Investing in land is often seen as a viable option for individuals looking to grow their wealth. The appeal of land investment lies in its potential for appreciation, versatility, and tangibility. Unlike stocks or bonds, land is a physical asset that can provide security and stability. However, the decision to invest in land requires careful consideration of various factors, including market conditions, location, and personal financial goals. This article explores the advantages and disadvantages of investing in land, providing insights to help potential investors make informed decisions.

| Advantages | Disadvantages |

|---|---|

| Scarcity and appreciation | Illiquidity |

| Low maintenance costs | High upfront costs |

| Multiple uses | Zoning and regulatory risks |

| Tangible asset | Market volatility |

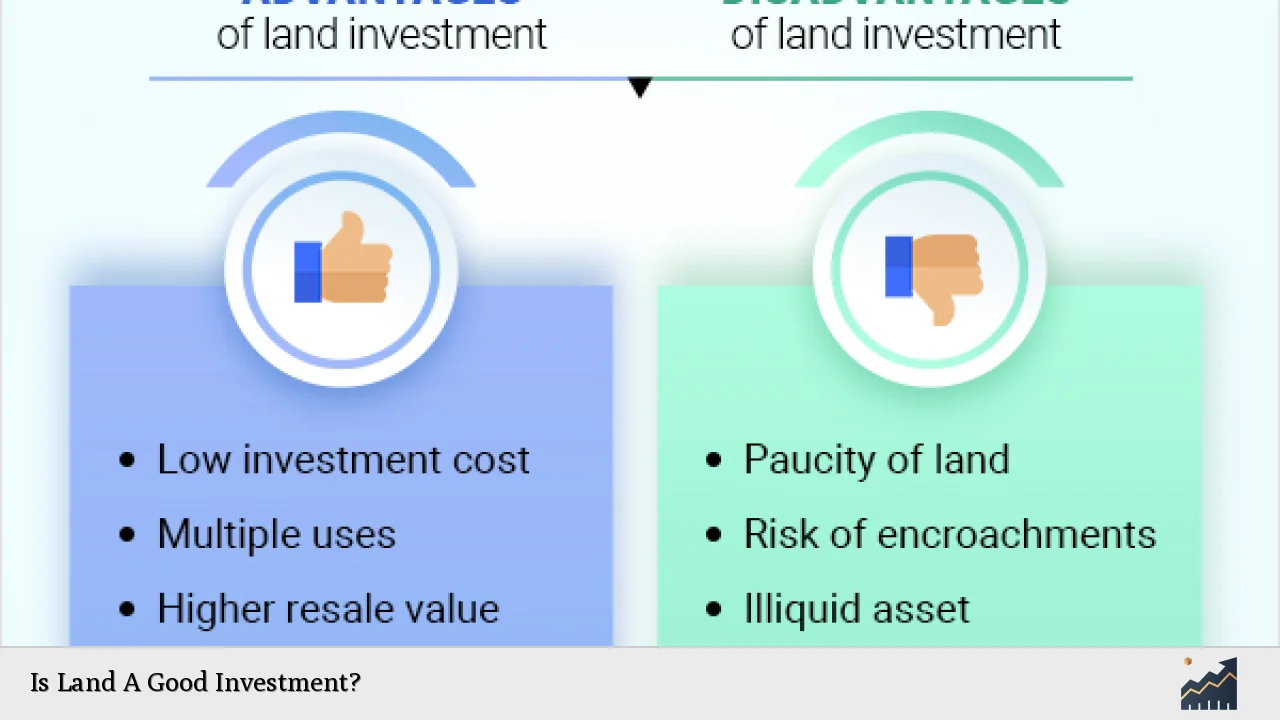

Advantages of Investing in Land

Investing in land offers several key benefits that can appeal to a wide range of investors.

- Scarcity and Appreciation: Land is a finite resource; they are not making more of it. This scarcity can lead to increased demand over time, resulting in appreciation in value. As populations grow and urban areas expand, the value of land in strategic locations tends to rise.

- Low Maintenance Costs: Unlike residential or commercial properties that require ongoing maintenance and repairs, land typically has lower upkeep costs. This makes it an attractive option for investors seeking minimal management responsibilities.

- Multiple Uses: Land can be utilized for various purposes, including residential development, agriculture, recreation, or commercial use. This versatility allows investors to adapt their strategies based on market demands and personal interests.

