Innovative Industrial Properties (NYSE: IIPR) has emerged as a unique player in the real estate investment trust (REIT) sector, specializing in properties leased to state-licensed cannabis operators. As the cannabis industry continues to evolve, investors are increasingly curious about IIPR’s potential as a long-term investment. This comprehensive analysis will delve into the company’s business model, financial performance, market position, and future prospects to determine whether IIPR represents a sound long-term investment opportunity.

| Key Concept | Description/Impact |

|---|---|

| Business Model | REIT focused on acquiring and leasing properties to state-licensed cannabis operators |

| Dividend Yield | Approximately 6.9% as of December 2024 |

| Portfolio | 108 properties across 19 states, with 9.0 million rentable square feet (RSF) |

| Occupancy Rate | 95.7% as of Q3 2024 |

| Average Lease Term | 14.4 years |

Market Analysis and Trends

The cannabis industry in the United States is experiencing significant growth and transformation. As more states legalize cannabis for medical and recreational use, the demand for specialized real estate to support cultivation, processing, and distribution continues to rise. IIPR has positioned itself as a leader in this niche market, capitalizing on the unique real estate needs of the cannabis sector.

The legal cannabis market is projected to grow at a compound annual growth rate (CAGR) of 9% through 2028, according to industry analysts. This growth trajectory presents substantial opportunities for IIPR to expand its portfolio and increase its revenue streams. However, it’s crucial to consider the potential challenges, including regulatory uncertainties and the possibility of federal legalization, which could impact the company’s business model.

IIPR’s market position is strengthened by its first-mover advantage and its status as the only NYSE-listed cannabis-focused REIT. This unique position has allowed the company to build strong relationships with multi-state operators (MSOs) and publicly traded cannabis companies, which account for 91% of its tenant base. These established partnerships provide a level of stability and predictability to IIPR’s revenue streams.

Implementation Strategies

IIPR’s success as a long-term investment hinges on its ability to execute several key strategies:

- Portfolio Expansion: The company continues to acquire and develop properties in states with favorable cannabis regulations. Recent acquisitions, such as the 23,000 square foot industrial property in Maryland, demonstrate IIPR’s commitment to growth.

- Tenant Diversification: While focusing on strong partnerships with MSOs, IIPR also seeks to diversify its tenant base to mitigate risks associated with individual operator performance.

- Capital Management: IIPR maintains a conservative balance sheet with a debt-to-total gross assets ratio of 11%. This prudent approach to leverage provides financial flexibility and stability.

- Dividend Growth: The company has consistently increased its dividend since 2016, with a current annualized dividend of $7.60 per share. This track record of dividend growth is attractive to income-focused investors.

- Adaptive Leasing Strategies: IIPR has demonstrated flexibility in working with tenants facing challenges, including the application of security deposits to cover rent payments when necessary.

Risk Considerations

Investing in IIPR comes with several risks that potential investors should carefully evaluate:

- Regulatory Uncertainty: The cannabis industry remains federally illegal in the United States. Changes in federal policy could significantly impact IIPR’s business model and tenant operations.

- Tenant Credit Risk: As a specialized REIT, IIPR is exposed to the financial health of its tenants. Any major tenant defaults could adversely affect the company’s revenue and dividend payments.

- Interest Rate Sensitivity: Like all REITs, IIPR is sensitive to interest rate fluctuations, which can impact borrowing costs and property valuations.

- Market Saturation: As the legal cannabis market matures, there’s a risk of oversupply, which could pressure IIPR’s tenants and potentially lead to lower rental rates or occupancy.

- Banking Legislation: The passage of the SAFE Banking Act or similar legislation could provide cannabis operators with more traditional financing options, potentially reducing demand for IIPR’s sale-leaseback arrangements.

Regulatory Aspects

The regulatory landscape for cannabis in the United States is complex and evolving. While IIPR benefits from the current federal prohibition that limits financing options for cannabis operators, any changes to federal law could have profound implications for the company’s business model.

Key regulatory considerations include:

- State-level legalization trends

- Federal rescheduling of cannabis

- Banking regulations affecting the cannabis industry

- Tax implications for cannabis-related businesses

IIPR must navigate these regulatory waters carefully, adapting its strategies to comply with both state and federal laws while positioning itself for various potential outcomes.

Future Outlook

The long-term prospects for IIPR as an investment are closely tied to the future of the cannabis industry in the United States. Several factors support a positive outlook:

- Continued state-level legalization momentum

- Growing public acceptance of cannabis

- Increasing market size and demand for cannabis products

- IIPR’s established relationships with leading MSOs

However, investors should also consider potential headwinds:

- Federal legalization could introduce new competition from traditional REITs and financial institutions

- Industry consolidation may lead to fewer, larger tenants, potentially increasing concentration risk

- Evolving consumer preferences and market dynamics in the cannabis sector

IIPR’s management has expressed confidence in the company’s ability to navigate these challenges, citing their strong capital position, high-quality tenant base, and strategic investment approach.

