Health Savings Accounts (HSAs) have gained popularity as a versatile financial tool, especially for those enrolled in high-deductible health plans (HDHPs). These accounts not only help individuals save for medical expenses but also offer significant tax advantages, making them an attractive option for long-term investment. Understanding the benefits, limitations, and strategies associated with HSAs can help individuals determine if investing in an HSA aligns with their financial goals.

| Feature | Description |

|---|---|

| Tax Benefits | Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. |

| Investment Options | Funds can be invested in various financial instruments once a minimum balance is met. |

Understanding Health Savings Accounts (HSAs)

Health Savings Accounts are designed for individuals with HDHPs, allowing them to save money specifically for medical expenses. Contributions to an HSA are made pre-tax, reducing taxable income. The funds in the account can be used for qualified medical expenses such as deductibles, copayments, and certain premiums. One of the most compelling aspects of HSAs is their triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for medical expenses are also tax-free.

Moreover, HSAs are not subject to the “use-it-or-lose-it” rule that affects Flexible Spending Accounts (FSAs). This means that any unspent money in an HSA rolls over year after year, allowing account holders to accumulate savings over time. Additionally, HSAs are portable; if you change jobs or health plans, your HSA remains yours.

The ability to invest HSA funds adds another layer of appeal. Once a minimum balance is reached—often around $1,000—account holders can invest their funds in various investment vehicles, including stocks and mutual funds. This potential for growth makes HSAs attractive not just for immediate medical expenses but also as a long-term investment strategy.

The Tax Advantages of HSAs

The tax benefits associated with HSAs are significant and can lead to substantial savings over time. Here’s how they work:

- Tax-Deductible Contributions: Contributions made to an HSA reduce your taxable income. For example, if you contribute $3,000 to your HSA in a given year, your taxable income is reduced by that amount.

- Tax-Free Growth: Any interest or investment gains generated within the HSA are not subject to federal income tax. This feature allows your savings to grow without the burden of annual taxes.

- Tax-Free Withdrawals: Withdrawals used for qualified medical expenses are completely tax-free. This means you can use your HSA funds without worrying about additional taxes when paying for healthcare costs.

These advantages make HSAs particularly appealing for those looking to save on taxes while preparing for future healthcare costs. By maximizing contributions and allowing funds to grow over time, individuals can significantly enhance their financial security.

Investment Strategies for HSAs

Investing within an HSA requires careful planning and strategy. Here are some key considerations:

- Determine Your Goals: Before investing HSA funds, it’s essential to define your financial goals. Are you saving primarily for short-term medical needs or looking to grow your savings for future healthcare expenses?

- Understand Investment Options: Many HSA providers offer a range of investment options once a minimum balance is reached. Familiarize yourself with these options and choose investments that align with your risk tolerance and time horizon.

- Maintain Adequate Cash Reserves: It’s crucial to keep enough cash in your HSA to cover immediate medical expenses while allowing excess funds to be invested. This balance ensures you’re prepared for unexpected healthcare costs without having to liquidate investments at an inopportune time.

- Regularly Review Investments: Just like any other investment account, it’s important to regularly review your HSA investments. Market conditions change, and so do personal financial situations; adjusting your investment strategy accordingly is vital.

Investing in an HSA can provide substantial long-term benefits due to its unique tax advantages and flexibility. However, it requires thoughtful planning and regular management.

