Evaluating whether Procter & Gamble (P&G) stock is a good investment requires a thorough analysis of various factors, including financial performance, market conditions, and future growth potential. P&G, a leading player in the consumer goods sector, has a long history of stability and profitability. However, like any investment, it comes with its own set of risks and rewards.

P&G’s recent financial results show a mixed performance. In the first quarter of fiscal year 2025, the company reported net sales of $21.7 billion, a 1% decrease compared to the previous year. However, organic sales grew by 2%, indicating some resilience in its core operations. The diluted earnings per share (EPS) decreased by 12% to $1.61, primarily due to higher restructuring charges, while core EPS increased by 5% to $1.93. This suggests that while P&G is facing challenges, it is also managing to maintain profitability in certain areas.

| Financial Metric | Value |

|---|---|

| Net Sales | $21.7 billion |

| Organic Sales Growth | 2% |

| Diluted EPS | $1.61 |

| Core EPS | $1.93 |

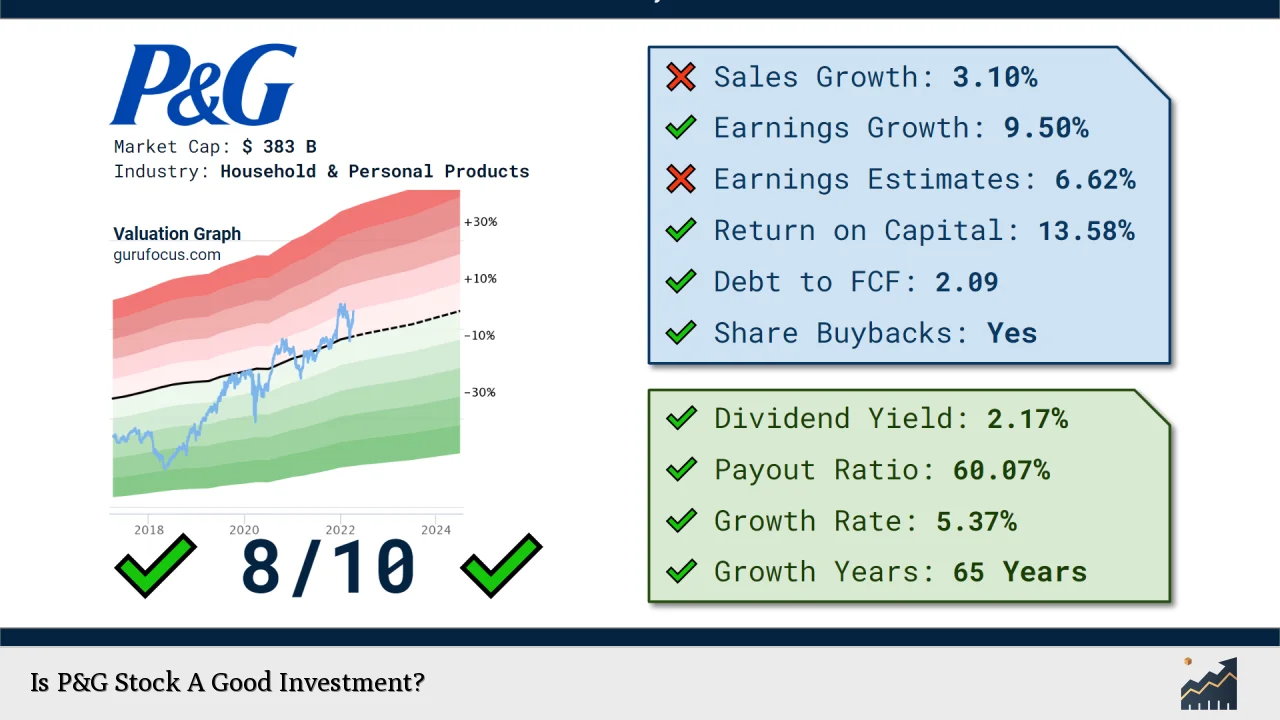

Investors often look at P&G as a defensive stock due to its strong brand portfolio and consistent dividend payments. The company has maintained a dividend yield of approximately 2.39%, which is attractive for income-focused investors. Furthermore, P&G has a solid reputation for returning capital to shareholders through dividends and share repurchases.

Financial Performance Overview

P&G’s financial performance over recent quarters provides insight into its operational efficiency and market positioning. The company’s ability to generate organic sales growth amidst challenging market conditions is noteworthy.

