared to other ETFs like QQQ (which has a longer trading history), some investors may feel uncertain about its long-term performance track record.

FAQs About QQQM

- What is the primary focus of QQQM?

It primarily focuses on large-cap growth stocks within the NASDAQ-100 Index. - How does QQQM compare with QQQ?

Both track the same index; however, QQQM has a lower expense ratio. - Is QQQM suitable for short-term trading?

No, it is better suited for long-term buy-and-hold strategies. - What are the top holdings in QQQM?

The top holdings include major tech companies like Apple and Microsoft. - How often does QQQM rebalance its portfolio?

It rebalances quarterly.

In conclusion, whether or not QQQM is a good investment depends on individual financial goals and risk tolerance. Its lower expense ratio and strong historical performance make it an attractive option for long-term investors seeking exposure to high-growth sectors like technology. However, potential investors should carefully consider their investment strategies and market conditions before making any decisions.