Investing on a monthly basis, also known as regular investing or dollar-cost averaging, can be a highly effective strategy for many investors. This approach involves consistently investing a fixed amount of money at regular intervals, typically monthly, regardless of market conditions. While it may not be suitable for everyone, monthly investing offers several advantages that make it an attractive option for both novice and experienced investors alike.

Regular monthly investing helps to instill discipline and consistency in your investment approach. By committing to invest a set amount each month, you develop a habit of saving and investing, which can be crucial for long-term financial success. This strategy also removes the emotional aspect of trying to time the market, as you’ll be investing regardless of whether prices are high or low.

One of the key benefits of monthly investing is its ability to mitigate the impact of market volatility. By spreading your investments over time, you reduce the risk of investing a large sum at an inopportune moment. This approach can be particularly beneficial in volatile markets, as it allows you to take advantage of price fluctuations and potentially lower your average cost per share over time.

| Pros of Monthly Investing | Cons of Monthly Investing |

|---|---|

| Reduces impact of market volatility | May miss out on lump sum growth potential |

| Instills disciplined saving habits | Higher transaction costs over time |

| Allows for easier budgeting | Requires consistent cash flow |

| Minimizes timing risk | May underperform in consistently rising markets |

Benefits of Monthly Investing

One of the primary advantages of monthly investing is its ability to smooth out market fluctuations. By investing a fixed amount regularly, you buy more shares when prices are low and fewer shares when prices are high. This strategy, known as dollar-cost averaging, can help reduce the average cost per share over time, potentially leading to better long-term returns.

Monthly investing also aligns well with most people’s income patterns. Since many individuals receive their salaries on a monthly basis, setting aside a portion for investments becomes more manageable. This approach makes it easier to budget and plan for your financial future, as you can allocate a specific percentage of your income to investments each month.

For those new to investing, monthly contributions can be an excellent way to build confidence and gain experience in the markets. Starting with smaller, regular investments allows you to become familiar with the process and observe how your portfolio performs over time without committing a large sum upfront.

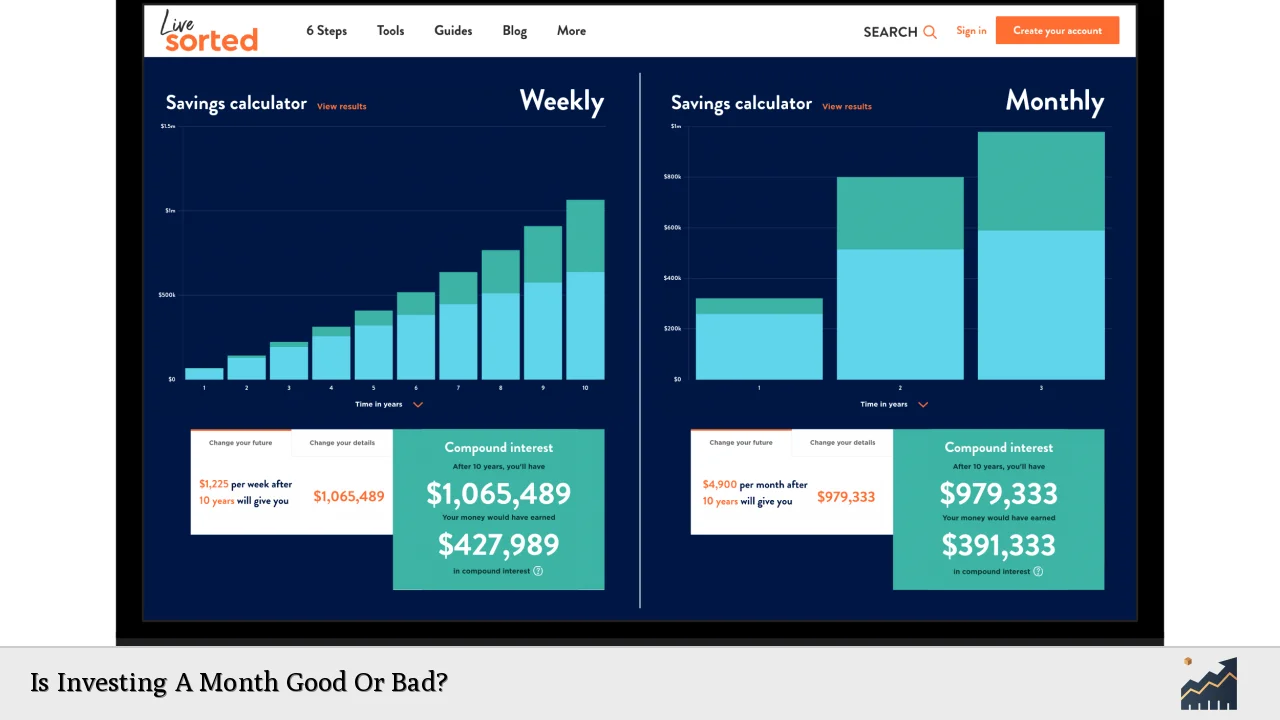

Another significant benefit is the potential for compound growth. By consistently investing month after month, you allow your returns to compound over time. This can lead to substantial growth in your portfolio, especially over longer investment horizons. The power of compounding becomes even more pronounced when you reinvest any dividends or interest earned.

