The Gabelli Utility Trust (NYSE: GUT) is a closed-end fund that primarily invests in utility companies, aiming for long-term capital growth and income. As of December 2024, the trust has garnered attention due to its substantial monthly dividend distributions and its unique position in the market. However, potential investors must consider various factors, including its performance metrics, market trends, and risks associated with investing in this fund.

| Key Concept | Description/Impact |

|---|---|

| Net Asset Value (NAV) | The NAV of Gabelli Utility Trust is approximately $3.22, with shares trading at an 87% premium to this value, raising concerns about overvaluation. |

| Dividend Yield | The fund offers a high dividend yield of about 11.38%, but 96% of distributions are classified as return of capital, which may affect long-term investment returns. |

| Performance Comparison | Over the past year, the Gabelli Utility Trust has underperformed compared to the Vanguard Utilities Index Fund ETF Shares (VPU), which raises questions about its competitiveness. |

| Market Trends | The utility sector is experiencing shifts due to rising interest rates and inflation pressures, impacting operational costs and investment strategies. |

| Investment Strategy | The trust employs a research-driven approach focusing on companies involved in electricity, gas, water, and telecommunications services. |

Market Analysis and Trends

The current landscape for utility investments is influenced by several key factors:

- Interest Rates: With rising interest rates, utility companies face increased borrowing costs. This can lead to reduced profitability and impact dividend sustainability.

- Inflation: Inflationary pressures have raised operational costs for utility providers. Companies are likely to pass these costs onto consumers, which could affect demand.

- Regulatory Environment: The utility sector is heavily regulated. Changes in regulations can significantly impact profitability and operational flexibility.

- Technological Advancements: The shift towards renewable energy sources and smart grid technologies presents both opportunities and challenges for traditional utility companies.

