Kleva Wallet is primarily classified as a non-custodial wallet, meaning that users maintain full control over their private keys and, consequently, their digital assets. This classification is significant as it influences how users interact with their cryptocurrencies, the level of security they can expect, and the responsibilities they bear regarding asset management. In non-custodial wallets like Kleva, the user is the sole custodian of their keys, which enhances security but also places the onus of safeguarding those keys entirely on the user.

| Key Concept | Description/Impact |

|---|---|

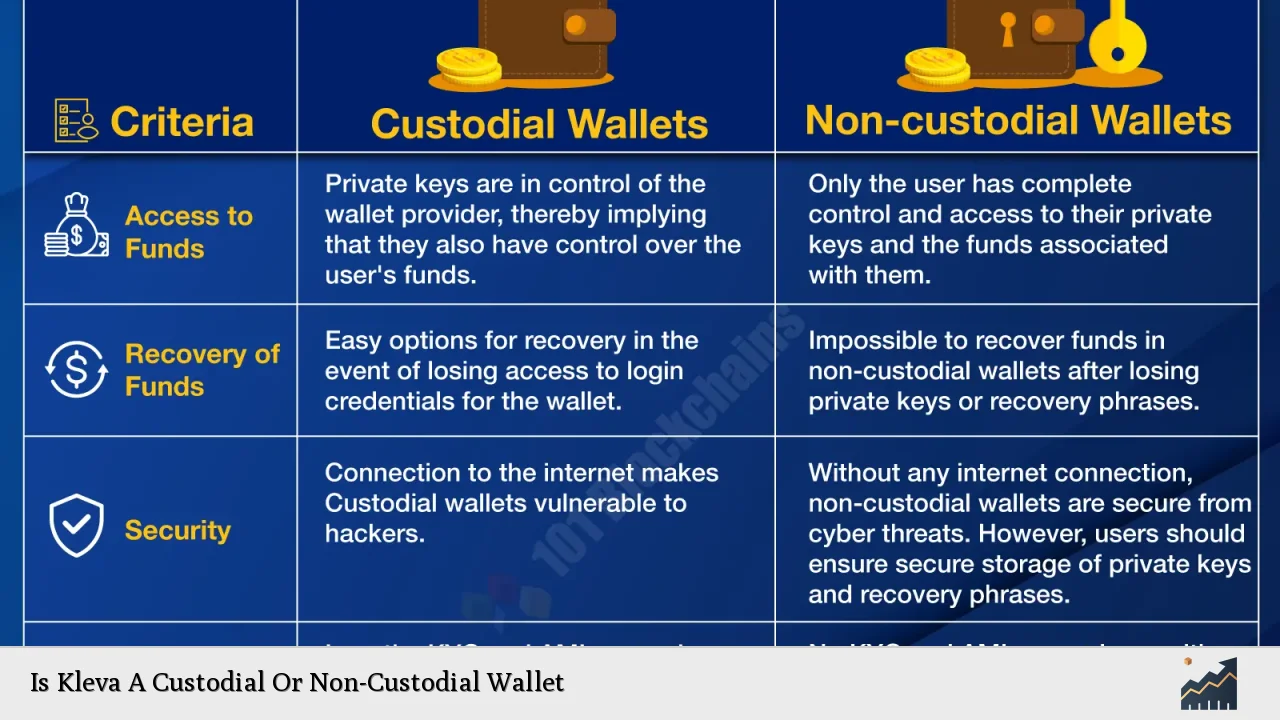

| Custodial Wallets | Third-party service providers hold and manage users’ private keys, which can lead to risks associated with hacks and mismanagement. |

| Non-Custodial Wallets | Users have complete control over their private keys, enhancing security but requiring personal responsibility for key management. |

| Kleva Wallet Features | Utilizes advanced encryption and blockchain technology to secure user assets while allowing for direct interaction with decentralized networks. |

| User Responsibility | If a user loses their private key or mnemonic phrase, they permanently lose access to their funds without recovery options. |

| Privacy Considerations | Kleva does not require personal information for wallet creation, enhancing user privacy compared to custodial options. |

Market Analysis and Trends

The cryptocurrency wallet market has seen exponential growth in recent years. As of 2023, the market was valued at approximately $10.93 billion and is projected to reach $14.39 billion by 2024, reflecting a compound annual growth rate (CAGR) of about 31.7%. This growth is driven by increased interest in cryptocurrencies, the expansion of digital asset ecosystems, and heightened demand for user-friendly wallet solutions.