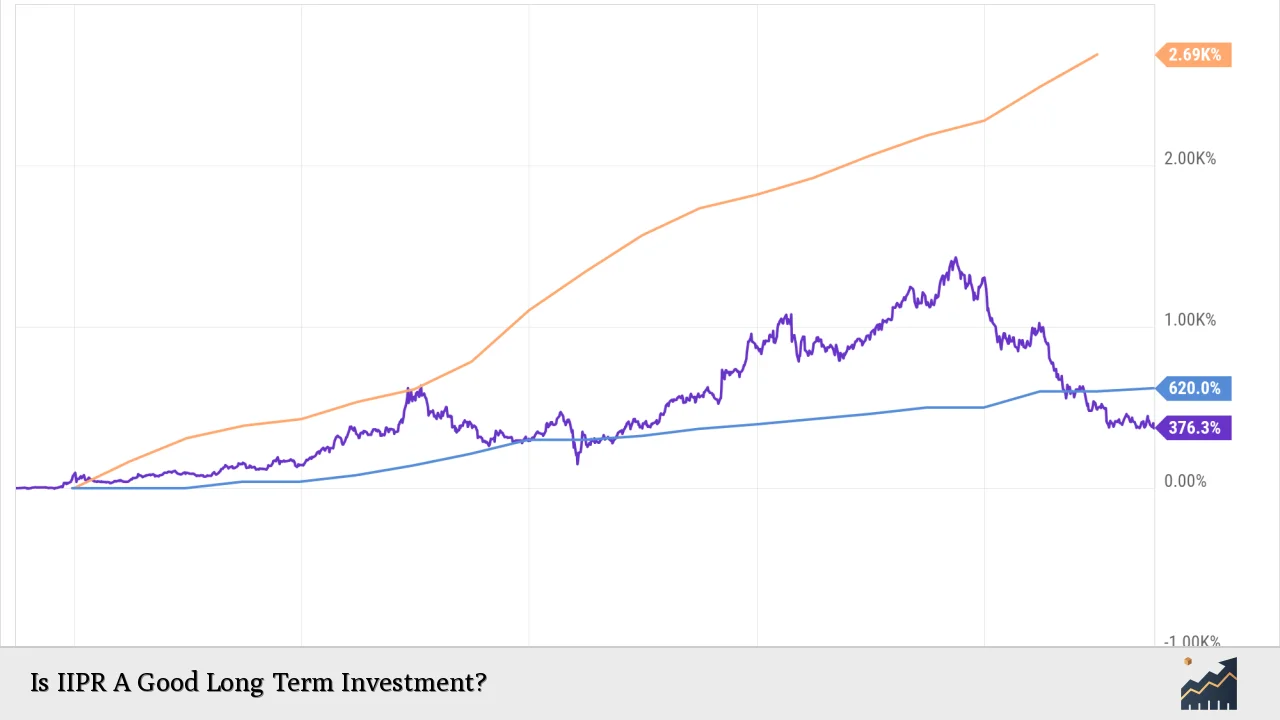

In conclusion, IIPR presents a unique investment opportunity in the growing cannabis real estate sector. Its strong financial performance, consistent dividend growth, and strategic positioning make it an attractive option for investors seeking exposure to the cannabis industry through a more traditional REIT structure. However, the regulatory risks and industry-specific challenges require careful consideration.

For long-term investors with a higher risk tolerance and a belief in the continued growth of the legal cannabis market, IIPR could be a compelling addition to a diversified portfolio. As with any investment, thorough due diligence and ongoing monitoring of industry trends and regulatory developments are essential.

Frequently Asked Questions About Is IIPR A Good Long Term Investment?

- What makes IIPR different from other REITs?

IIPR is unique as it focuses exclusively on properties leased to state-licensed cannabis operators, making it the first and only NYSE-listed cannabis-focused REIT. - How does federal legalization of cannabis potentially affect IIPR?

Federal legalization could introduce new competition and financing options for cannabis operators, potentially impacting IIPR’s business model. However, it could also open up new opportunities for expansion and partnerships. - What is IIPR’s dividend history?

IIPR has consistently increased its dividend since 2016, with a current annualized dividend of $7.60 per share and a yield of approximately 6.9% as of December 2024. - How diversified is IIPR’s tenant base?

91% of IIPR’s properties are leased to multi-state operators and publicly traded cannabis companies, providing a level of stability. However, this concentration also presents potential risks if major tenants face financial difficulties. - What are the main risks associated with investing in IIPR?

Key risks include regulatory uncertainty, tenant credit risk, interest rate sensitivity, potential market saturation in the cannabis industry, and the impact of potential banking legislation changes. - How has IIPR performed financially in recent quarters?

In Q3 2024, IIPR reported total revenues of $76.5 million and an AFFO of $64.3 million. The company maintains a strong balance sheet with a conservative debt-to-total gross assets ratio of 11%. - What is the average lease term for IIPR’s properties?

IIPR’s portfolio has a weighted average remaining lease term of 14.4 years, which provides long-term revenue visibility and stability.