In the latest quarter, P&G’s organic sales growth was driven by a combination of pricing increases and volume growth. Specifically, there was a 1% increase in both pricing and organic volume. This indicates that consumers are willing to pay more for P&G products, which is a positive sign for the company’s pricing power.

However, the decline in net sales highlights some challenges that P&G faces, particularly from foreign exchange fluctuations and divestitures impacting overall growth. The company anticipates that these factors will negatively affect all-in sales growth by about one percentage point for the fiscal year.

Despite these challenges, P&G has maintained its guidance for fiscal year 2025, projecting an all-in sales growth of 2-4% and organic sales growth of 3-5%. This forward-looking perspective suggests that management remains confident in the company’s ability to navigate market headwinds.

Market Position and Competitive Landscape

P&G operates in a highly competitive consumer goods market where it faces competition from both established brands and emerging players. Its extensive portfolio includes well-known brands across various categories such as beauty, grooming, health care, fabric care, and baby care.

The company’s strong market position is bolstered by its commitment to innovation and sustainability. P&G has been investing in digital capabilities to enhance supply chain efficiency and improve customer engagement. These initiatives are expected to contribute positively to the company’s long-term growth prospects.

Moreover, P&G’s focus on sustainability aligns with growing consumer preferences for environmentally friendly products. This strategic positioning could provide an edge over competitors who may not prioritize sustainability as strongly.

Dividend Stability and Shareholder Returns

One of the key attractions of investing in P&G stock is its history of stable dividend payments. The company has consistently increased its dividends over the years, making it a popular choice among income investors.

In fiscal year 2025, P&G plans to return approximately $10 billion to shareholders through dividends and share repurchases. This commitment underscores the company’s focus on delivering value to its investors while maintaining financial stability.

The dividend yield of around 2.39% may not seem high compared to some other sectors; however, it is important to consider the reliability and growth potential of these dividends over time. Many investors view P&G as a “dividend aristocrat,” given its long track record of increasing dividends annually.

Future Growth Potential

Looking ahead, analysts have mixed forecasts for P&G’s stock performance. Some predict moderate price increases based on expected earnings growth driven by operational efficiencies and strategic investments.

For instance, analysts have set price targets ranging from $175 to $190, reflecting varying levels of optimism about the company’s future performance. The consensus among analysts leans towards a “strong buy,” indicating confidence in P&G’s ability to deliver shareholder value despite current challenges.

P&G’s projected diluted EPS growth of 10-12% for fiscal year 2025 further supports this optimistic outlook. Additionally, the company expects core EPS growth between 5-7%, which aligns with its long-term strategy of balancing growth with shareholder returns.

Risks and Considerations

While there are many positive indicators regarding P&G’s investment potential, it is also essential to consider potential risks that could impact stock performance.

- Economic downturns can affect consumer spending on non-essential goods.

- Foreign exchange fluctuations can negatively impact international revenues.

- Increased competition may pressure margins if competitors offer lower-priced alternatives.

- Supply chain disruptions could affect product availability and costs.

Investors should weigh these risks against the potential rewards when considering an investment in P&G stock.

Conclusion

In summary, whether Procter & Gamble stock is a good investment depends on individual investor goals and risk tolerance. The company demonstrates resilience through organic sales growth and maintains a solid dividend policy that appeals to income-focused investors.

While facing challenges such as declining net sales and competitive pressures, P&G’s strong brand portfolio and strategic initiatives position it well for future growth. The projected earnings growth adds another layer of appeal for those looking at long-term investments.

Investors should conduct their own research or consult with financial advisors before making investment decisions regarding P&G stock.

FAQs About P&G Stock

- Is Procter & Gamble stock considered a good investment?

P&G stock is often viewed as a stable investment due to its strong brand portfolio and consistent dividend payments. - What is Procter & Gamble’s current dividend yield?

The current dividend yield for Procter & Gamble is approximately 2.39%. - How has Procter & Gamble performed financially recently?

P&G reported net sales of $21.7 billion with organic sales growing by 2%, although diluted EPS decreased by 12% due to restructuring charges. - What are analysts’ price targets for Procter & Gamble stock?

Analysts have set price targets ranging from $175 to $190 for Procter & Gamble stock. - What risks should investors consider with Procter & Gamble?

Investors should consider risks such as economic downturns affecting consumer spending and foreign exchange fluctuations impacting revenues.