Fry’s Investment Report, led by seasoned analyst Eric Fry, has garnered attention in the investment community for its promise of delivering high-quality stock recommendations and market insights. However, potential subscribers often wonder about the legitimacy and effectiveness of this investment newsletter. This article delves into the core aspects of Fry’s Investment Report, providing a comprehensive analysis of its offerings, market strategies, risks, and overall credibility.

| Key Concept | Description/Impact |

|---|---|

| Macro Analysis Approach | Fry emphasizes a top-down investment strategy, focusing on macroeconomic trends rather than individual stock metrics. This approach aims to identify sectors with significant growth potential. |

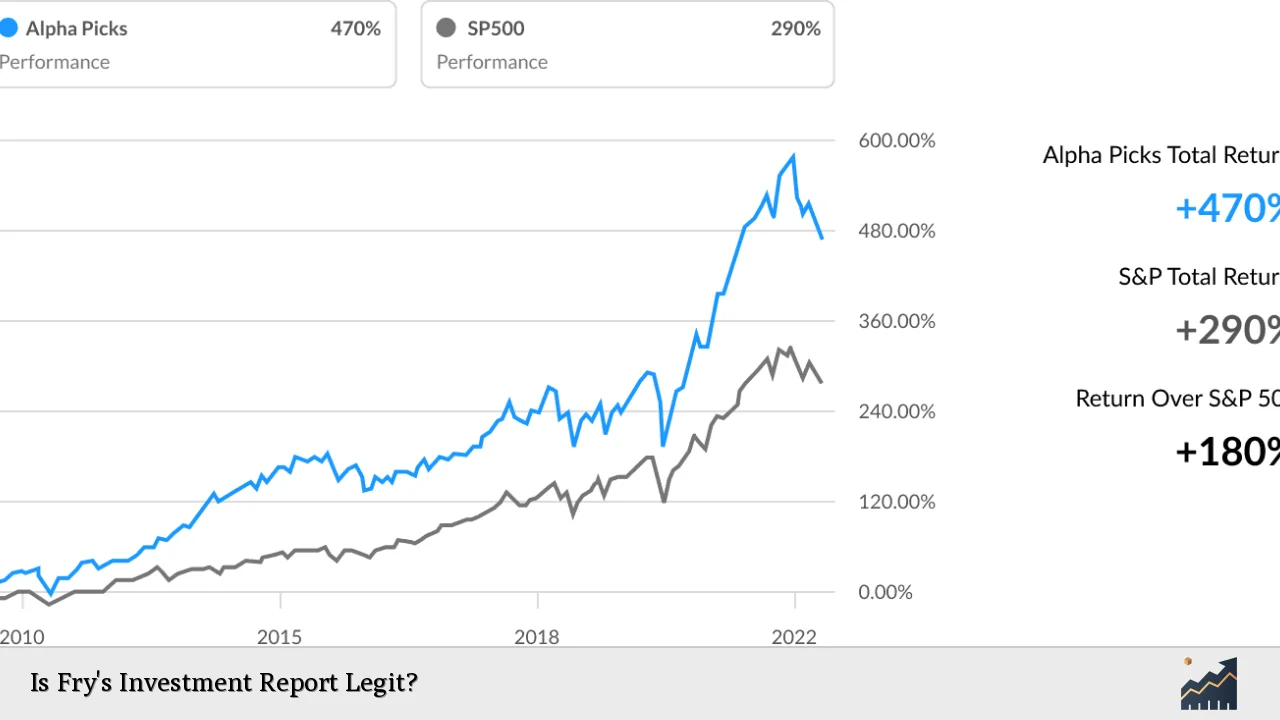

| Stock Recommendations | The report provides monthly stock picks that have historically yielded substantial returns, although past performance does not guarantee future results. |

| Educational Content | Subscribers receive insights into market dynamics and investment strategies, enhancing their financial literacy and decision-making skills. |

| Subscription Cost | The annual subscription fee is relatively low at $49, but there are numerous upsells that can increase overall costs significantly. |

| Market Focus | Fry’s Investment Report targets emerging markets and technology sectors, which can offer high returns but also come with increased risk. |

| Customer Feedback | While many subscribers report satisfaction with the insights provided, some express concerns over aggressive marketing tactics and upselling practices. |

Market Analysis and Trends

In recent years, the investment landscape has evolved significantly due to various global factors. Fry’s Investment Report positions itself within this context by focusing on macroeconomic trends that influence entire sectors. Key trends include:

- Technological Advancements: The rise of artificial intelligence (AI) and renewable energy technologies is reshaping investment opportunities. Fry has been an early proponent of investing in AI-related companies, predicting substantial growth as these technologies mature.