- Tangible Asset: Owning land provides a sense of security as it is a physical asset that cannot disappear overnight. This tangibility can be reassuring for investors looking for stable investment options.

Investors should consider these advantages when evaluating land as part of their investment portfolio.

Disadvantages of Investing in Land

Despite its advantages, investing in land comes with several challenges that potential investors should be aware of.

- Illiquidity: Selling land can be a lengthy process compared to other investments like stocks or bonds. The market for land may not always have buyers readily available, which can delay returns on investment.

- High Upfront Costs: Purchasing land often involves significant initial expenditures. Beyond the purchase price, investors may incur costs related to taxes, surveys, and legal fees that can add up quickly.

- Zoning and Regulatory Risks: Changes in zoning laws or local regulations can affect the potential uses of a piece of land. What may seem like a lucrative investment today could become less valuable if zoning restrictions change unexpectedly.

- Market Volatility: While land is generally seen as a stable investment, it is still subject to market fluctuations. Economic downturns can lead to declines in property values, impacting the overall return on investment.

Understanding these disadvantages is crucial for anyone considering investing in land.

Types of Land Investments

Investors can choose from various types of land investments based on their interests and financial goals.

- Residential Development Land: This type involves purchasing land intended for building homes or apartments. Investors can profit from selling developed lots or constructing properties for rental income.

- Commercial Development Land: Similar to residential development but focused on business use, this type includes purchasing land for office buildings, retail spaces, or industrial facilities.

- Agricultural Land: Investors may buy farmland to cultivate crops or raise livestock. This type of investment offers potential income through farming operations while benefiting from long-term appreciation.

- Recreational Land: This includes parcels used for recreational purposes such as hunting, fishing, or camping. Investors may enjoy personal use while also having the potential for rental income from recreational leases.

Each type of land investment carries its own set of risks and rewards that should be carefully evaluated before making a decision.

Factors Influencing Land Investment Value

Several factors can significantly influence the value of land investments:

- Location: The adage “location, location, location” holds true in real estate. Proximity to urban centers, schools, transportation hubs, and amenities can greatly affect demand and pricing.

- Market Trends: Understanding current market trends is essential for predicting future value increases. Economic growth in an area often correlates with rising property values.

- Zoning Laws: Local zoning regulations dictate what can be built on a piece of land. Favorable zoning laws can enhance property values by allowing more lucrative developments.

- Infrastructure Development: Upcoming infrastructure projects such as roads, schools, or public transport can increase the desirability of nearby land. Investors should keep an eye on planned developments that could impact their investments positively.

By considering these factors when investing in land, individuals can make more informed decisions that align with their financial goals.

Strategies for Successful Land Investment

To maximize the chances of success in land investment, consider implementing the following strategies:

- Conduct Thorough Research: Before purchasing any land parcel, conduct comprehensive research on local market conditions, zoning laws, and future development plans. Understanding the area will help you make informed decisions.

- Diversify Your Investments: Like any other investment strategy, diversification is key. Consider investing in different types of land or locations to spread risk and increase potential returns.

- Consult Experts: Engaging with real estate professionals who specialize in land investments can provide valuable insights and guidance throughout the buying process.

- Be Patient: Land investments often require a long-term perspective. Be prepared to hold onto your property until market conditions are favorable for selling or developing.

Implementing these strategies can enhance your chances of achieving success in the competitive field of land investment.

FAQs About Is Land A Good Investment?

- What are the main benefits of investing in land?

The main benefits include scarcity leading to appreciation, low maintenance costs, multiple uses for the property, and it being a tangible asset. - What are the risks associated with investing in land?

The risks include illiquidity, high upfront costs, zoning changes impacting value, and market volatility. - How do I determine if a piece of land is a good investment?

Evaluate location trends, zoning regulations, market conditions, and potential future developments. - Can I make money from agricultural land?

Yes, agricultural land can generate income through farming activities while also appreciating over time. - Is it better to invest in developed properties or raw land?

This depends on your investment strategy; developed properties may offer immediate cash flow while raw land has potential for long-term appreciation.

Investing in land presents both opportunities and challenges. By understanding the benefits and drawbacks associated with this type of investment and employing effective strategies, individuals can make informed decisions that align with their financial goals while navigating this complex landscape effectively.