Johnson & Johnson (JNJ) has long been considered a stalwart in the healthcare industry, known for its diverse portfolio of consumer health products, pharmaceuticals, and medical devices. As investors seek stable, long-term growth opportunities, JNJ’s track record and future prospects warrant careful examination. The company’s financial performance, strategic initiatives, and market position all play crucial roles in determining its potential as a long-term investment.

JNJ’s consistent dividend growth, strong market presence, and innovative pipeline make it an attractive option for many investors. However, like any investment, it comes with its own set of risks and challenges. To make an informed decision, it’s essential to analyze various aspects of the company’s performance and outlook.

Let’s take a closer look at key factors that influence JNJ’s long-term investment potential:

| Factor | Impact on Long-term Investment |

|---|---|

| Dividend Growth | Positive – 60+ years of consecutive increases |

| Market Diversification | Strong – Presence in multiple healthcare segments |

| Innovation Pipeline | Robust – Ongoing R&D in pharmaceuticals and medical devices |

| Financial Stability | Solid – Consistent revenue and earnings growth |

Financial Performance and Stability

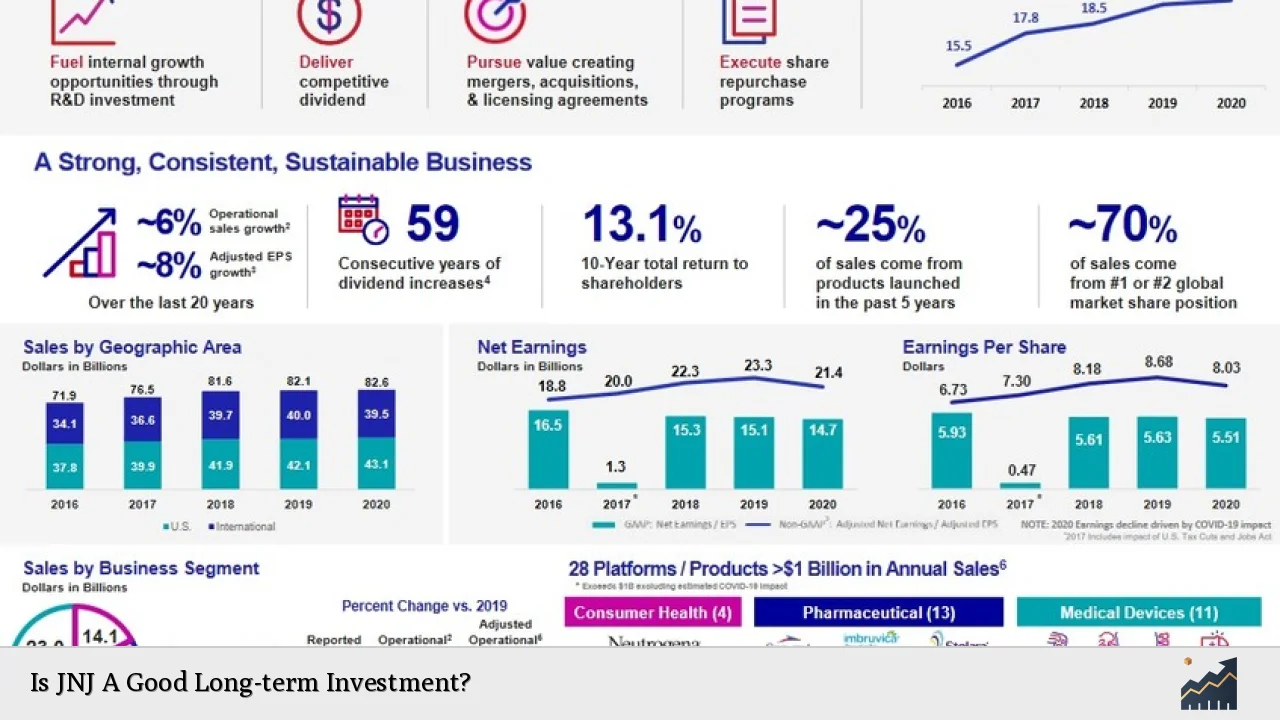

Johnson & Johnson’s financial performance is a critical factor in assessing its long-term investment potential. The company has demonstrated remarkable consistency in revenue growth and profitability over the years. In the third quarter of 2024, JNJ reported a 5.2% increase in sales, reaching $22.5 billion, with operational growth of 6.3%. This growth trajectory indicates the company’s ability to adapt to market changes and maintain its competitive edge.

The company’s diverse business model, spanning pharmaceuticals, medical devices, and consumer health products, provides a stable foundation for long-term growth. This diversification helps mitigate risks associated with market fluctuations in any single segment. For instance, while the consumer health segment may face challenges, strong performance in pharmaceuticals can offset potential losses.

JNJ’s financial stability is further underscored by its robust cash flow generation. This allows the company to invest in research and development, pursue strategic acquisitions, and return value to shareholders through dividends and share repurchases. The company’s ability to maintain a healthy balance sheet while funding growth initiatives is a positive indicator for long-term investors.

Dividend Growth and Shareholder Value

One of the most compelling reasons for considering JNJ as a long-term investment is its impressive dividend history. The company has increased its dividend for over 60 consecutive years, making it a member of the elite group of Dividend Kings. This consistent dividend growth demonstrates JNJ’s commitment to returning value to shareholders and its ability to generate sustainable cash flows.

