Investing in financial products can often feel overwhelming, particularly when evaluating options like Maximum Premium Indexing (MPI). This investment strategy combines elements of life insurance and retirement planning, offering potential benefits that appeal to various investors. However, understanding whether MPI is a suitable investment requires a thorough examination of its features, market trends, risks, and future outlook.

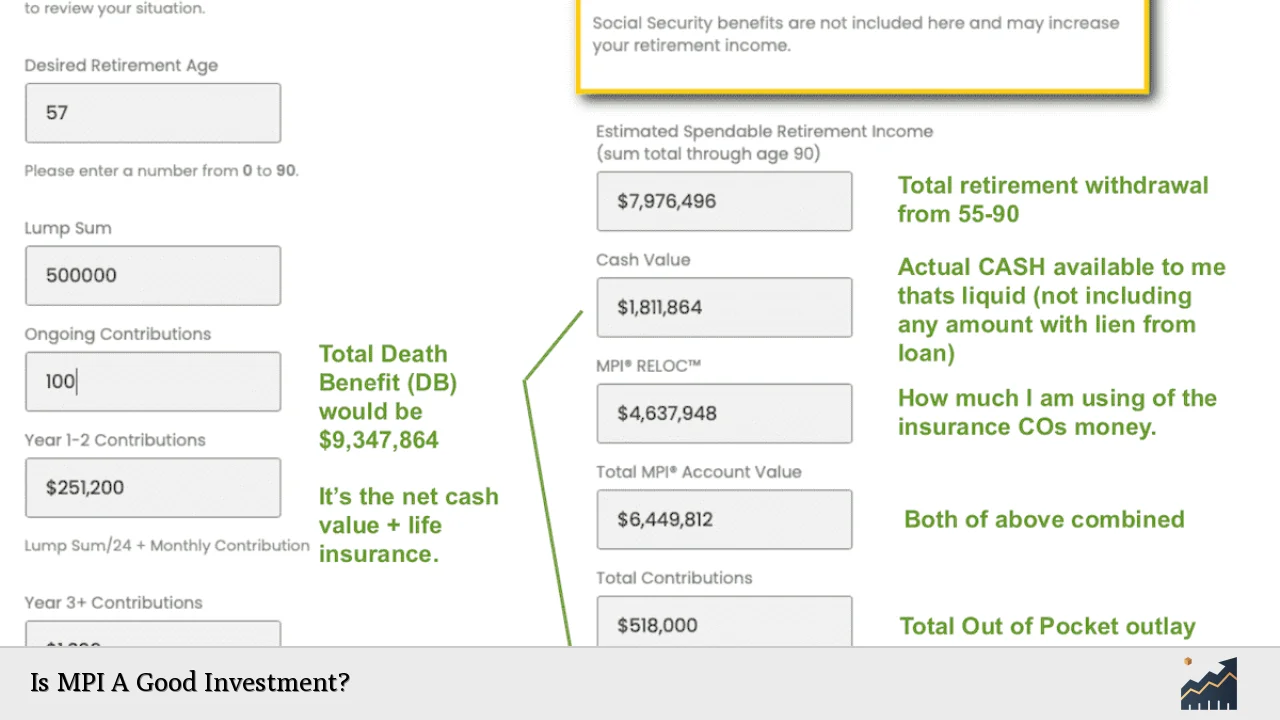

The MPI strategy allows investors to benefit from stock market growth while protecting their principal investment through a unique structure that features a 0% floor on losses. This means that even in market downturns, the investor’s principal remains intact. Additionally, MPI accounts can provide tax-free retirement income and offer flexibility with early withdrawals without penalties. However, these advantages come with trade-offs, including limited upside potential and ongoing fees that can affect overall returns.

| Key Concept | Description/Impact |

|---|---|

| 0% Floor Guarantee | Protects the principal from market losses, ensuring that the investment does not decrease in value even during downturns. |

| Tax-Free Growth | Funds grow without incurring annual taxes, allowing for compounding growth over time. |

| Cap on Returns | While there is potential for significant gains linked to the S&P 500 index, returns are capped at around 10%, limiting upside potential. |

| No Early Withdrawal Penalty | Investors can access their funds without incurring penalties before retirement age, providing greater liquidity. |

| Ongoing Fees | Annual fees and costs associated with maintaining the policy can erode returns, especially during low-growth periods. |

Market Analysis and Trends

The MPI investment strategy has gained traction among investors seeking a balance between risk and return. Recent market trends indicate a growing interest in financial products that offer both security and growth potential. The following factors are influencing the current landscape:

- Market Volatility: Increased volatility in traditional equity markets has led many investors to seek safer alternatives. MPI accounts provide a hedge against downturns while still offering some exposure to market gains.

