May is often viewed with caution by investors due to the historical adage "Sell in May and go away." This saying suggests that stock market performance tends to decline during the warmer months, particularly from May to October. Historical data supports this notion, indicating that the stock market has generally underperformed during this period compared to the November-April timeframe. However, while these trends are noteworthy, they do not necessarily dictate investment strategies. Understanding the nuances of market performance in May can help investors make informed decisions.

The stock market's cyclical nature means that certain months can exhibit distinct trends. For instance, many investors have observed that the months leading up to summer often yield lower returns. The reasons behind this phenomenon can be attributed to various factors, including seasonal trading patterns, lower trading volumes during summer vacations, and shifts in investor sentiment. Despite these trends, it is essential for investors to consider their long-term goals and risk tolerance before making decisions based solely on historical performance.

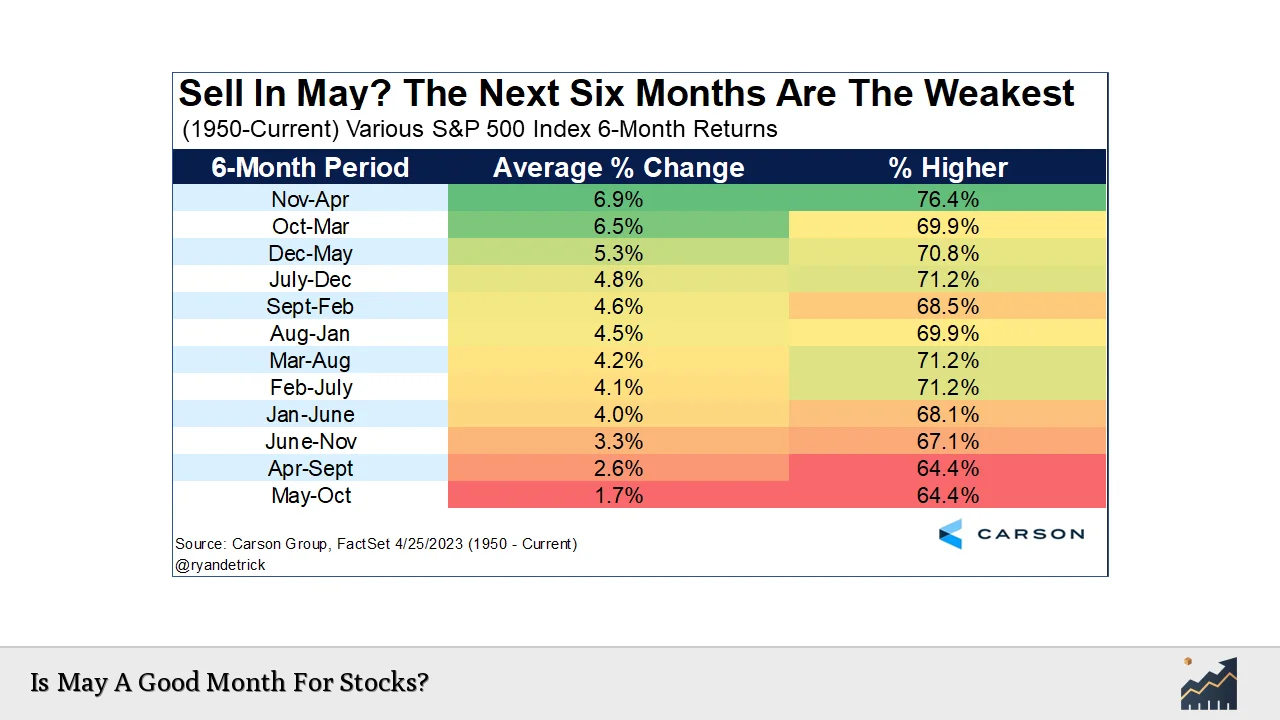

To provide a clearer picture of stock market performance in May, the following table summarizes key historical data:

| Period | Average Return |

|---|---|

| November-April | 6.7% |

| May-October | 2.1% |

Historical Performance Trends

The historical performance of stocks from May through October has shown a consistent pattern of underperformance compared to the November-April period. Since 1928, the S&P 500 has averaged a gain of 5.2% during the November-April stretch, while the May-October period has only seen an average gain of 2.1%. This trend has persisted over decades and is often cited by financial analysts when discussing seasonal trading strategies.