Current Trends

- Shift Towards Non-Custodial Solutions: Users are increasingly concerned about security and privacy, leading to a growing preference for non-custodial wallets. This trend aligns with the broader movement towards decentralization in finance.

- Integration with DeFi: Non-custodial wallets like Kleva facilitate direct interactions with decentralized finance (DeFi) platforms, allowing users to engage in lending, borrowing, and trading without intermediaries.

- Technological Advancements: The adoption of advanced security features such as biometric authentication and hardware wallets is becoming more prevalent as users seek enhanced protection for their digital assets.

Implementation Strategies

When considering the use of a non-custodial wallet like Kleva, users should adopt specific strategies to maximize security and usability:

- Secure Key Management: Users should employ best practices for managing private keys, including using hardware wallets for offline storage and ensuring backup phrases are stored securely.

- Regular Security Audits: Engaging in regular audits of wallet security features can help identify vulnerabilities and enhance overall protection against potential threats.

- Education on Risks: Users must be educated about the risks associated with losing access to their private keys and the importance of maintaining secure backups.

Risk Considerations

While non-custodial wallets offer numerous benefits, they also come with inherent risks:

- Loss of Access: If users lose their private keys or mnemonic phrases, they cannot recover their funds. This risk underscores the importance of diligent key management.

- Security Vulnerabilities: Although non-custodial wallets reduce counterparty risk associated with custodians, they are still susceptible to phishing attacks and malware if users do not take appropriate precautions.

- Market Volatility: The value of cryptocurrencies can be highly volatile. Users should be prepared for significant fluctuations in asset values when using any cryptocurrency wallet.

Regulatory Aspects

The regulatory landscape surrounding cryptocurrency wallets is evolving rapidly. Non-custodial wallets like Kleva often operate outside traditional financial regulations since they do not hold users’ funds or personal data. However, users should remain informed about:

- Compliance Requirements: In certain jurisdictions, regulations may require disclosures or compliance checks even for non-custodial services.

- Tax Implications: Users must understand how cryptocurrency transactions are taxed in their region to ensure compliance with local laws.

Future Outlook

The future of non-custodial wallets looks promising as more individuals seek control over their digital assets. Key factors influencing this outlook include:

- Increased Adoption of Cryptocurrencies: As more people enter the cryptocurrency market, demand for secure wallet solutions is expected to rise significantly.

- Technological Innovations: Ongoing advancements in blockchain technology will likely enhance the functionality and security features of non-custodial wallets.

- Growing Awareness of Privacy Issues: With increasing concerns about data privacy and centralized control over financial assets, non-custodial solutions will continue to attract users who prioritize autonomy.

Frequently Asked Questions About Is Kleva A Custodial Or Non-Custodial Wallet

- What is a custodial wallet?

A custodial wallet is a type of cryptocurrency wallet where a third party manages your private keys on your behalf. This means you rely on that third party to secure your funds. - What are the advantages of using a non-custodial wallet like Kleva?

Non-custodial wallets provide greater control over your assets, enhanced privacy since they typically do not require personal information, and reduced risk from third-party breaches. - Can I recover my funds if I lose my private key?

No, if you lose your private key or mnemonic phrase associated with a non-custodial wallet like Kleva, you will permanently lose access to your funds. - How does Kleva ensure my security?

Kleva employs advanced encryption techniques and utilizes blockchain technology to safeguard your assets while allowing direct interaction with decentralized networks. - Is it safe to use a mobile wallet?

Mobile wallets can be safe if proper security measures are taken. Always use strong passwords, enable two-factor authentication if available, and keep your device secure from malware. - What should I do if I suspect my wallet has been compromised?

If you suspect your wallet has been compromised, immediately transfer your assets to a new wallet with new keys that have not been exposed. - Are there transaction fees associated with using Kleva?

Kleva may have transaction fees depending on network conditions; however, using a non-custodial wallet generally allows for lower fees compared to custodial services. - How do I choose between custodial and non-custodial wallets?

Your choice should depend on your comfort level with managing private keys versus your need for convenience. Non-custodial wallets offer more control but require careful key management.