Indexed Universal Life (IUL) insurance is a complex financial product that combines life insurance coverage with an investment component tied to stock market indexes. As a potential investment vehicle, IUL offers unique features that can be attractive to certain individuals, but it also comes with significant considerations and potential drawbacks. Understanding the pros and cons of IUL is crucial for determining whether it’s a suitable investment for your financial goals.

IUL policies provide a death benefit to beneficiaries and accumulate cash value over time. The cash value growth is linked to the performance of a stock market index, such as the S&P 500, but with certain protections against market downturns. This structure aims to offer policyholders the potential for higher returns compared to traditional universal life insurance while providing a safety net against losses.

| IUL Feature | Description |

|---|---|

| Death Benefit | Provides financial protection for beneficiaries |

| Cash Value Growth | Linked to stock market index performance |

| Downside Protection | Typically includes a 0% or 1% floor on returns |

| Upside Potential | Returns capped at a certain percentage |

Advantages of Indexed Universal Life Insurance

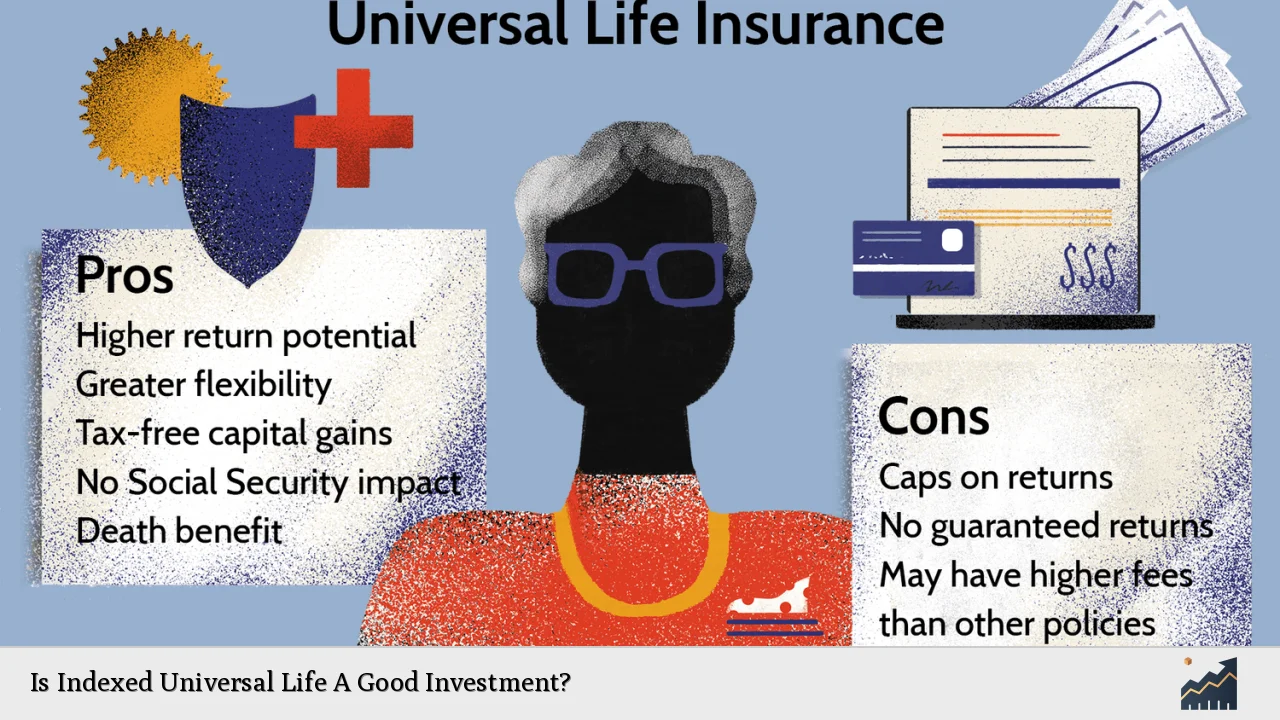

One of the primary benefits of IUL is the potential for higher returns compared to other types of permanent life insurance. Unlike whole life or traditional universal life policies that offer fixed interest rates, IUL policies can capitalize on stock market gains while providing a buffer against losses. This feature makes IUL attractive to individuals seeking growth potential with some level of protection.

Another significant advantage is the tax-deferred growth of the cash value component. As the policy’s cash value increases, policyholders don’t pay taxes on the gains unless they withdraw funds exceeding their basis (the amount paid into the policy). This tax treatment can be particularly beneficial for high-income earners looking for tax-advantaged investment options.

