JD.com, Inc. is a prominent player in the Chinese e-commerce market, often compared to Alibaba but distinguished by its focus on direct sales and logistics. As an investor, evaluating whether JD.com is a good investment involves analyzing various factors, including its financial performance, growth prospects, market position, and broader economic conditions. This article delves into these aspects to provide a comprehensive overview of JD.com’s investment potential.

| Aspect | Details |

|---|---|

| Current Price | $28.89 |

| Market Cap | $445.82 billion |

| P/E Ratio | 13.50 |

| 52-Week Range | $20.82 – $41.95 |

| Analyst Recommendations | Buy (37 Analysts) |

Financial Performance

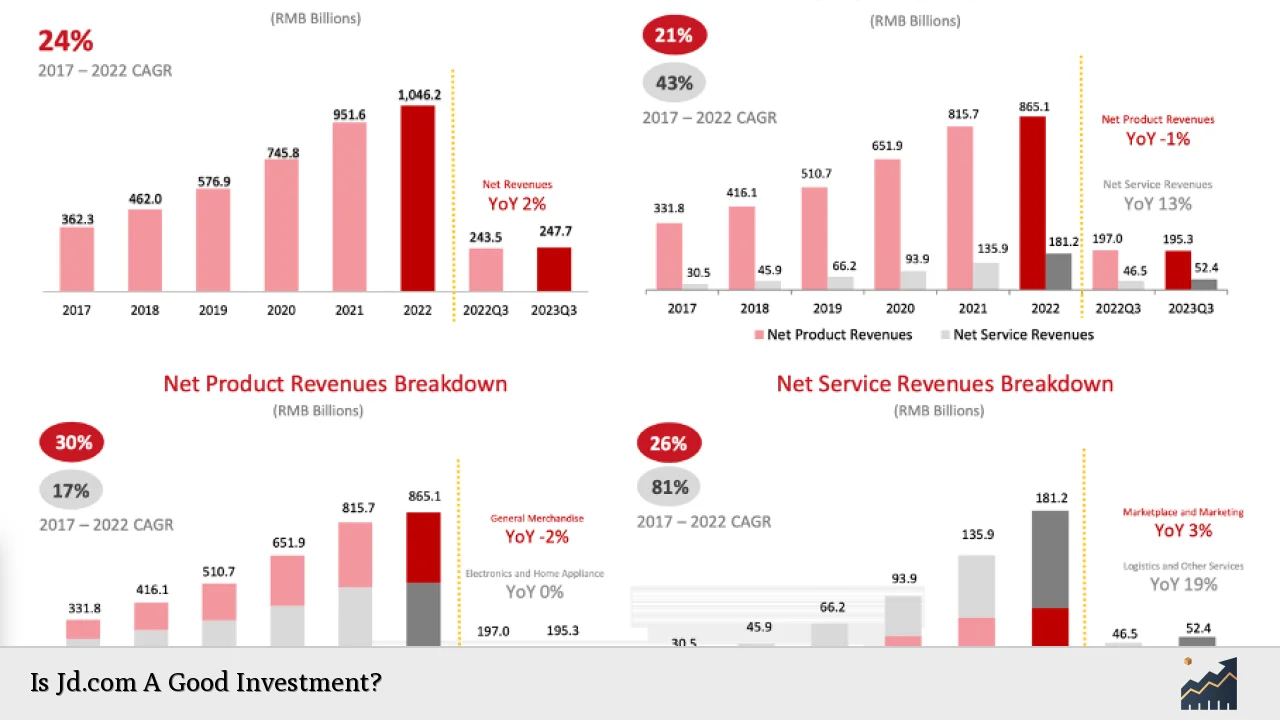

JD.com has shown solid financial performance over recent years, driven by its extensive logistics network and strong online marketplace. In the third quarter of 2024, JD.com reported net revenues of CN¥260.4 billion (approximately $37.1 billion), marking a 5.1% increase compared to the same period in the previous year. This growth reflects the company’s resilience amid fluctuating market conditions.

The company also reported a net income of CN¥11.7 billion, which is an impressive 48% increase year-over-year. Such figures indicate that JD.com is not only growing in revenue but also improving its profitability margins. The earnings per share (EPS) exceeded analyst expectations by 25%, showcasing the company’s ability to generate income effectively.

Moreover, JD.com’s gross margin expanded significantly to 15.84%, illustrating improved cost management and operational efficiency. With a P/E ratio of approximately 13.50, JD.com appears reasonably valued compared to its growth rate and industry peers.

Growth Prospects

JD.com is well-positioned for future growth due to several factors:

- E-commerce Demand: The increasing demand for e-commerce services in China continues to drive JD.com’s growth. As more consumers shift to online shopping, JD.com stands to benefit from this trend.

- Logistics Investments: The company has made substantial investments in its logistics infrastructure, enhancing delivery capabilities and customer satisfaction. This strategic focus on logistics differentiates JD.com from competitors who may rely more heavily on third-party services.

