Liquid Piston, Inc. is an innovative technology startup that aims to revolutionize the internal combustion engine market through its patented High-Efficiency Hybrid Cycle™ (HEHC) and advanced rotary engine designs. Founded in 2003 by Dr. Nikolay Shkolnik and Dr. Alexander Shkolnik, the company has garnered significant attention and investment, raising over $35 million from more than 10,000 investors. With a potential addressable market of approximately $400 billion, Liquid Piston presents an intriguing opportunity for investors looking to capitalize on the future of power and propulsion.

However, investing in Liquid Piston is not without its challenges. The company operates in a highly competitive landscape dominated by established players and emerging electric vehicle technologies. This analysis will explore the current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook for Liquid Piston as an investment opportunity.

| Key Concept | Description/Impact |

|---|---|

| Market Potential | Liquid Piston targets a $400 billion market with applications across various sectors including military, automotive, and portable power generation. |

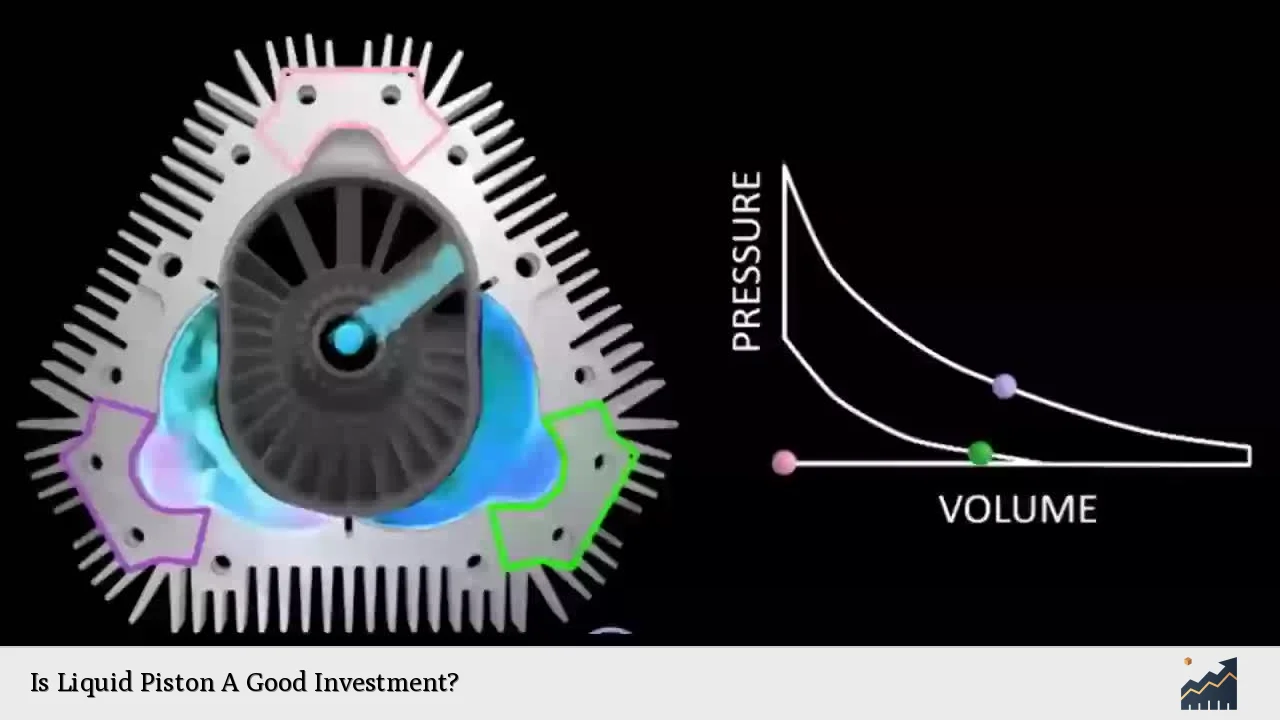

| Innovative Technology | The company’s HEHC technology promises up to 10 times more power than traditional engines while being compact and fuel-efficient. |

| Funding Success | Liquid Piston has successfully raised over $35 million through equity crowdfunding and government contracts, indicating strong investor interest. |

| Competitive Landscape | The company faces competition from both traditional engine manufacturers and the rapidly growing electric vehicle sector. |

| Regulatory Challenges | Shifts towards green technologies and regulations may impact the demand for conventional internal combustion engines. |

| Financial Performance | The company reported revenue growth from $6.68 million in FY 2022 to $8.17 million in FY 2023, demonstrating a positive trajectory. |

Market Analysis and Trends

The internal combustion engine market is undergoing significant transformation as sustainability becomes a priority across industries. Liquid Piston’s technology positions it uniquely within this landscape:

- Growth of Alternative Fuels: The increasing push for greener technologies has led to a growing interest in alternative fuels such as hydrogen. Liquid Piston’s engines can run on multiple fuel types, including hydrogen and traditional fossil fuels, aligning with this trend.