- Interest Rates: With rising interest rates globally, investors are becoming more cautious. The fixed nature of returns in MPI accounts can be appealing compared to fluctuating bond yields.

- Demographic Shifts: As more individuals approach retirement age, there is a heightened focus on preserving capital while generating income. MPI’s features align well with these needs.

- Technological Advancements: The integration of technology in financial services is making it easier for investors to manage their MPI accounts and understand their performance metrics.

Implementation Strategies

Investors considering MPI as part of their portfolio should adopt strategic approaches to maximize its benefits:

- Long-Term Commitment: MPI accounts are best suited for individuals who can commit to long-term funding. This allows for the compounding of returns and maximizes tax advantages.

- Diversification: While MPI provides a safety net, it should not be the sole investment vehicle. Combining MPI with other assets such as stocks or bonds can enhance overall portfolio performance.

- Regular Contributions: Consistent contributions can help build cash value within the policy, which can be accessed later for tax-free income or loans.

- Monitoring Performance: Regularly reviewing the performance of the MPI account against market indices will help investors make informed decisions about their investments.

Risk Considerations

Like any investment strategy, MPI comes with its own set of risks that potential investors should consider:

- Limited Growth Potential: The cap on returns means that during strong bull markets, investors may miss out on higher gains available through direct stock investments.

- Fees and Costs: Ongoing fees associated with maintaining an MPI account can significantly impact net returns over time. Investors should carefully review these costs before committing.

- Health Dependency: Accessing certain features like tax-free loans may require proof of insurability. If health declines over time, this could limit access to funds when needed most.

- Market Conditions: While the 0% floor protects against losses, prolonged periods of low market growth could lead to suboptimal performance compared to other investment vehicles.

Regulatory Aspects

Investors must also be aware of the regulatory environment surrounding MPI accounts:

- Insurance Regulations: As an insurance product, MPI is subject to state regulations that govern how policies are structured and sold. Understanding these regulations is crucial for compliance and protection.

- Tax Implications: While contributions are made with after-tax dollars and growth is tax-free, withdrawals may have different tax implications depending on how funds are accessed (e.g., loans vs. distributions).

- Consumer Protections: Regulatory bodies ensure that consumers are protected from misleading practices in selling insurance products like MPI. Investors should ensure they work with licensed professionals who adhere to these regulations.

Future Outlook

The future of MPI as an investment strategy appears promising but will depend on several factors:

- Economic Recovery: As economies rebound from downturns, interest rates stabilize, and inflation concerns ease, more investors may look toward hybrid products like MPI for stability combined with growth potential.

- Increased Financial Literacy: As more individuals become educated about financial products, demand for structured products like MPI may rise as they seek safer investment options with growth potential.

- Innovation in Financial Products: Ongoing innovation in financial services may lead to new iterations of MPI or similar products that enhance benefits while reducing drawbacks.

In conclusion, while Maximum Premium Indexing offers unique advantages such as loss protection and tax-free growth potential, it is essential for investors to weigh these benefits against the limitations and risks involved. A thorough understanding of personal financial goals and market conditions will aid in determining whether MPI is a suitable addition to an investment portfolio.

Frequently Asked Questions About Is MPI A Good Investment?

- What is an MPI account?

An MPI account combines elements of life insurance with investment strategies aimed at providing tax-free growth and protection against market downturns. - How does the 0% floor work?

The 0% floor guarantees that your principal investment will not decrease in value due to market fluctuations. - Are there any penalties for early withdrawal from an MPI account?

No, unlike traditional retirement accounts, there are no penalties for early withdrawals from an MPI account. - What are the main advantages of investing in an MPI account?

Main advantages include tax-free growth, protection against losses, no early withdrawal penalties, and flexibility in accessing funds. - What are the risks associated with investing in an MPI account?

Main risks include limited upside potential due to capped returns, ongoing fees that can erode profits, and dependency on health status for accessing certain features. - How does an MPI account compare to traditional IRAs?

MPI accounts offer more flexibility regarding withdrawals without penalties but have limited investment choices compared to self-directed IRAs. - Is professional advice recommended when considering an MPI account?

Yes, consulting with a financial advisor is advisable to ensure that an MPI account aligns with your overall financial goals and risk tolerance. - What factors should I consider before investing in an MPI account?

Consider your financial goals, risk tolerance, commitment level for long-term contributions, and how this investment fits into your overall portfolio strategy.