Oxford Square Capital Corp. (NASDAQ: OXSQ) is a business development company (BDC) that has attracted attention from income-focused investors due to its high dividend yield. However, determining whether OXSQ is a good investment requires a comprehensive analysis of its business model, financial performance, risks, and market position. This article will provide an in-depth examination of Oxford Square Capital to help investors make an informed decision.

| Key Concept | Description/Impact |

|---|---|

| Business Model | BDC specializing in debt investments and CLO equity |

| Dividend Yield | Currently around 14.5%, paid monthly |

| Net Asset Value (NAV) | $2.35 per share as of Q3 2024 |

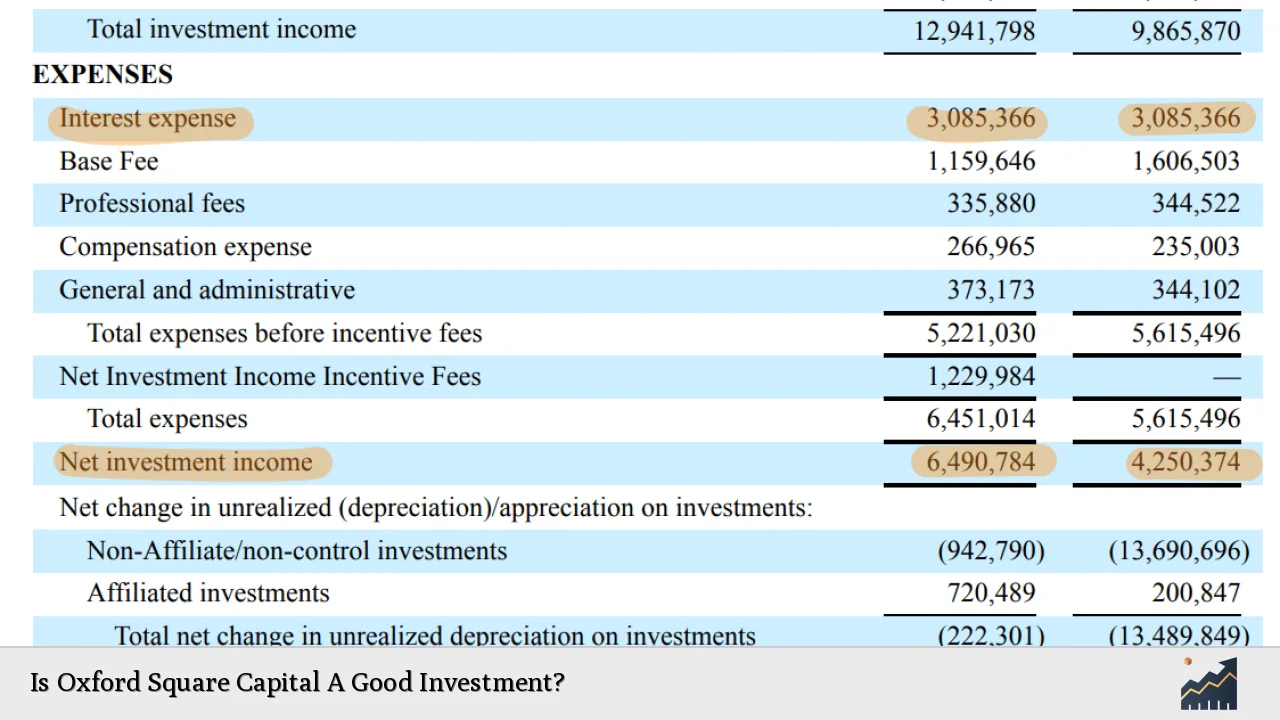

| Investment Income | Declining trend, $10.3 million in Q3 2024 |

| Market Capitalization | Approximately $179.91 million |

Market Analysis and Trends

Oxford Square Capital operates in the business development company sector, which has faced challenges in recent years due to economic uncertainties and interest rate fluctuations. The company’s focus on corporate debt investments and collateralized loan obligations (CLOs) exposes it to specific market dynamics:

Corporate Debt Market: The U.S. corporate debt market has shown signs of stress, with the Morningstar LSTA US Leveraged Loan Index indicating a slight downturn in loan prices. This trend affects OXSQ’s ability to generate consistent income from its debt investments.

CLO Market: CLO equity investments, which make up a significant portion of OXSQ’s portfolio, are particularly sensitive to changes in interest rates and credit quality. The weighted average effective yield of OXSQ’s CLO equity investments was 9.6% as of Q3 2024, reflecting the complex nature of these securities.

