Investing in stocks is a crucial decision for many individuals seeking to grow their wealth over time. One of the prominent companies in the consumer goods sector is Procter & Gamble (P&G), which operates under the ticker symbol PG. This article delves into whether P&G is a good investment by examining its financial performance, market position, and future prospects.

Procter & Gamble is known for its extensive portfolio of trusted brands, including Tide, Pampers, and Gillette. With a strong market presence and a commitment to innovation, the company has consistently delivered value to its shareholders. However, potential investors must consider various factors before making investment decisions.

The following table summarizes key aspects of Procter & Gamble:

| Aspect | Details |

|---|---|

| Market Capitalization | $392 billion |

| Dividend Yield | 2.5% |

| P/E Ratio | 27.61 |

| Annual Revenue | $76 billion |

Financial Performance

Procter & Gamble has demonstrated solid financial performance over the years. The company reported net sales of $21.7 billion for the first quarter of fiscal year 2025, reflecting a slight decrease of 1% compared to the previous year. However, organic sales increased by 2%, indicating resilience in its core business operations despite external challenges such as inflation and supply chain disruptions.

P&G’s diluted earnings per share (EPS) for the same quarter was $1.61, down 12% from the prior year due to higher restructuring charges. Conversely, core EPS increased by 5% to $1.93, showcasing the company’s ability to manage costs effectively while maintaining profitability.

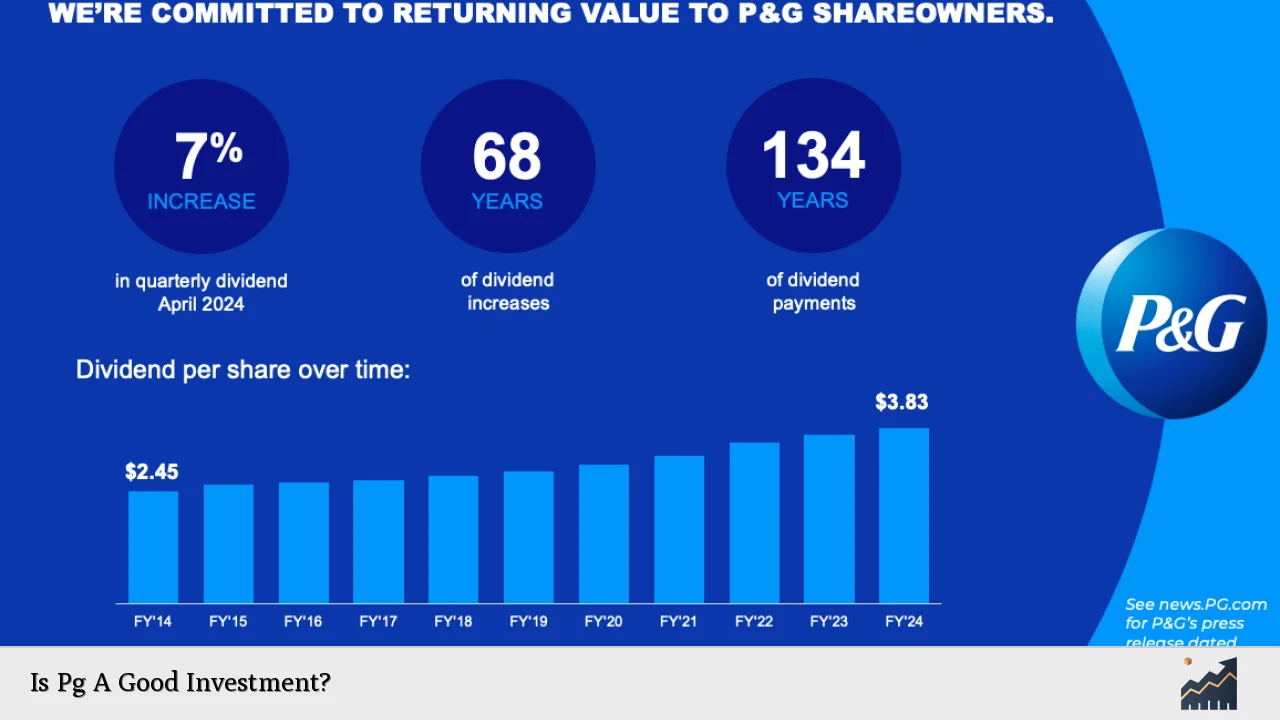

The company’s commitment to returning value to shareholders is evident through its dividend policy. P&G has consistently increased its dividends for 66 consecutive years, making it a reliable choice for income-focused investors. The current dividend yield stands at 2.5%, which is attractive compared to many other stocks in the market.

Market Position and Competitive Advantage

P&G operates in a highly competitive consumer goods market, facing rivals like Unilever and Colgate-Palmolive. However, its strong brand portfolio gives it a competitive edge. The company’s brands are household names, which fosters customer loyalty and repeat purchases.

P&G’s focus on innovation is another critical factor contributing to its market position. By continually investing in research and development, the company introduces new products that meet changing consumer preferences. For instance, P&G has made significant strides in sustainability by launching eco-friendly products and packaging solutions.

Moreover, P&G’s global presence allows it to capitalize on emerging markets where demand for consumer goods is growing rapidly. This geographical diversification helps mitigate risks associated with economic downturns in specific regions.

Future Growth Prospects

Looking ahead, Procter & Gamble’s growth prospects remain promising despite current market challenges. The company aims for an annual sales growth rate of 2-4% over the next few years, driven by product innovation and strategic marketing initiatives.

Analysts predict that P&G will continue to benefit from rising consumer demand for personal care and hygiene products, especially in light of increased health awareness post-pandemic. Furthermore, the company’s digital transformation efforts are expected to enhance customer engagement and streamline operations.

However, potential investors should be aware of certain risks that could impact P&G’s performance. These include fluctuating commodity prices, regulatory changes, and intense competition that could pressure profit margins.

Investment Strategy

For those considering investing in Procter & Gamble stock, it is essential to adopt a long-term perspective. While short-term fluctuations may occur due to market volatility or economic conditions, P&G’s historical performance suggests stability and resilience over time.

Investors can consider several strategies when investing in P&G:

- Buy and Hold: This strategy involves purchasing shares and holding them for an extended period to benefit from capital appreciation and dividend income.

- Dividend Reinvestment: Investors can reinvest dividends to purchase additional shares automatically, compounding their returns over time.

- Dollar-Cost Averaging: This strategy entails investing a fixed amount regularly regardless of share price fluctuations, reducing the impact of volatility on overall investment costs.

By employing these strategies, investors can position themselves for potential long-term gains with Procter & Gamble.

FAQs About Is Pg A Good Investment?

- What is Procter & Gamble’s current dividend yield?

The current dividend yield for Procter & Gamble is approximately 2.5%. - How long has P&G been increasing its dividends?

P&G has increased its dividends for 66 consecutive years. - What are P&G’s future growth prospects?

P&G aims for annual sales growth of 2-4% driven by innovation and market expansion. - Is P&G considered a defensive stock?

Yes, P&G is often viewed as a defensive stock due to its stable demand even during economic downturns. - What investment strategies are recommended for P&G?

Recommended strategies include buy-and-hold, dividend reinvestment, and dollar-cost averaging.

In conclusion, investing in Procter & Gamble can be considered a sound decision for those seeking stability and consistent returns through dividends. While there are inherent risks associated with any investment, P&G’s strong market position and commitment to innovation provide a solid foundation for future growth. As always, potential investors should conduct thorough research and consider their financial goals before making investment decisions regarding PG stock.