Orchid Island Capital, Inc. (NYSE: ORC) has emerged as a notable player in the mortgage real estate investment trust (REIT) sector, primarily focusing on investing in residential mortgage-backed securities (RMBS). As of December 2024, the company is navigating a complex financial landscape characterized by high dividend yields, recent profitability improvements, and significant debt levels. This analysis aims to provide a comprehensive overview of Orchid Island Capital’s investment potential, examining market trends, financial performance, risk factors, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Market Capitalization | Approximately $638 million, indicating a mid-sized player in the REIT sector. |

| Dividend Yield | Currently around 17.9%, one of the highest in the sector, but with concerns about sustainability. |

| Debt Levels | Debt-to-equity ratio exceeding 7.9, raising concerns about financial stability and risk management. |

| Recent Profitability | Reported net income of $17.3 million for Q3 2024, a significant recovery from previous losses. |

| Book Value Per Share | Decreased to $8.40 as of September 30, 2024, reflecting ongoing volatility in asset values. |

Market Analysis and Trends

The mortgage REIT market has been under considerable pressure due to rising interest rates and economic uncertainty. However, Orchid Island Capital has shown resilience:

- Interest Rate Environment: The Federal Reserve’s monetary policy has led to fluctuating interest rates that significantly affect RMBS pricing and yields. As of late 2024, the average yield on Orchid’s RMBS increased to 5.43%, up from 5.05% in the previous quarter.

- Performance Relative to Peers: Over the past year, Orchid Island’s stock has outperformed the broader US Mortgage REIT sector but lagged behind the general market indices. This indicates a mixed performance that may appeal to certain risk-tolerant investors.

- Market Sentiment: Analysts maintain a consensus rating of “Buy” for ORC stock with an average price target of $9.50, suggesting potential upside from current levels.

Implementation Strategies

Investors considering Orchid Island Capital should adopt a strategic approach:

- Dividend Reinvestment: Given its high dividend yield, investors might consider reinvesting dividends to capitalize on compounding returns.

- Diversification: Including ORC as part of a diversified portfolio can help mitigate risks associated with its high debt levels and market volatility.

- Monitoring Economic Indicators: Keeping an eye on macroeconomic indicators such as interest rates, inflation rates, and employment data can provide insights into future performance.

Risk Considerations

Investing in Orchid Island Capital comes with several risks:

- High Debt Levels: The company’s debt-to-equity ratio stands at approximately 797%, which is alarmingly high compared to industry norms. This level of leverage can amplify risks during economic downturns or rising interest rate environments.

- Volatile Dividend History: Despite its attractive yield, Orchid has a history of dividend cuts and fluctuations that may deter income-focused investors.

- Market Sensitivity: The performance of ORC is highly sensitive to changes in interest rates and housing market conditions. Any adverse changes could significantly impact profitability and stock performance.

Regulatory Aspects

As a publicly traded REIT, Orchid Island Capital must comply with various regulatory requirements:

- SEC Filings: Regular filings with the Securities and Exchange Commission (SEC) ensure transparency regarding financial health and operational strategies.

- REIT Compliance: To maintain its tax-advantaged status as a REIT, Orchid must distribute at least 90% of its taxable income as dividends. This requirement can strain cash flows during periods of lower earnings.