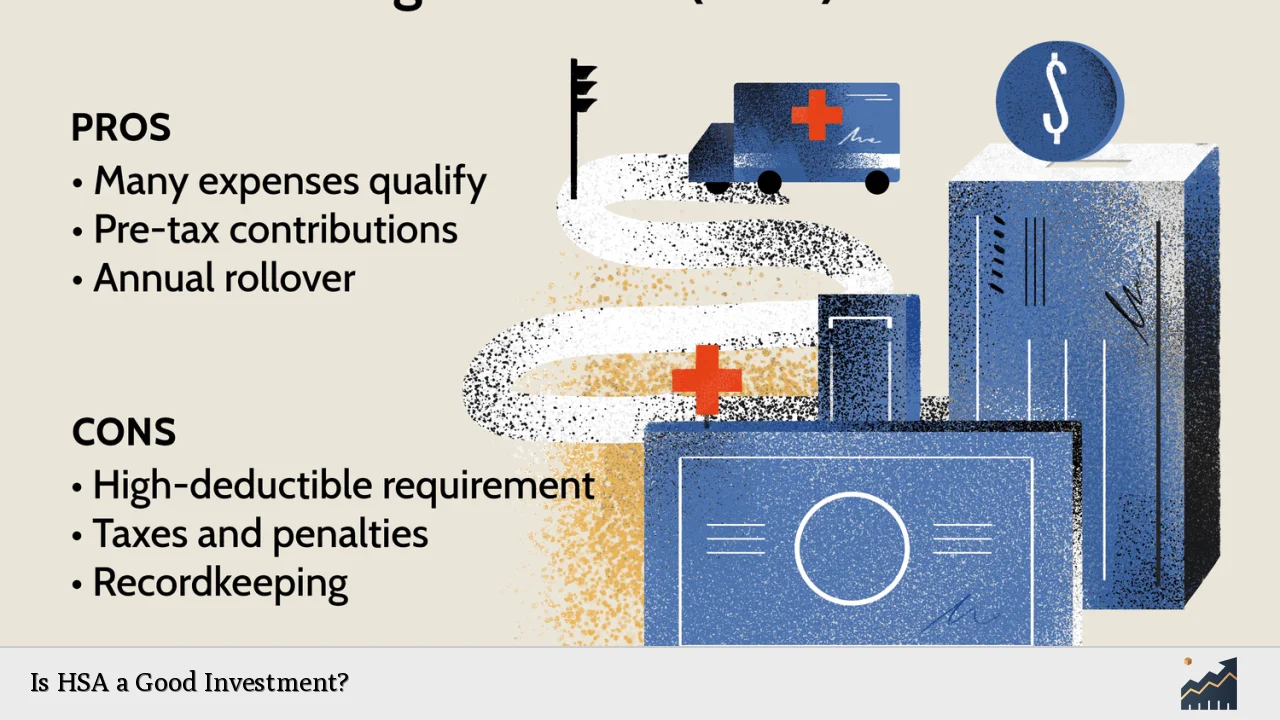

Pros and Cons of Investing in HSAs

Like any investment vehicle, HSAs come with both advantages and disadvantages that individuals should consider before committing their funds.

Pros:

- Tax Advantages: The triple tax benefit makes HSAs one of the most efficient savings tools available.

- Long-Term Growth Potential: Investing HSA funds allows account holders to potentially grow their savings significantly over time.

- Rollover Feature: Unlike FSAs, unspent HSA money rolls over indefinitely.

- Flexibility: Funds can be used for a wide range of qualified medical expenses as well as non-medical expenses after age 65 (subject to income tax).

Cons:

- Investment Risks: Investing carries inherent risks; market fluctuations can lead to losses if investments are not managed wisely.

- Fees: Some HSA providers charge maintenance fees or require minimum balances that can eat into returns.

- Limited Immediate Access: Funds invested may not be readily accessible for immediate medical needs without selling investments.

Understanding these pros and cons is essential for making informed decisions about whether investing in an HSA is suitable for your financial situation.

Comparing HSAs with Other Savings Accounts

When considering whether an HSA is a good investment option, it’s helpful to compare it with other types of savings accounts like IRAs or 401(k)s. Below is a comparison highlighting key differences:

| Account Type | Key Features |

|---|---|

| HSA | Triple tax advantage; funds roll over; no RMDs; used primarily for medical expenses. |

| 401(k) | Tax-deferred growth; employer matching contributions; penalties for early withdrawal. |

| IRA | Tax-deferred growth; contribution limits; penalties for early withdrawal unless exceptions apply. |

This comparison illustrates that while each account type has its unique benefits, HSAs stand out due to their flexibility and favorable tax treatment specifically related to healthcare costs.

FAQs About HSAs

FAQs About Is HSA a Good Investment?

- What is an HSA?

An HSA is a tax-advantaged savings account designed for individuals enrolled in high-deductible health plans. - How does investing in an HSA work?

You can invest funds once you reach a minimum balance; earnings grow tax-free. - What are the contribution limits for HSAs?

The contribution limit for individuals is $4,300 and $8,550 for families in 2025. - Can I use my HSA funds for non-medical expenses?

You can withdraw funds tax-free after age 65 or pay income taxes on non-medical withdrawals before that age. - Are there penalties for withdrawing from my HSA?

Withdrawals used for non-qualified expenses before age 65 incur income taxes plus a 20% penalty.

In conclusion, Health Savings Accounts represent a compelling investment opportunity due to their unique combination of tax advantages and flexibility. By understanding how HSAs function and developing effective investment strategies, individuals can leverage these accounts not only as tools for managing current healthcare costs but also as vehicles for long-term wealth accumulation.