- Emerging Markets: With a focus on international equities, Fry identifies opportunities in markets that are often overlooked by mainstream investors. This includes sectors in Asia and Eastern Europe that are poised for growth as global trade dynamics shift.

- Sustainable Investing: There is a growing trend towards sustainable and socially responsible investing. Fry’s recommendations often align with these values, tapping into companies that prioritize environmental sustainability.

- Market Volatility: The current economic climate is characterized by uncertainty due to geopolitical tensions and inflationary pressures. Fry’s macroeconomic analysis helps investors navigate these turbulent waters by identifying resilient sectors.

Implementation Strategies

Investing based on Fry’s insights involves several strategic considerations:

- Diversification: Subscribers are encouraged to diversify their portfolios across different sectors and geographies to mitigate risks associated with market volatility.

- Long-Term Perspective: Fry advocates for a long-term investment horizon, suggesting that investors should be patient as they wait for their investments to mature.

- Regular Updates: The report provides frequent updates on market conditions and portfolio recommendations, allowing investors to adjust their strategies as needed.

- Risk Management: Understanding the inherent risks in recommended stocks is crucial. Investors should assess their risk tolerance before diving into high-volatility investments.

Risk Considerations

While Fry’s Investment Report offers valuable insights, potential investors must be aware of several risks:

- Market Dependency: The success of recommended stocks can be heavily influenced by broader market conditions. Poor economic performance can lead to losses even for well-researched picks.

- Performance Variability: Not all stock recommendations will yield positive results. Historical successes do not guarantee future gains; thus, investors should be prepared for fluctuations in performance.

- Upselling Practices: Some users have reported aggressive marketing tactics aimed at upselling additional services or products. This can lead to unexpected costs beyond the initial subscription fee.

- High-Risk Investments: Many of the stocks recommended by Fry are in emerging markets or innovative sectors, which can carry higher risks compared to established companies.

Regulatory Aspects

Fry’s Investment Report operates under the regulatory framework set by financial authorities such as the SEC (Securities and Exchange Commission). While it provides investment advice, it is essential for subscribers to understand that:

- No Guarantees: The report does not guarantee returns. All investments carry risk, and past performance is not indicative of future results.

- Due Diligence Required: Investors should conduct their own research or consult with financial advisors before making significant investment decisions based on newsletter recommendations.

Future Outlook

The future of Fry’s Investment Report appears promising if it continues to adapt to changing market conditions. Key factors influencing its trajectory include:

- Technological Integration: As technology continues to evolve, incorporating data analytics and AI into investment strategies could enhance decision-making processes.

- Global Economic Recovery: A rebound in global economic activity could present new opportunities for growth in various sectors highlighted by Fry.

- Investor Education Demand: With increasing interest in personal finance and investing among retail investors, educational content provided by reports like Fry’s could become even more valuable.

Frequently Asked Questions About Is Fry’s Investment Report Legit?

- What is Fry’s Investment Report?

Fry’s Investment Report is an investment newsletter authored by Eric Fry that focuses on macroeconomic trends and provides stock recommendations primarily in technology and emerging markets. - Is Eric Fry a credible analyst?

Yes, Eric Fry has a solid track record in investment analysis with significant experience in identifying market trends before they become mainstream. - What is the cost of subscribing?

The annual subscription fee is $49; however, there are additional upsells that may increase overall costs. - What types of investments does the report focus on?

The report primarily focuses on technology stocks and emerging markets but also covers various other sectors. - Are there any risks associated with following this report?

Yes, investments based on the report can be risky due to market volatility and the nature of recommended stocks. - Can I get a refund if I’m not satisfied?

The subscription typically comes with a money-back guarantee within a specified period if you are not satisfied with the service. - How often are stock recommendations updated?

Subscribers receive monthly updates along with special reports detailing crucial market developments. - Is this report suitable for beginners?

The report contains educational content that can benefit beginners; however, new investors should be cautious due to the inherent risks involved.

In conclusion, while Fry’s Investment Report offers valuable insights and potential investment opportunities through Eric Fry’s macroeconomic analysis approach, individual investors should carefully consider their risk tolerance and conduct thorough research before making any decisions based on its recommendations.