Future Outlook

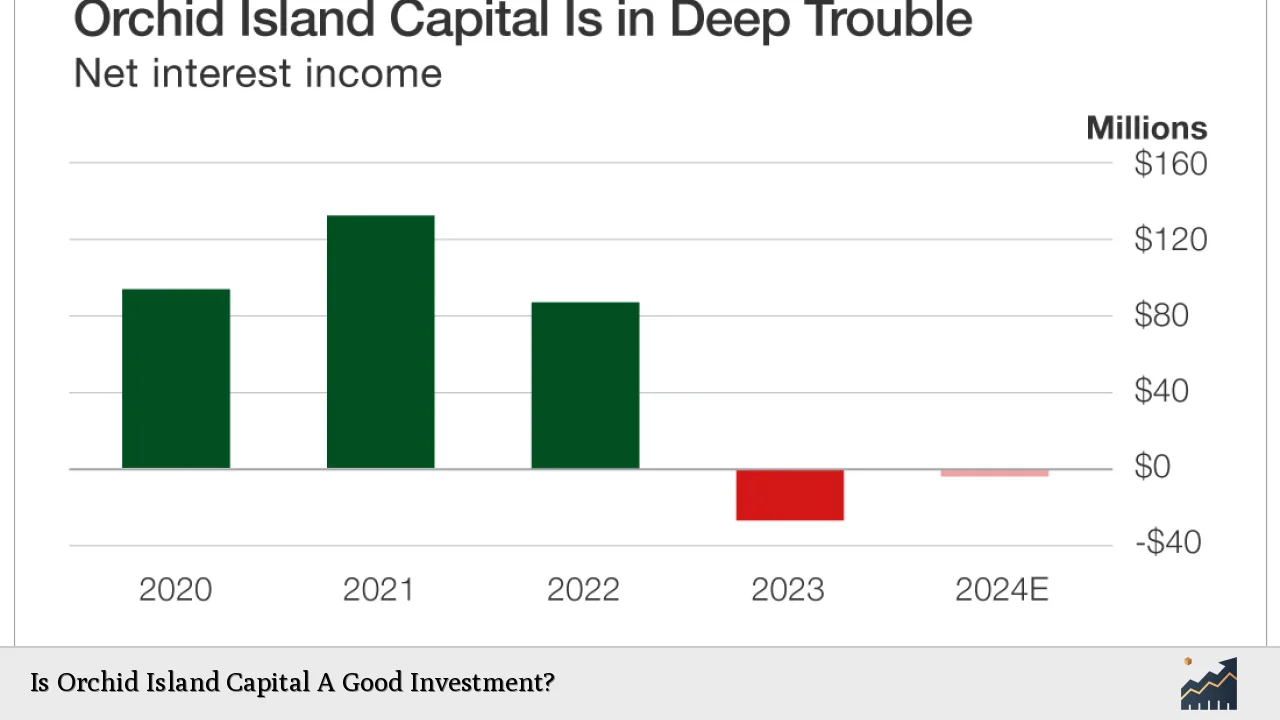

Looking ahead, several factors will influence Orchid Island Capital’s trajectory:

- Economic Recovery: If economic conditions improve and interest rates stabilize or decrease, ORC could benefit from enhanced profitability through increased asset valuations and stable cash flows.

- Strategic Adjustments: The management’s recent shift towards higher coupon mortgages indicates a proactive approach to navigating current challenges. Continued strategic repositioning may enhance resilience against market fluctuations.

- Potential for Growth: Analysts project that if Orchid can maintain its growth trajectory while managing debt effectively, it could achieve profitability in the near term—potentially by late 2024 or early 2025.

Frequently Asked Questions About Is Orchid Island Capital A Good Investment?

- What is the current dividend yield for Orchid Island Capital?

The current dividend yield is approximately 17.9%, which is significantly higher than the average for REITs. - How has Orchid Island’s stock performed recently?

The stock has shown mixed performance; it outperformed the US Mortgage REIT sector but lagged behind broader market indices over the past year. - What are the risks associated with investing in ORC?

The primary risks include high debt levels, volatile dividends, and sensitivity to interest rate changes. - What is the company’s strategy moving forward?

Orchid plans to focus on higher coupon mortgages and strategically manage its portfolio to navigate economic uncertainties. - Is Orchid Island Capital expected to become profitable soon?

Analysts predict that ORC could reach breakeven within approximately twelve months if growth targets are met. - How does Orchid’s debt level compare to industry standards?

The company’s debt-to-equity ratio exceeds 797%, which is significantly higher than typical industry benchmarks. - What should investors consider before investing in ORC?

Investors should weigh their risk tolerance against the potential for high returns through dividends and capital appreciation while being mindful of financial stability concerns. - Are there any recent developments affecting ORC?

Recent quarterly results showed net income recovery and strategic adjustments in portfolio management aimed at enhancing future performance.

In conclusion, while Orchid Island Capital presents an intriguing investment opportunity due to its high dividend yield and recent profitability improvements, potential investors must carefully consider the associated risks stemming from its high leverage and volatile market conditions. A strategic approach that includes diversification and close monitoring of economic indicators will be essential for navigating this investment landscape successfully.