Interest Rate Environment: The Federal Reserve’s monetary policy decisions have a direct impact on OXSQ’s investment income. With potential rate hikes on the horizon, the company may face challenges in maintaining its current yield levels.

Implementation Strategies

Oxford Square Capital employs several strategies to manage its portfolio and generate returns for investors:

Diversification: OXSQ maintains a diversified portfolio across various industries, with significant exposure to software and business services. This approach helps mitigate sector-specific risks.

Active Management: The company actively manages its investments, making purchases of approximately $47.7 million and receiving $27.9 million from sales and repayments in Q3 2024. This dynamic approach allows OXSQ to adjust its portfolio based on market conditions.

Leverage: OXSQ utilizes leverage to enhance returns, with long-term debt of $123.4 million as of the latest financial statements. While this can amplify gains, it also increases risk during market downturns.

Capital Raising: The company has issued new shares through an at-the-market offering, raising net proceeds of $14.5 million in Q3 2024. This strategy helps OXSQ maintain liquidity and fund new investments.

Risk Considerations

Investing in Oxford Square Capital comes with several significant risks that potential investors must carefully consider:

Dividend Sustainability: OXSQ’s high dividend yield of 14.5% may not be sustainable in the long term. The company has a history of dividend cuts, with the payout ratio reaching 91% of investment income in 2024.

Net Asset Value Erosion: The company’s NAV per share has been declining, dropping from $2.43 to $2.35 in Q3 2024. This trend could indicate potential value destruction for shareholders.

Credit Risk: As of Q3 2024, OXSQ had three debt investments on non-accrual status, highlighting the credit risk inherent in its portfolio.

Market Volatility: The company’s investments, particularly in CLO equity, are subject to significant market volatility and can experience rapid value fluctuations.

Interest Rate Sensitivity: Changes in interest rates can significantly impact OXSQ’s investment income and the value of its portfolio.

Regulatory Aspects

As a business development company, Oxford Square Capital is subject to specific regulatory requirements:

Investment Company Act: OXSQ must comply with the Investment Company Act of 1940, which mandates certain portfolio diversification and asset coverage ratios.

SEC Reporting: The company is required to file regular reports with the Securities and Exchange Commission, providing transparency to investors.

RIC Status: To maintain its Regulated Investment Company status, OXSQ must distribute at least 90% of its taxable income to shareholders, which influences its dividend policy.

Future Outlook

The future performance of Oxford Square Capital will largely depend on several factors:

Economic Conditions: The overall health of the economy and corporate credit markets will play a crucial role in OXSQ’s ability to generate returns.

Interest Rate Trajectory: Future interest rate decisions by the Federal Reserve will impact OXSQ’s cost of capital and investment yields.

Portfolio Performance: The company’s ability to manage credit risk and select profitable investments will be critical for maintaining and growing NAV.

Market Sentiment: Investor appetite for high-yield BDCs will influence OXSQ’s stock price and ability to raise capital.

In conclusion, while Oxford Square Capital offers an attractive dividend yield, it comes with significant risks. The company’s declining NAV, high payout ratio, and exposure to volatile CLO investments make it a speculative investment. Conservative investors may find the risk profile too high, while those with a higher risk tolerance might see potential in the current valuation gap between market price and NAV. As with any investment decision, thorough due diligence and consideration of one’s financial goals and risk tolerance are essential.

Frequently Asked Questions About Is Oxford Square Capital A Good Investment?

- What is Oxford Square Capital’s primary business focus?

Oxford Square Capital is a business development company that primarily invests in corporate debt and collateralized loan obligation (CLO) equity securities. - How often does Oxford Square Capital pay dividends?

OXSQ pays monthly dividends to its shareholders, currently at a rate of $0.035 per share per month. - What is the current dividend yield for OXSQ?

As of the latest data, OXSQ’s dividend yield is approximately 14.5%, which is considered high compared to many other investments. - Has Oxford Square Capital’s net asset value (NAV) been stable?

No, OXSQ’s NAV has been declining. As of Q3 2024, the NAV per share was $2.35, down from $2.43 in the previous quarter. - What are the main risks of investing in Oxford Square Capital?

The main risks include potential dividend cuts, NAV erosion, credit risk in its investment portfolio, market volatility, and sensitivity to interest rate changes. - How does Oxford Square Capital’s performance compare to other BDCs?

OXSQ has underperformed many of its BDC peers in terms of NAV stability and consistent dividend growth, though it offers a higher yield than many competitors. - Is Oxford Square Capital’s dividend sustainable?

There are concerns about the sustainability of OXSQ’s dividend, given its high payout ratio of 91% and history of dividend cuts.