Mid-America Apartment Communities, Inc. (NYSE: MAA) is a prominent real estate investment trust (REIT) that specializes in owning, managing, and developing apartment communities primarily in the Southeast, Southwest, and Mid-Atlantic regions of the United States. As an investment option, MAA has garnered attention due to its robust performance metrics and strategic initiatives aimed at capitalizing on favorable market conditions. This article will explore whether MAA is a good investment by analyzing its financial health, market position, growth potential, and risks associated with investing in this REIT.

MAA has established itself as a significant player in the real estate sector with a strong focus on multifamily housing. Its business model revolves around acquiring and developing properties that cater to the growing demand for rental apartments. The company operates over 102,000 apartment units across 16 states and Washington D.C., making it one of the largest apartment owners in the United States.

Investors often seek REITs like MAA for their potential to provide consistent income through dividends while also offering opportunities for capital appreciation. In this context, understanding MAA’s financial performance, market trends, and strategic initiatives is crucial for making informed investment decisions.

| Key Metric | Value |

|---|---|

| Market Capitalization | $19.56 billion |

| Dividend Yield | 4.21% |

| P/E Ratio | 37.15 |

| Core FFO per Share (Q3 2024) | $2.21 |

Financial Performance Overview

MAA’s financial performance is a critical factor in evaluating its investment potential. The company reported strong demand for apartment housing in its recent earnings calls, reflecting a positive outlook for the sector. In Q3 2024, MAA achieved earnings per share (EPS) of $2.21, which exceeded analysts’ expectations but represented a slight decline from the previous year. The company’s Core Funds from Operations (Core FFO) reached $2.22 per share for Q2 2024, indicating robust operational efficiency.

MAA’s revenue growth has been stable, although it faced challenges with property operating expenses increasing by approximately 3% year-over-year. Despite these challenges, MAA maintained a strong occupancy rate of 95.7% across its Same Store Portfolio, showcasing its ability to retain tenants even in fluctuating market conditions.