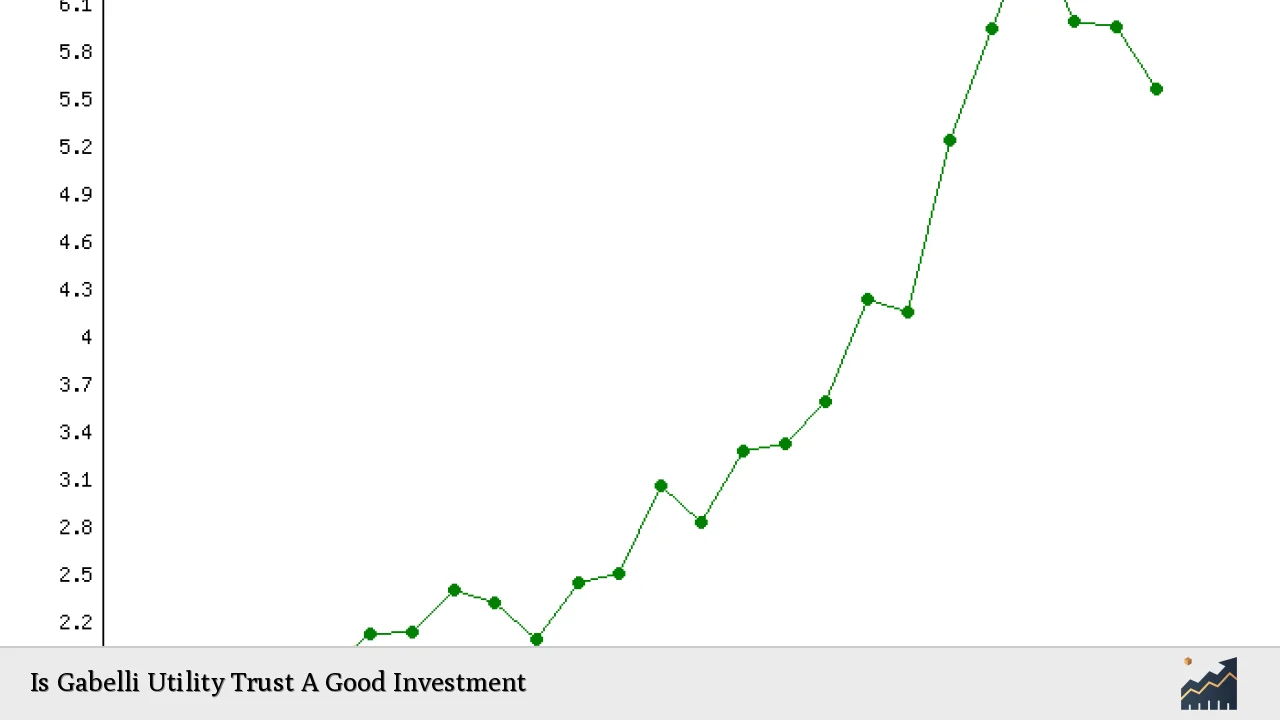

Recent performance data indicates that the Gabelli Utility Trust has experienced fluctuations in its share price. As of December 2024, shares were trading around $5.41, reflecting a modest decline from earlier highs but still maintaining a significant premium over NAV.

Implementation Strategies

Investors considering the Gabelli Utility Trust should adopt specific strategies:

- Diversification: Given the trust’s focus on utilities, investors should diversify their portfolios with other asset classes to mitigate sector-specific risks.

- Monitoring NAV Trends: Keep an eye on NAV trends relative to market price. A persistent premium may indicate overvaluation.

- Dividend Reinvestment: Consider reinvesting dividends to capitalize on compound growth over time, especially given the high yield.

- Long-Term Perspective: Focus on long-term growth rather than short-term price fluctuations. The trust’s historical performance shows resilience over longer periods despite recent challenges.

Risk Considerations

Investing in the Gabelli Utility Trust involves several risks:

- High Premium to NAV: The current premium of 87% raises concerns about potential corrections in share price if market sentiment shifts.

- Dependence on Distributions: With 96% of distributions classified as return of capital, investors should be cautious about relying solely on dividends for income.

- Market Volatility: The utility sector can be affected by broader market volatility, particularly during economic downturns or changes in fiscal policy.

- Interest Rate Sensitivity: As interest rates rise, utilities may face pressure on their margins, impacting overall performance.

Regulatory Aspects

The Gabelli Utility Trust operates under strict regulatory oversight typical for closed-end funds:

- SEC Regulations: Compliance with SEC regulations ensures transparency and protects investor interests. Investors should review periodic filings for insights into fund performance and management practices.

- Distribution Policies: The trust’s distribution policies are subject to change based on market conditions and regulatory requirements. Investors should stay informed about any announcements regarding distribution changes.

Future Outlook

Looking ahead, the Gabelli Utility Trust faces both challenges and opportunities:

- Sustainable Growth: The shift towards renewable energy sources could provide growth opportunities for utilities adapting to new technologies and consumer preferences.

- Market Adjustments: As interest rates stabilize or decline in the future, there may be renewed interest in utility stocks as safe-haven investments.

- Strategic Partnerships: Continued exploration of strategic partnerships and investments in emerging markets could enhance portfolio diversification and growth potential.

Overall, while the Gabelli Utility Trust presents an attractive yield opportunity through its monthly distributions, potential investors must weigh these benefits against the risks associated with high valuations and market volatility.

Frequently Asked Questions About Is Gabelli Utility Trust A Good Investment

- What is the current yield of Gabelli Utility Trust?

The current yield is approximately 11.38%, but it’s essential to note that a significant portion comes from return of capital. - How does Gabelli Utility Trust compare to other utility funds?

It has underperformed compared to benchmarks like the Vanguard Utilities Index Fund ETF Shares (VPU), which raises concerns about its competitiveness. - What are the primary sectors invested in by Gabelli Utility Trust?

The trust primarily invests in companies involved in electricity, gas, water services, and telecommunications. - Is it safe to invest in Gabelli Utility Trust given its high premium?

While it offers high dividends, the significant premium over NAV suggests caution due to potential overvaluation risks. - What should investors consider when investing in Gabelli Utility Trust?

Investors should consider diversification strategies, monitor NAV trends closely, and maintain a long-term investment perspective. - How often does Gabelli Utility Trust pay dividends?

The trust pays monthly dividends consistently since October 1999. - What impact do rising interest rates have on utility investments?

Rising interest rates can increase borrowing costs for utilities and potentially reduce profitability. - Are there any recent strategic initiatives by Gabelli Utility Trust?

The trust has been exploring strategic partnerships and investments in emerging markets as part of its growth strategy.

In conclusion, while the Gabelli Utility Trust offers attractive dividends and a diversified portfolio within the utility sector, potential investors must carefully evaluate its valuation metrics against broader market conditions before making investment decisions.