Investing in Hilton Grand Vacations (HGV) presents a unique opportunity within the hospitality and leisure sector, particularly in the timeshare market. As a publicly traded company on the NYSE, HGV has garnered attention due to its strong brand association with Hilton Hotels, strategic acquisitions, and fluctuating stock performance. This analysis will delve into current market trends, financial performance, risk considerations, and future outlook to determine whether HGV is a sound investment choice.

| Key Concept | Description/Impact |

|---|---|

| Revenue Growth | HGV reported a revenue increase of 27.7% year-over-year, reaching $4.24 billion in 2024, indicating strong demand for vacation ownership products. |

| Market Position | With a market cap of approximately $4 billion, HGV is a major player in the timeshare industry, benefiting from its association with Hilton. |

| Profitability Challenges | The company’s profit margin has decreased significantly, from 10% to 2.5%, raising concerns about operational efficiency and cost management. |

| Stock Volatility | The stock has shown considerable volatility, with a high P/E ratio of 42.05 compared to industry averages, suggesting it may be overvalued at current levels. |

| Future Earnings Potential | Analysts forecast revenue growth of approximately 13% annually over the next three years, indicating potential for recovery and profitability improvements. |

Market Analysis and Trends

The timeshare market has experienced significant shifts due to changing consumer preferences and economic conditions. Following the pandemic, there has been a resurgence in travel demand, which has positively impacted Hilton Grand Vacations. The company’s recent financial results reflect this trend:

- Revenue Performance: In Q3 2024, HGV reported total revenues of $1.306 billion, up from $1.018 billion in Q3 2023. This growth is attributed to increased contract sales and member engagement.

- Member Growth: HGV’s member count reached 722,000, with a net owner growth rate of 1.2%. This expansion is crucial as it drives future revenue through recurring sales and services.

- Market Position: HGV’s strategic acquisitions of Bluegreen Vacations and Diamond Resorts have broadened its portfolio and geographic reach, positioning it well against competitors.

Implementation Strategies

For individual investors considering HGV as an investment opportunity, understanding the company’s strategies for growth is essential:

- Diversification through Acquisitions: HGV’s recent acquisitions have diversified its offerings and customer base. This strategy not only mitigates risks associated with reliance on single markets but also enhances revenue potential through cross-selling opportunities.

