Electric vehicles (EVs) have garnered significant attention in recent years, driven by a global push for sustainability and a shift towards cleaner transportation. As more consumers and investors consider the implications of this transition, the question arises: Is investing in EVs a good decision? This article will explore various aspects of EV investment, including market trends, financial considerations, environmental impact, and potential risks.

Investing in electric vehicles can be viewed from multiple angles: purchasing an EV for personal use, investing in EV-related stocks, or supporting startups in the EV sector. Each approach carries its own set of benefits and challenges. The growing demand for EVs is influenced by factors such as rising fuel prices, government incentives, and increasing environmental awareness among consumers.

The following table provides a quick overview of the key factors influencing the EV market:

| Factor | Impact on EV Investment |

|---|---|

| Government Incentives | Encourages consumer adoption and lowers initial costs |

| Market Demand | Growing consumer interest drives sales and stock performance |

| Technological Advancements | Improves vehicle performance and reduces costs over time |

| Environmental Concerns | Increases public support for sustainable transport solutions |

Understanding the Electric Vehicle Market

The electric vehicle market has experienced rapid growth over the past decade. With advancements in battery technology and increasing charging infrastructure, consumers are becoming more comfortable with the idea of owning an EV. This shift is evident in market statistics: a significant portion of potential car buyers are considering electric options due to their lower operating costs and environmental benefits.

As more manufacturers enter the EV space, competition is intensifying. Established automakers are expanding their electric lineups while new startups are emerging with innovative models. This increased competition is beneficial for consumers as it leads to better products and lower prices.

However, it is crucial to understand that while the market is growing, it is also volatile. Factors such as fluctuating raw material prices for batteries, regulatory changes, and technological challenges can impact the stability of investments in this sector.

Investors should keep an eye on trends such as:

- Consumer Preferences: Shifts towards eco-friendly options are influencing buying decisions.

- Government Policies: Supportive regulations can enhance market growth.

- Technological Innovations: Advancements in battery technology can reduce costs and improve performance.