- Military Contracts: The company has secured over $30 million in contracts with the U.S. Department of Defense (DoD), underscoring its relevance in military applications where efficiency and compactness are critical.

- Market Size: The U.S. internal combustion engine market alone is projected to be worth approximately $84.2 billion by 2024, with a compound annual growth rate (CAGR) of 4.7%. This expansive market offers substantial opportunities for growth.

- Technological Innovation: Liquid Piston’s HEHC technology represents one of the first major advancements in engine design in over a century, which could lead to widespread adoption across various sectors including automotive, aerospace, and portable power generation.

Implementation Strategies

For investors considering Liquid Piston, understanding the company’s strategic approach is essential:

- Focus on R&D: Continued investment in research and development is crucial for refining their technology and ensuring it meets market demands.

- Partnerships: Collaborating with military and commercial partners can provide valuable testing grounds for their engines while securing additional funding.

- Diversification of Applications: Expanding into various markets such as drones, generators, and even personal vehicles can mitigate risks associated with reliance on any single sector.

- Marketing Efforts: Increasing brand awareness through media coverage and industry partnerships will be vital to attract further investment and customer interest.

Risk Considerations

Investing in Liquid Piston carries inherent risks that potential investors should consider:

- Capital Intensity: The development of advanced engine technology requires substantial capital investment which could lead to dilution of existing shares if additional funding rounds are needed.

- Market Competition: Established players in the automotive sector are also innovating rapidly, particularly in electric vehicles which may overshadow Liquid Piston’s offerings.

- Regulatory Environment: As governments push for greener technologies, there may be regulatory shifts that could negatively impact demand for conventional internal combustion engines.

- Long Sales Cycles: The lengthy sales cycles typical in the automotive and aerospace industries can delay revenue recognition and affect cash flow stability.

Regulatory Aspects

The regulatory landscape surrounding internal combustion engines is shifting significantly:

- Environmental Regulations: Increasingly stringent emissions standards may pose challenges for traditional engine manufacturers while favoring companies focused on greener alternatives like Liquid Piston.

- Government Support: Contracts from government entities such as the DoD provide non-dilutive funding but also require compliance with specific performance standards that can be demanding.

- Investment Opportunities: Regulatory frameworks allowing equity crowdfunding have opened new avenues for public investment in startups like Liquid Piston, democratizing access to early-stage investment opportunities.

Future Outlook

The future outlook for Liquid Piston appears promising yet complex:

- Technological Advancements: If successful in refining its HEHC technology further, Liquid Piston could lead a significant shift in engine design that meets modern efficiency standards.

- Market Demand: As global demand for efficient power solutions grows, particularly amidst rising fuel costs and environmental concerns, Liquid Piston’s adaptable technology could see increased adoption across various sectors.

- Potential IPO: While there are discussions regarding a potential initial public offering (IPO), the company currently appears focused on equity crowdfunding as its primary means of raising capital. This strategy allows them to maintain flexibility while engaging with a broad base of investors.

In conclusion, while Liquid Piston presents an intriguing investment opportunity due to its innovative technology and substantial market potential, prospective investors must weigh these advantages against the inherent risks associated with startup investments in a competitive landscape.

Frequently Asked Questions About Is Liquid Piston A Good Investment?

- What is Liquid Piston’s primary product?

Liquid Piston develops advanced rotary engines based on its patented High-Efficiency Hybrid Cycle™ (HEHC), which aims to improve fuel efficiency and reduce emissions compared to traditional engines. - How much funding has Liquid Piston raised?

The company has raised over $35 million through equity crowdfunding and government contracts. - What markets does Liquid Piston target?

Liquid Piston targets various markets including military applications, automotive sectors, portable power generation, drones, and more. - What are the main risks associated with investing in Liquid Piston?

Main risks include high capital intensity requirements, competition from established manufacturers and electric vehicle technologies, long sales cycles, and regulatory challenges. - Is there potential for significant returns on investment?

If successful in scaling operations and capturing market share within its addressable $400 billion market, significant returns are possible; however, this depends on overcoming various operational challenges. - What role do government contracts play for Liquid Piston?

Government contracts provide critical funding support while serving as testing grounds for their technology within military applications. - How does environmental regulation affect Liquid Piston?

Increasingly stringent environmental regulations may favor companies developing greener technologies like those offered by Liquid Piston while posing challenges for traditional internal combustion engines. - What is the outlook for an IPO?

The company has not confirmed plans for an IPO but continues to focus on equity crowdfunding as its primary means of raising capital at this time.

This comprehensive analysis provides a detailed overview of whether investing in Liquid Piston is a sound decision based on current market conditions and future prospects.