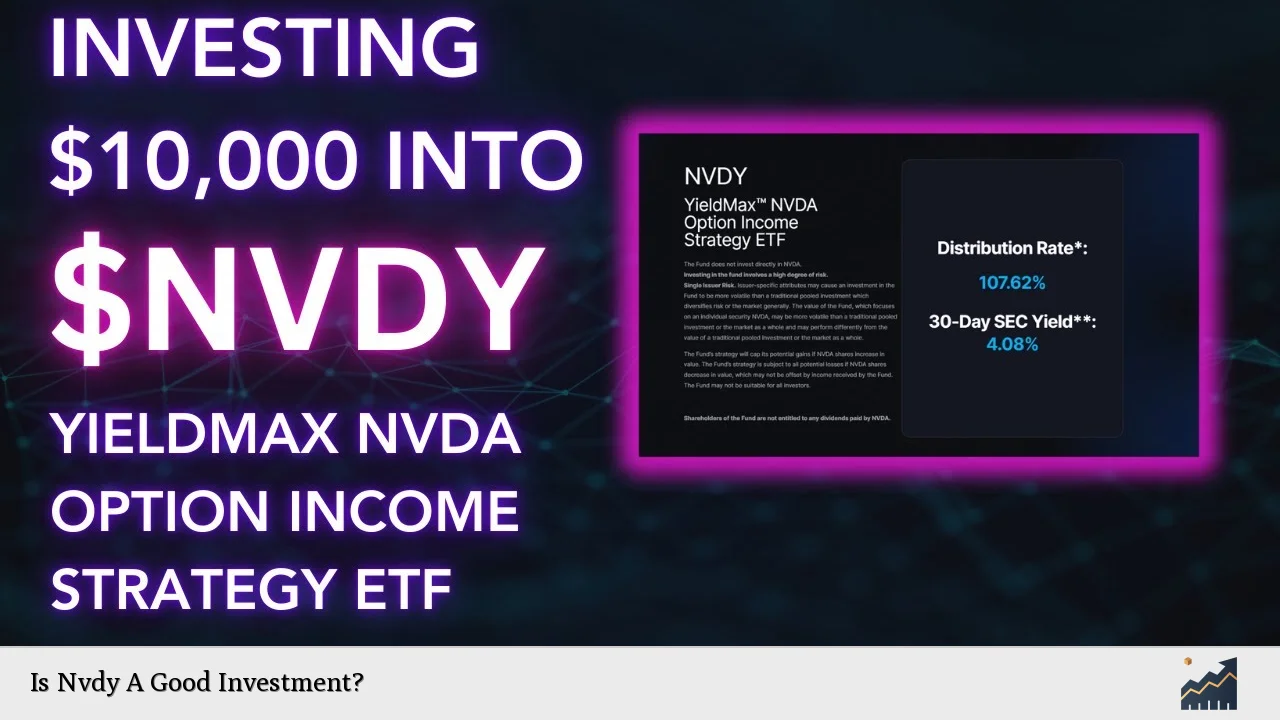

Investing in exchange-traded funds (ETFs) has become increasingly popular, particularly for those looking to gain exposure to specific stocks or sectors without the need for direct stock ownership. One such ETF is the YieldMax NVDA Option Income Strategy ETF, commonly referred to as NVDY. This fund aims to generate monthly income by utilizing a strategy that involves selling call options on NVIDIA Corporation (NVDA). As with any investment, potential investors must carefully evaluate whether NVDY aligns with their financial goals and risk tolerance.

NVDY seeks to provide investors with income through a synthetic covered call strategy. This approach allows the fund to replicate the price movements of NVIDIA while generating income through option premiums. However, this strategy comes with certain limitations. Notably, it caps the potential upside gains from NVIDIA’s stock price increases while exposing investors to losses if the stock price declines. Thus, understanding the intricacies of NVDY is crucial for making an informed investment decision.

| Feature | Description |

|---|---|

| Investment Strategy | Selling call options on NVDA to generate income |

| Dividend Yield | High yield but inconsistent due to market volatility |

Understanding NVDY’s Investment Strategy

NVDY employs a synthetic covered call strategy, which involves three main components: synthetic long exposure, covered call writing, and U.S. Treasuries for collateral. The fund aims to replicate the price movements of NVIDIA by engaging in options trading rather than directly purchasing shares of NVDA. This method allows NVDY to generate income through premiums received from selling call options.