As of 2024, JNJ’s dividend yield stands at approximately 2.5%, with a payout ratio of 47.7%. This relatively conservative payout ratio suggests that the company has room to continue increasing its dividend in the future, even if faced with temporary setbacks or economic challenges. For income-focused investors, this reliable and growing dividend stream can provide a stable foundation for long-term portfolio growth.

The company’s share repurchase programs further enhance shareholder value. By reducing the number of outstanding shares, JNJ effectively increases earnings per share, potentially driving long-term stock price appreciation. This dual approach of dividend growth and share buybacks reflects a balanced strategy for creating shareholder value over time.

Innovation and Research & Development

Johnson & Johnson’s long-term success heavily relies on its ability to innovate and bring new products to market. The company’s substantial investment in research and development is a key driver of its future growth potential. In 2024, JNJ continued to make significant strides in its pharmaceutical and medical device segments, with several notable achievements:

- Approval of TREMFYA for ulcerative colitis

- Approval of RYBREVANT + LAZCLUZE for non-small cell lung cancer

- Submission of an investigational device exemption for the OTTAVA general surgery robotic system

These developments showcase JNJ’s commitment to advancing medical innovation and expanding its product portfolio. The company’s robust pipeline, with multiple drugs in late-stage clinical trials and new medical devices under development, positions it well for future growth. This continuous focus on innovation helps JNJ maintain its competitive edge in the rapidly evolving healthcare industry.

Market Position and Competitive Landscape

Johnson & Johnson’s strong market position across various healthcare segments contributes to its appeal as a long-term investment. The company’s well-established brands in consumer health, coupled with its leadership in pharmaceuticals and medical devices, provide a competitive advantage. This diversified portfolio allows JNJ to capitalize on growth opportunities in multiple markets while mitigating risks associated with any single product or segment.

In the pharmaceutical sector, JNJ faces competition from other major players and emerging biotech companies. However, its strong research capabilities and strategic partnerships help maintain its position at the forefront of drug development. The company’s focus on high-growth therapeutic areas, such as oncology and immunology, aligns with long-term healthcare trends.

The medical devices segment presents significant growth potential, particularly with the integration of innovative technologies. JNJ’s investments in robotic surgery platforms and digital health solutions position it to capitalize on the growing demand for minimally invasive procedures and personalized healthcare.

Risks and Challenges

While Johnson & Johnson offers many attractive qualities as a long-term investment, it’s crucial to consider potential risks:

- Legal Liabilities: JNJ has faced numerous lawsuits related to product safety, which could impact financial performance and reputation.

- Patent Expirations: The loss of exclusivity on key drugs can lead to revenue declines as generic competitors enter the market.

- Regulatory Environment: Changes in healthcare policies and regulations can affect JNJ’s operations and profitability.

- Global Economic Factors: As a multinational corporation, JNJ is exposed to currency fluctuations and geopolitical risks.

- Competition: Intense competition in all segments requires continuous innovation and market adaptation.

Investors should weigh these risks against the company’s strengths and long-term growth potential when considering JNJ as an investment.

Future Outlook and Growth Prospects

Looking ahead, Johnson & Johnson’s future appears promising. The company has revised its full-year 2024 guidance, anticipating operational sales growth between 6.3% and 6.8%. This positive outlook is driven by expected contributions from new product launches, expansion in emerging markets, and continued strength in core franchises.

JNJ’s strategic focus on high-growth areas, such as oncology, immunology, and robotic surgery, aligns with long-term healthcare trends. The company’s ongoing investment in research and development, coupled with strategic acquisitions, positions it to capitalize on emerging opportunities in personalized medicine and digital health technologies.

The recent acquisition of V-Wave, while impacting short-term earnings, demonstrates JNJ’s commitment to expanding its capabilities in treating cardiovascular diseases. Such strategic moves are likely to contribute to long-term value creation for shareholders.

FAQs About JNJ As A Long-term Investment

- Is Johnson & Johnson’s dividend safe?

Yes, JNJ’s dividend is considered very safe due to its consistent growth history and conservative payout ratio. - How does JNJ’s diversification benefit investors?

Diversification across healthcare segments provides stability and multiple growth avenues, reducing overall investment risk. - What are the main growth drivers for JNJ in the coming years?

Key growth drivers include new drug approvals, expansion in medical devices, and strategic acquisitions in high-growth areas. - How does JNJ compare to other healthcare stocks for long-term investment?

JNJ is often considered a more stable option due to its size, diversification, and consistent dividend growth. - What potential risks should investors consider with JNJ?

Key risks include legal liabilities, patent expirations, regulatory changes, and intense market competition.

In conclusion, Johnson & Johnson presents a compelling case as a long-term investment option. Its strong financial performance, consistent dividend growth, and robust innovation pipeline provide a solid foundation for future growth. The company’s diversified business model and strategic focus on high-growth areas in healthcare position it well to navigate market challenges and capitalize on emerging opportunities.

While risks such as legal liabilities and patent expirations exist, JNJ’s track record of adapting to market changes and maintaining its competitive edge offers reassurance to long-term investors. The company’s commitment to shareholder value, evidenced by its dividend history and share repurchase programs, further enhances its appeal.

For investors seeking a stable, income-generating stock with potential for capital appreciation, Johnson & Johnson warrants serious consideration. Its blend of defensive characteristics and growth prospects makes it an attractive option for those looking to build a resilient, long-term investment portfolio in the healthcare sector. As with any investment decision, it’s crucial to conduct thorough research and consider personal financial goals and risk tolerance before investing in JNJ or any other stock.