Financial Considerations for Investing in EVs

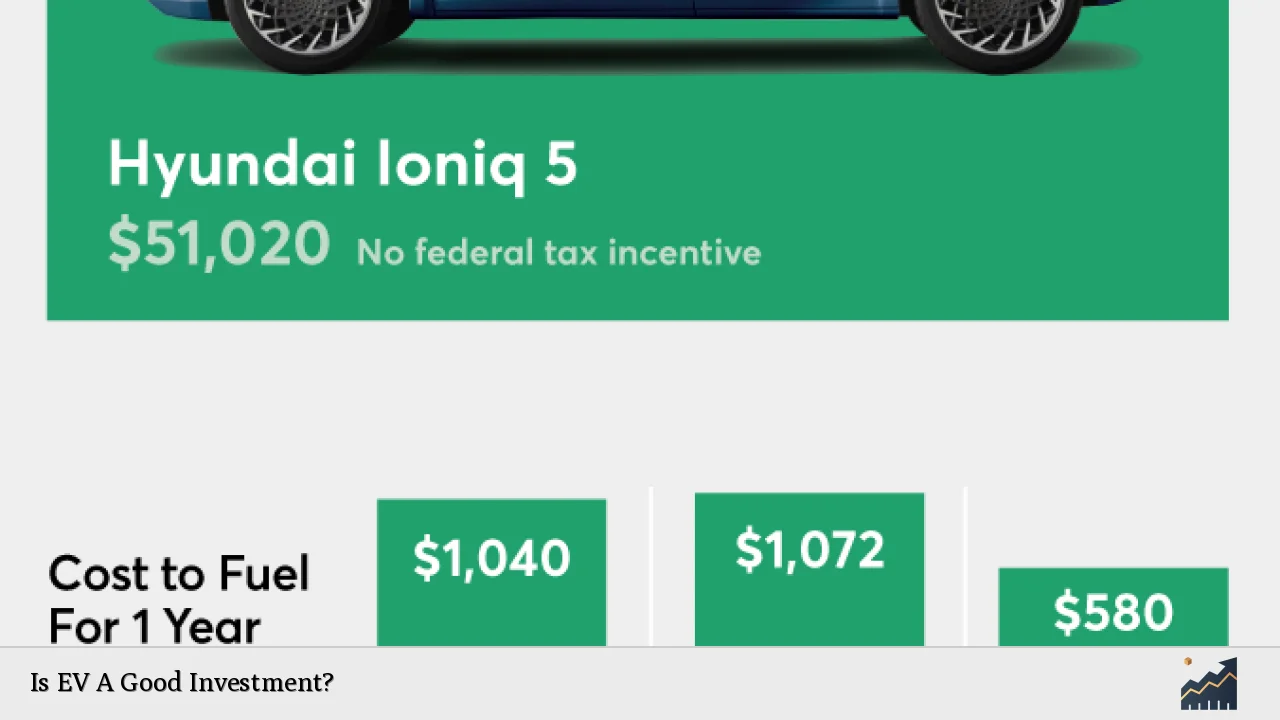

When considering whether to invest in electric vehicles, financial implications play a significant role. The initial purchase price of an EV is often higher than that of a traditional gasoline-powered vehicle. However, this cost can be offset by lower operating expenses over time.

Key financial aspects to consider include:

- Purchase Incentives: Many governments offer tax credits or rebates for purchasing EVs, which can significantly reduce upfront costs.

- Operating Costs: Electric vehicles typically have lower fuel costs compared to gasoline vehicles. Charging an EV is generally cheaper than filling up a gas tank.

- Maintenance Costs: EVs have fewer moving parts than traditional cars, leading to lower maintenance requirements and costs over time.

- Resale Value: As the market matures, resale values for used EVs may stabilize or even increase due to growing demand.

Investors should conduct thorough research on specific models and brands to understand their market positioning and potential return on investment.

Environmental Impact of Electric Vehicles

One of the most compelling reasons to invest in electric vehicles is their positive impact on the environment. Unlike traditional vehicles that emit greenhouse gases, electric cars produce zero tailpipe emissions when operating on battery power. This contributes significantly to reducing air pollution and combating climate change.

However, it is essential to consider where the electricity used to charge these vehicles comes from. In regions where electricity is generated from renewable sources like wind or solar power, the environmental benefits of EVs are maximized. Conversely, if electricity comes from fossil fuels, the overall emissions reduction may be less significant.

Investing in electric vehicles aligns with broader sustainability goals that many governments and corporations are adopting. As public awareness of climate issues grows, so does support for technologies that promote cleaner transport solutions.

Risks Associated with Investing in Electric Vehicles

While there are many advantages to investing in electric vehicles, potential investors must also be aware of the risks involved:

- Market Volatility: The EV market can be unpredictable due to changing consumer preferences and economic conditions.

- Technological Challenges: Rapid advancements can render existing technologies obsolete quickly, impacting companies that fail to keep pace.

- Regulatory Risks: Changes in government policies or incentives can significantly affect market dynamics.

- Infrastructure Development: The success of electric vehicles relies heavily on adequate charging infrastructure; delays or failures in this area could hinder growth.

Investors should weigh these risks against potential rewards when considering investments in the electric vehicle sector.

Future Outlook for Electric Vehicles

The future of electric vehicles appears promising as both consumer acceptance and technological advancements continue to grow. Industry analysts predict that by 2030, a substantial percentage of new car sales will be electric or hybrid models. This shift will likely be driven by ongoing improvements in battery technology that enhance range and reduce charging times.

Additionally, government initiatives aimed at reducing carbon emissions will likely support further growth in this sector. Many countries have set ambitious targets for phasing out internal combustion engine vehicles entirely within the next few decades.

Investors looking at long-term opportunities should consider companies that are well-positioned to capitalize on these trends—those with strong R&D capabilities and a commitment to sustainability will likely thrive as demand increases.

FAQs About Is EV A Good Investment?

- Are electric vehicles worth the investment?

Yes, they often have lower operating costs despite higher initial purchase prices. - What financial incentives are available for buying an EV?

Many governments offer tax credits or rebates that can significantly reduce upfront costs. - How do maintenance costs compare between EVs and gasoline cars?

EVs generally have lower maintenance costs due to fewer moving parts. - What are the environmental benefits of electric vehicles?

They produce zero tailpipe emissions and contribute to reduced air pollution. - What risks should I consider before investing in EVs?

The market can be volatile with technological challenges and regulatory risks.

In conclusion, investing in electric vehicles presents both opportunities and challenges. The growing demand for sustainable transport solutions coupled with technological advancements makes this sector appealing for investors willing to navigate its complexities. By considering financial implications, environmental impacts, risks involved, and future trends, potential investors can make informed decisions about entering the electric vehicle market.