The covered call writing aspect entails selling call options with strike prices set above NVIDIA’s current share price. While this generates income in a sideways or moderately bullish market, it limits potential gains if NVIDIA’s stock experiences significant price increases. Therefore, NVDY is more suited for investors who expect stable or slightly rising prices rather than those anticipating substantial growth.

Investors should be aware that while NVDY offers attractive yields, these are often tied directly to NVIDIA’s stock performance and market volatility. The fund does not pay dividends from NVDA shares, which means that its income is solely derived from option premiums.

Evaluating NVDY’s Performance and Risks

When considering an investment in NVDY, it is essential to evaluate its performance metrics and associated risks. The fund has demonstrated a high yield, reportedly reaching as much as 84% at times; however, this figure may raise concerns about sustainability and risk exposure. High yields can often signal underlying risks that investors should carefully assess.

One of the critical risks associated with NVDY is its exposure to NVIDIA’s stock price fluctuations. If NVDA experiences a downturn, investors in NVDY will bear those losses due to the fund’s structure. Additionally, the fund has underperformed compared to NVIDIA’s total return since inception, indicating that it may not be suitable for highly bullish investors who expect significant gains from NVDA.

Moreover, NVDY carries a high expense ratio of 0.99%, which can erode returns over time. Investors should weigh this cost against the potential benefits of investing in an ETF that employs a complex options strategy.

Who Should Consider Investing in NVDY?

NVDY may appeal primarily to income-focused investors looking for monthly cash flow rather than capital appreciation. This fund could be particularly attractive for those who believe that NVIDIA will maintain stable performance without significant price swings.

Potential investors should consider their risk tolerance carefully:

- Moderately Bullish Investors: Those who expect slight upward movements in NVDA may find NVDY appealing due to its income generation capabilities.

- Risk-Averse Investors: Individuals seeking regular income without direct exposure to volatile equity markets might also consider this ETF.

However, highly bullish or bearish investors may want to look elsewhere, as NVDY’s structure limits upside potential and exposes them fully to downside risks.

Market Conditions Impacting NVDY

The performance of NVDY is closely linked to broader market conditions and specifically the technology sector’s health. Factors such as interest rates, economic growth forecasts, and investor sentiment towards technology stocks can significantly impact both NVIDIA’s stock price and NVDY’s performance.

In periods of market volatility or economic uncertainty, stocks like NVIDIA may experience sharp price fluctuations. This can lead to inconsistent dividends from NVDY and heightened risks for investors relying on stable income streams.

Additionally, changes in interest rates can affect the attractiveness of dividend-yielding investments like NVDY compared to fixed-income securities. Investors should remain vigilant about macroeconomic indicators that could influence their investment decisions.

Comparing NVDY with Other Investment Options

When evaluating whether NVDY is a good investment choice, it is helpful to compare it with other ETFs and investment vehicles within the same sector or strategy type.

| ETF | Strategy |

|---|---|

| NVDY | Selling call options on NVDA |

| SPY | Tracks S&P 500 Index |

| QQQ | Tracks Nasdaq-100 Index |

While NVDY focuses specifically on generating income through options related to NVIDIA stock, ETFs like SPY and QQQ offer broader market exposure without capping potential gains. For instance:

- SPY: Provides diversified exposure across various sectors within the S&P 500.

- QQQ: Focuses on large-cap technology stocks without employing complex strategies that limit upside potential.

Investors should consider their overall portfolio goals when deciding between these options.

Conclusion: Is NVDY a Good Investment?

Determining whether NVDY is a good investment ultimately depends on individual financial goals and risk tolerance levels. For those seeking high monthly income and willing to accept capped upside potential and exposure to NVIDIA’s volatility, this ETF may be suitable.

However, it is crucial for investors to conduct thorough research and consider how NVDY fits within their overall investment strategy. Given its complexities and associated risks, consulting with a financial advisor could provide valuable insights tailored to individual circumstances.

FAQs About Nvdy

- What is the primary goal of investing in NVDY?

The primary goal is generating monthly income through selling call options on NVIDIA. - How does NVDY limit potential gains?

NVDY caps gains by selling call options with strike prices above NVIDIA’s current share price. - Is NVDY suitable for all investors?

No, it’s best suited for moderately bullish investors seeking income rather than capital appreciation. - What are the risks associated with investing in NVDY?

The main risks include exposure to NVIDIA’s stock price declines and high expense ratios. - How does NVDY perform compared to other ETFs?

NVDY has underperformed compared to direct investments in NVIDIA and broader market ETFs.