Monthly investing also provides flexibility in adjusting your investment strategy. If your financial situation changes, you can easily increase or decrease your monthly contribution without significantly impacting your overall investment plan. This adaptability is particularly valuable for those with fluctuating incomes or changing financial goals.

Potential Drawbacks of Monthly Investing

While monthly investing offers numerous benefits, it’s important to consider potential drawbacks as well. One notable concern is the possibility of missing out on lump sum growth. In consistently rising markets, investing a large sum at once could potentially yield higher returns than spreading investments over time. However, predicting market movements is notoriously difficult, and the risk of poor timing with a lump sum investment remains.

Another consideration is the impact of transaction costs. Depending on your investment platform, making monthly investments may incur more frequent transaction fees compared to less frequent, larger investments. These costs can add up over time and potentially eat into your returns. It’s crucial to choose an investment platform that offers low or no transaction fees for regular investments to mitigate this issue.

Monthly investing requires a consistent cash flow to maintain the investment schedule. This can be challenging for individuals with irregular incomes or fluctuating expenses. Missing contributions or having to reduce them frequently can disrupt the benefits of dollar-cost averaging and potentially impact long-term performance.

In some cases, monthly investing may lead to analysis paralysis. The regular nature of the investments might cause some investors to become overly focused on short-term market movements or constantly second-guess their investment choices. It’s important to maintain a long-term perspective and avoid making frequent changes to your investment strategy based on short-term market fluctuations.

Strategies for Effective Monthly Investing

To maximize the benefits of monthly investing, it’s essential to implement effective strategies. First and foremost, automate your investments whenever possible. Set up automatic transfers from your bank account to your investment account on a specific date each month. This ensures consistency and removes the temptation to skip contributions or time the market.

Diversification remains crucial in monthly investing. Spread your investments across different asset classes, sectors, and geographic regions to reduce risk. Consider using low-cost index funds or exchange-traded funds (ETFs) that offer broad market exposure. This approach helps to mitigate the impact of poor performance in any single investment.

When choosing investments for your monthly contributions, pay attention to fees and expenses. Look for funds with low expense ratios and avoid those with high front-end loads or redemption fees. Over time, even small differences in fees can significantly impact your overall returns.

It’s important to regularly review and rebalance your portfolio. While monthly investing helps to maintain a consistent approach, your asset allocation may drift over time due to market performance. Set a schedule to review your portfolio annually or semi-annually and make adjustments as needed to maintain your desired asset allocation.

Consider increasing your contributions over time as your income grows. Many successful investors follow the principle of “paying yourself first” by allocating a percentage of their income to investments before other expenses. As your earnings increase, try to increase your monthly investment amount proportionally.

Long-Term Perspective on Monthly Investing

When evaluating the effectiveness of monthly investing, it’s crucial to maintain a long-term perspective. The true benefits of this strategy often become apparent over extended periods, typically five years or more. Short-term market fluctuations may cause temporary underperformance, but the consistent approach of monthly investing can lead to significant wealth accumulation over time.

Research has shown that time in the market is generally more important than timing the market. By committing to regular monthly investments, you ensure that your money is consistently working for you, regardless of short-term market conditions. This approach aligns well with the historical upward trend of markets over long periods.

It’s important to stay committed to your investment plan, even during market downturns. In fact, periods of market decline can present opportunities to acquire more shares at lower prices, potentially enhancing long-term returns. Resist the urge to halt or reduce your monthly investments based on short-term market movements.

Consider complementing your monthly investing strategy with occasional lump sum investments when possible. For example, if you receive a bonus or windfall, you might choose to invest a portion as a lump sum while maintaining your regular monthly contributions. This hybrid approach can combine the benefits of dollar-cost averaging with the potential for enhanced returns from timely lump sum investments.

Remember that monthly investing is just one component of a comprehensive financial plan. Ensure that you have an emergency fund in place and address any high-interest debt before committing to a monthly investment strategy. Additionally, consider your overall financial goals, risk tolerance, and time horizon when determining the appropriate amount and allocation for your monthly investments.

FAQs About Is Investing A Month Good Or Bad?

- How much should I invest monthly?

The amount depends on your financial situation, but aim for at least 10-15% of your income. - Can I skip monthly investments if finances are tight?

It’s best to maintain consistency, but adjust the amount if necessary rather than skipping entirely. - Is monthly investing better than lump sum investing?

Both have merits; monthly investing reduces timing risk, while lump sum can potentially yield higher returns. - How long should I commit to monthly investing?

Aim for a long-term approach, ideally 5-10 years or more, to see significant benefits. - Can I combine monthly investing with other strategies?

Yes, you can complement monthly investing with occasional lump sum investments or other approaches.