From 1950 onward, the disparity between these two periods has remained significant, with the November-April cycle yielding an average increase of 7% compared to just 1.7% for May through October. While these statistics highlight a clear trend, it is crucial to recognize that past performance does not guarantee future results.

Moreover, certain factors can influence these trends. For example, economic conditions, interest rates, and geopolitical events can all impact market performance regardless of seasonal patterns. Investors should remain vigilant and consider broader economic indicators alongside historical data when making investment decisions.

The "Sell in May" Strategy

The "Sell in May and go away" strategy is based on the premise that investors should liquidate their stock holdings at the beginning of May and re-enter the market around Halloween when historical returns are more favorable. This strategy aims to avoid potential downturns during the summer months when trading volumes typically decrease and volatility may increase.

However, while this strategy has historical backing, it is not without its critics. Many financial advisors caution against making hasty decisions based solely on calendar trends. They argue that such strategies may lead investors to miss out on potential gains during the summer months when markets can sometimes surprise with positive performance.

In fact, some studies indicate that stocks have posted gains in approximately two-thirds of the time from May to October despite lower average returns. Therefore, while it may be prudent to be cautious during this period, completely exiting the market could result in missed opportunities.

Market Behavior in Election Years

Interestingly, stock market behavior can also vary significantly during U.S. presidential election years. Historically, election years tend to see stronger summer rallies compared to non-election years. For instance, data shows that from June through August during election years, the S&P 500 has risen approximately 7.3% on average.

This trend suggests that political events and investor sentiment surrounding elections can create unique opportunities for growth even during traditionally weaker months like May through October. Investors should consider these dynamics when evaluating their strategies for this period.

Strategies for Navigating May

Given the mixed signals associated with stock performance in May, investors may benefit from adopting a more nuanced approach rather than strictly adhering to the "Sell in May" adage. Here are some strategies to consider:

- Sector Rotation: Instead of exiting the market entirely, consider shifting investments into sectors that historically perform better during summer months. Defensive sectors such as utilities and consumer staples often outperform cyclical sectors like technology and discretionary spending during this time.

- Stay Invested: Maintaining a long-term investment strategy can be beneficial even if short-term performance is lackluster. Historically, staying invested through various market cycles has yielded better long-term results than trying to time the market.

- Monitor Economic Indicators: Keep an eye on economic indicators such as interest rates and inflation rates which can impact overall market sentiment and performance.

- Use Dollar-Cost Averaging: This strategy involves consistently investing a fixed amount over time regardless of market conditions. This approach helps mitigate risks associated with market volatility.

- Review Portfolio Allocations: Regularly assess your portfolio allocations to ensure they align with your investment goals and risk tolerance.

By employing these strategies, investors can navigate potential downturns while remaining open to opportunities for growth.

FAQs About Is May A Good Month For Stocks

- Why do stocks tend to underperform in May?

Stocks often underperform in May due to seasonal trading patterns and lower trading volumes as many investors take vacations. - What is the "Sell in May" strategy?

The "Sell in May" strategy suggests selling stocks at the beginning of May and re-entering around Halloween based on historical performance trends. - Are there exceptions to the May downturn trend?

Yes, stocks can still perform well during summer months; some years have seen significant gains despite historical averages. - How should I adjust my portfolio for May?

Consider sector rotation into defensive sectors or maintain a diversified portfolio aligned with long-term goals. - What role do elections play in stock performance?

Elections can influence investor sentiment; historically, election years have seen stronger summer rallies compared to non-election years.

In conclusion, while historical trends suggest caution during May due to potential underperformance in stocks, it is essential for investors to evaluate their individual circumstances and long-term strategies before making decisions based solely on seasonal patterns. By understanding both historical data and current market dynamics, investors can make more informed choices that align with their financial goals.