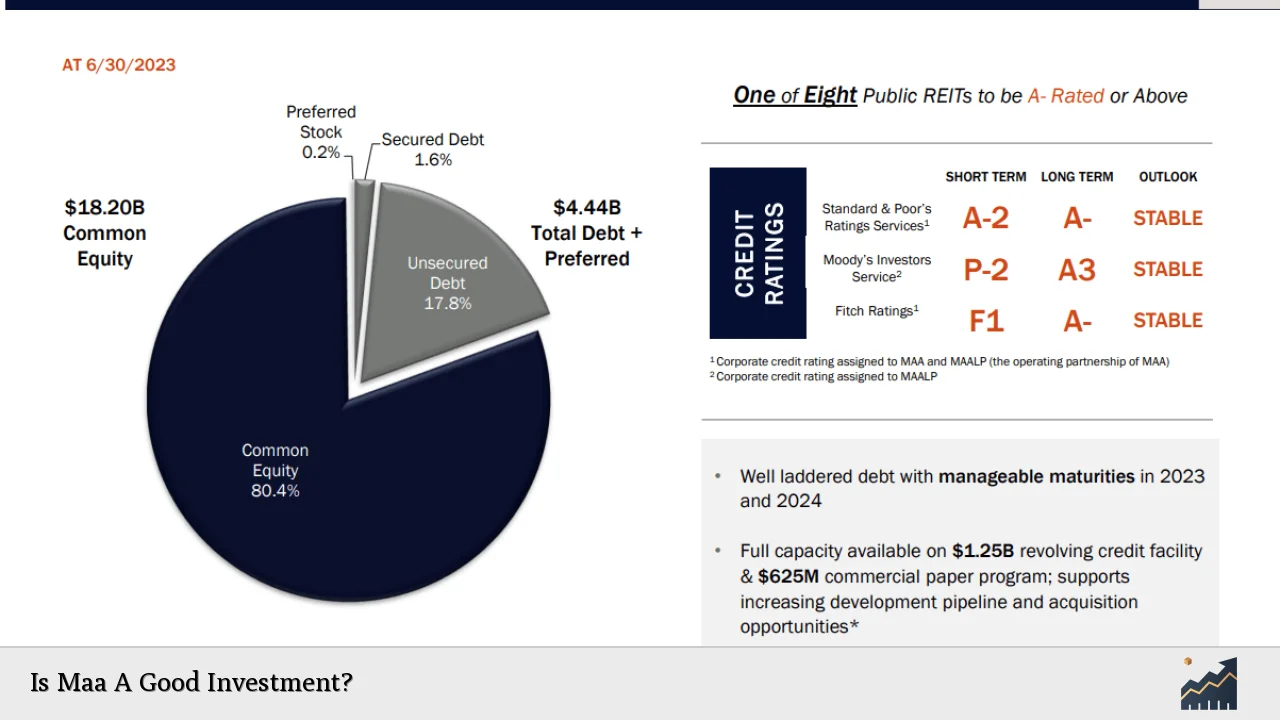

The company’s balance sheet remains solid with low leverage ratios and significant cash reserves, allowing it to pursue strategic acquisitions and developments without compromising financial stability. With a Net Debt/Adjusted EBITDA ratio of 3.9, MAA is well-positioned to capitalize on growth opportunities while managing its debt effectively.

Market Trends Affecting MAA

The real estate market is influenced by various trends that can significantly impact MAA’s performance as an investment option. One notable trend is the increasing demand for rental housing driven by demographic shifts such as urbanization and changing lifestyle preferences among younger generations. Many individuals are opting to rent rather than buy homes due to high property prices and rising interest rates.

Additionally, MAA’s focus on the Sun Belt region aligns well with favorable migration trends where job growth and household formation are robust. This demographic shift supports sustained demand for rental apartments in these areas.

However, potential investors should be aware of challenges such as increased competition from other housing alternatives and economic uncertainties that could affect rental rates and occupancy levels. Despite these risks, MAA’s strategic initiatives aimed at enhancing its property portfolio through redevelopment and technology integration position it favorably within the market.

Growth Potential

MAA’s growth potential is supported by its proactive approach to property management and development strategies. The company plans to invest between $1 billion to $1.2 billion in new developments funded through additional debt, indicating confidence in future cash flows generated from these investments.

The anticipated decline in new supply deliveries in the latter half of 2024 is expected to benefit MAA by reducing competition for tenants and stabilizing rental rates. Furthermore, MAA’s commitment to enhancing tenant experiences through Smart Home technology installations positions it as an innovative leader within the multifamily housing sector.

Analysts predict that MAA will continue to experience moderate revenue growth of approximately 4.3% annually over the next few years as it expands its footprint in high-demand markets while maintaining strong operational performance.

Dividend Sustainability

For many investors, dividends are a crucial aspect of total return on investment. MAA has consistently increased its dividend payouts over the years, with a five-year annualized dividend growth rate of 10.48%. The current dividend yield stands at 4.21%, making it an attractive option for income-focused investors looking for reliable cash flow from their investments.

The company’s commitment to dividend growth is supported by its strong financial metrics and operational efficiency, ensuring that it can continue rewarding shareholders even amidst market fluctuations.

Risks Associated with Investing in MAA

While MAA presents several attractive investment qualities, potential investors should also consider inherent risks associated with investing in this REIT:

- Market Competition: The residential real estate market is highly competitive with various housing alternatives available to consumers, which may limit MAA’s ability to raise rents or maintain occupancy levels during economic downturns.

- Economic Uncertainty: Economic fluctuations can impact consumer confidence and spending habits, potentially leading to increased vacancies or reduced rental income.

- Supply Chain Constraints: Ongoing supply chain issues may lead to cost overruns on new development projects or delays in property renovations.

- Interest Rate Sensitivity: As interest rates rise, borrowing costs increase which may affect MAA’s ability to finance new projects or refinance existing debt at favorable terms.

Conclusion

In conclusion, Mid-America Apartment Communities (MAA) offers a compelling investment opportunity characterized by strong financial performance, a positive outlook driven by favorable market trends, and a commitment to shareholder returns through consistent dividend payouts. However, investors should remain vigilant about potential risks associated with market competition and economic uncertainties that could impact future performance.

Ultimately, whether MAA is a good investment depends on individual investor goals and risk tolerance levels. Those seeking stable income combined with moderate growth potential may find MAA aligns well with their investment strategy.

FAQs About Is Maa A Good Investment?

- What is Mid-America Apartment Communities?

MAA is a real estate investment trust specializing in apartment communities across the U.S. - How has MAA performed financially?

MAA reported strong earnings per share of $2.21 for Q3 2024 despite slight declines year-over-year. - What is the current dividend yield for MAA?

The current dividend yield stands at approximately 4.21%. - What are the main risks of investing in MAA?

Main risks include market competition and economic uncertainties affecting rental income. - Is MAA focused on growth?

Yes, MAA plans significant investments in new developments indicating strong growth potential.