IUL policies also offer flexibility in premium payments and death benefits. Policyholders can adjust their premium payments within certain limits, allowing for adaptability to changing financial circumstances. Additionally, the death benefit can often be increased or decreased, providing customization options as needs evolve over time.

For those concerned about market volatility, IUL provides a level of reassurance. The policy’s cash value is protected from market downturns by a guaranteed minimum interest rate, typically 0% or 1%. This floor ensures that even in years when the market performs poorly, the policyholder’s cash value won’t decrease due to negative returns.

Disadvantages and Considerations

Despite its potential benefits, IUL comes with several important considerations. One of the most significant drawbacks is the complexity of these policies. Understanding how premiums, fees, and returns interact can be challenging, making it difficult for policyholders to fully grasp the long-term implications of their investment.

IUL policies often come with high fees and expenses, including mortality and expense charges, administrative fees, and costs for additional riders. These fees can significantly impact the policy’s cash value growth, especially in the early years when the cash value is still building.

While IUL offers upside potential, it’s important to note that returns are typically capped. Insurance companies set a maximum rate of return, often between 10% and 12%, limiting the policyholder’s participation in strong market years. This cap can result in underperformance compared to direct stock market investments during bull markets.

Another consideration is the lack of guarantees on premium amounts or market returns. Poor market performance over extended periods could necessitate higher premium payments to keep the policy in force. This uncertainty can make long-term financial planning challenging.

Suitability for Different Investors

IUL may be suitable for certain types of investors, particularly those with specific financial goals and risk tolerances. High-income earners looking for tax-advantaged investment options might find IUL attractive due to its tax-deferred growth potential and the ability to access cash value through policy loans.

Individuals seeking a balance between growth potential and downside protection may also be drawn to IUL. The policy’s structure allows for participation in market gains while providing a safety net against losses, which can be appealing to conservative investors who want some exposure to market returns.

IUL can also be a useful tool for estate planning. The death benefit can provide liquidity to cover estate taxes or equalize inheritances among heirs. Additionally, the potential for cash value growth can offer a source of supplemental retirement income through policy loans or withdrawals.

However, IUL may not be appropriate for everyone. Young individuals with limited income might be better served by term life insurance, which offers higher coverage amounts at lower premiums. Similarly, those seeking guaranteed returns or who are uncomfortable with market-linked products might prefer whole life insurance or other fixed-income investments.

Evaluating IUL as an Investment

When considering IUL as an investment, it’s crucial to conduct a thorough analysis of your financial situation, goals, and risk tolerance. Here are some key factors to consider:

- Long-term commitment: IUL policies are designed to be held for many years, often decades. Evaluate whether you can commit to the long-term nature of this investment.

- Cash flow: Assess your ability to consistently pay premiums, especially if market performance is poor and additional payments are required to keep the policy in force.

- Risk tolerance: While IUL offers downside protection, it still involves market risk. Determine if you’re comfortable with the potential volatility in returns.

- Fees and expenses: Carefully review all costs associated with the policy, including surrender charges, which can be significant in the early years.

- Policy illustrations: Examine multiple scenarios, including those with poor market performance, to understand potential outcomes.

- Alternative investments: Compare IUL with other investment options, such as 401(k)s, IRAs, or direct market investments, to ensure it aligns with your overall financial strategy.

Conclusion

Indexed Universal Life insurance can be a good investment for certain individuals, particularly those seeking a combination of life insurance coverage, tax-advantaged growth potential, and downside protection. However, it’s not a one-size-fits-all solution. The complexity, high fees, and potential for underperformance in strong markets make it crucial to carefully evaluate whether IUL aligns with your financial goals and risk tolerance.

Before investing in an IUL policy, consult with a qualified financial advisor who can provide personalized guidance based on your specific situation. They can help you navigate the complexities of IUL and determine if it’s an appropriate addition to your investment portfolio. Remember that IUL should be considered as part of a comprehensive financial plan, not as a standalone investment strategy.

FAQs About Indexed Universal Life Insurance

- How does Indexed Universal Life insurance differ from other types of life insurance?

IUL combines life insurance with cash value growth linked to stock market indexes, offering potential for higher returns with downside protection. - Can I lose money in an Indexed Universal Life policy?

While the cash value is protected from market losses, high fees and poor long-term performance can result in lower-than-expected returns. - Are there tax benefits to Indexed Universal Life insurance?

Yes, IUL offers tax-deferred growth and potentially tax-free access to cash value through policy loans. - How flexible are premium payments in an IUL policy?

IUL typically allows for flexible premium payments within certain limits, but consistent funding is important for policy performance. - What happens if I can’t pay the premiums on my IUL policy?

Missed premiums can result in reduced coverage or policy lapse, depending on the cash value and policy terms.