- Technological Advancements: JD.com is investing in advanced technologies like artificial intelligence and big data analytics to optimize operations and enhance customer experiences.

- Market Expansion: As JD.com continues to expand its product offerings and reach into new markets, it can tap into additional revenue streams and diversify its business model.

Analysts project that JD.com’s revenue will grow at an average annual rate of 5.1% over the next three years, although this is below the expected 10% growth rate for the broader multiline retail sector in the U.S. Nevertheless, this steady growth trajectory indicates that JD.com can maintain its competitive edge in the evolving e-commerce landscape.

Market Position

JD.com holds a significant market share in China’s e-commerce sector, competing directly with Alibaba and Pinduoduo. Unlike Alibaba, which primarily operates as a marketplace for third-party sellers, JD.com emphasizes direct sales and inventory management, allowing for greater control over product quality and customer service.

The company’s commitment to authenticity and reliability has earned it a loyal customer base, particularly among consumers wary of counterfeit products often associated with online marketplaces. Additionally, JD.com’s strong logistics network enables rapid delivery times, further enhancing customer satisfaction.

Despite facing challenges such as regulatory scrutiny and economic fluctuations in China, JD.com’s robust business model positions it favorably within the competitive landscape.

Ownership Structure

Understanding the ownership structure of JD.com provides insights into investor confidence and potential volatility in stock performance:

- Retail Investors: Retail investors hold approximately 41% of JD.com’s shares, indicating significant public interest in the company.

- Institutional Investors: Institutional investors own about 38% of the company’s shares. Their involvement typically signifies a level of credibility and trust within the investment community.

- Insider Ownership: Insiders hold around 11% of the shares, with CEO Qiangdong Liu being the largest individual shareholder. High insider ownership can be viewed positively as it suggests alignment between management’s interests and those of shareholders.

The diverse ownership structure indicates that no single entity has controlling interest in JD.com, which can help mitigate risks associated with sudden sell-offs by major shareholders.

Economic Environment

The broader economic environment plays a crucial role in determining JD.com’s investment potential:

- Chinese Economic Recovery: Following significant monetary easing measures by China’s central bank, there is optimism regarding economic recovery post-pandemic. Such measures are expected to stimulate consumer spending, benefiting e-commerce companies like JD.com.

- Regulatory Landscape: Investors should remain aware of regulatory changes affecting Chinese tech companies. While recent crackdowns have raised concerns, ongoing dialogues between regulators and companies may lead to more favorable conditions in the future.

- Global Market Conditions: As global economic conditions fluctuate, JD.com’s performance may be influenced by international trade dynamics and consumer confidence levels both domestically and abroad.

Investors should monitor these macroeconomic factors closely as they can significantly impact JD.com’s stock performance.

Analyst Opinions

Analyst sentiment regarding JD.com remains largely positive:

- The average brokerage recommendation for JD.com is around 1.33, indicating a consensus rating between “Buy” and “Hold.”

- Many analysts highlight JD.com’s strong financial fundamentals and growth prospects as key reasons for their bullish outlook on the stock.

- Recent upgrades from major financial institutions emphasize confidence in JD.com’s ability to navigate market challenges effectively.

This analyst support reinforces the view that JD.com presents a compelling investment opportunity for those looking to gain exposure to China’s burgeoning e-commerce sector.

Risks Involved

While there are many positive aspects regarding investing in JD.com, potential investors should also consider inherent risks:

- Market Volatility: As with any stock market investment, fluctuations in share price can occur due to various factors including market sentiment or broader economic changes.

- Regulatory Risks: Ongoing scrutiny from Chinese regulators poses risks that could impact operational flexibility or profitability for e-commerce companies like JD.com.

- Competitive Pressure: The competitive landscape remains fierce with rivals like Alibaba continually innovating and expanding their offerings.

Investors must weigh these risks against potential rewards when considering an investment in JD.com.

FAQs About Jd.com

- Is JD.com profitable?

Yes, JD.com has shown consistent profitability with increasing net income over recent quarters. - What are analysts saying about JD.com’s stock?

Analysts generally rate JD.com’s stock as a “Buy,” citing strong fundamentals. - How does JD.com compare to Alibaba?

JD.com focuses more on direct sales while Alibaba operates primarily as a marketplace. - What are the main risks of investing in JD.com?

The main risks include market volatility and regulatory scrutiny. - What is the expected growth rate for JD.com?

The company is projected to grow revenue at an average annual rate of 5.1% over the next three years.

In conclusion, considering all factors—financial performance, growth prospects, market position, ownership structure, economic environment, analyst opinions, and associated risks—JD.com appears to be a solid investment opportunity for those looking to capitalize on the growing e-commerce sector in China. However, investors should remain vigilant about market conditions and regulatory developments that could impact their investment outcomes.