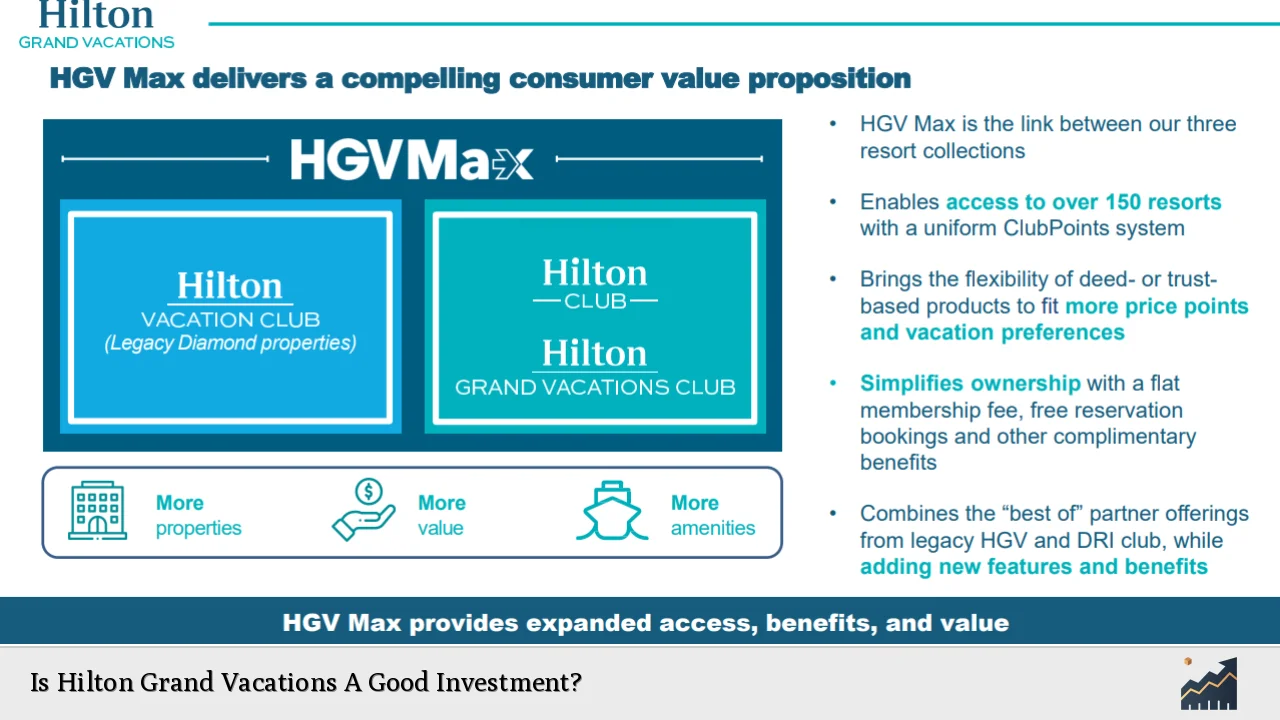

- Enhancing Customer Experience: The introduction of programs like HGV Max aims to improve customer satisfaction by offering greater flexibility in booking and utilizing points across various properties.

- Operational Efficiency: The company is focusing on streamlining operations post-acquisition to reduce costs and improve profit margins. Investors should monitor these efforts closely as they could significantly impact future profitability.

Risk Considerations

Investing in Hilton Grand Vacations comes with inherent risks that potential investors must evaluate:

- Profitability Concerns: The company’s profit margin has seen a sharp decline from previous years. Investors should be cautious about ongoing operational costs and their impact on net income.

- Market Volatility: HGV’s stock has been volatile, reflecting broader market trends and investor sentiment towards the hospitality sector. Its high beta indicates sensitivity to market fluctuations.

- Regulatory Risks: As a timeshare operator, HGV operates under various regulatory frameworks that could impact its business model and profitability.

Regulatory Aspects

Hilton Grand Vacations operates within a heavily regulated environment that affects its business practices:

- SEC Regulations: As a publicly traded company, HGV must comply with SEC reporting requirements which provide transparency regarding its financial health and operational strategies.

- Consumer Protection Laws: The timeshare industry is subject to strict consumer protection laws designed to prevent misleading sales practices. Compliance with these regulations is crucial for maintaining brand reputation.

Future Outlook

Looking ahead, several factors will influence Hilton Grand Vacations’ investment potential:

- Growth Projections: Analysts project an average annual revenue growth of 13% over the next three years for HGV, which is promising compared to the broader hospitality industry forecast of 9.7%.

- Strategic Initiatives: Continued focus on integrating recent acquisitions and enhancing customer engagement through innovative programs will be key drivers for future success.

- Market Conditions: The overall economic environment will play a significant role in consumer spending on travel and leisure activities. Economic recovery post-pandemic could further bolster demand for timeshare products.

Frequently Asked Questions About Is Hilton Grand Vacations A Good Investment?

- What are the main financial metrics for Hilton Grand Vacations?

The company reported revenues of $4.24 billion in 2024 with a profit margin of only 2.5%, indicating challenges in profitability despite strong sales growth. - How does HGV’s stock perform compared to competitors?

HGV’s stock has shown volatility with a P/E ratio significantly higher than industry averages, suggesting it may be overvalued at current prices. - What are the risks associated with investing in HGV?

The main risks include declining profit margins, stock volatility, regulatory compliance issues, and sensitivity to economic conditions. - What strategies is HGV implementing for growth?

HGV focuses on diversifying through acquisitions, enhancing customer experience with new programs like HGV Max, and improving operational efficiency. - Is now a good time to invest in HGV?

This depends on individual risk tolerance; while there are growth prospects, the current stock valuation may not offer an attractive entry point. - How does Hilton’s brand reputation affect HGV?

The strong brand association with Hilton enhances customer trust and loyalty but can also lead to heightened scrutiny regarding service quality. - What should investors watch for in HGV’s future reports?

Investors should monitor profitability trends, integration success from acquisitions, and overall market conditions affecting consumer travel behavior. - Can I expect dividends from investing in HGV?

Currently, HGV does not have a consistent dividend policy; investors should focus more on capital appreciation potential.

In conclusion, while Hilton Grand Vacations presents opportunities for growth within the timeshare market due to its strategic initiatives and strong brand affiliation with Hilton Hotels, potential investors should carefully weigh these prospects against the company’s current financial challenges and market volatility. Conducting thorough research and considering personal investment goals will be essential before making any decisions regarding this stock.