The iShares Core Dividend Growth ETF (DGRO) is a popular exchange-traded fund that focuses on U.S. companies with a history of consistently growing dividends. As investors seek reliable income streams and long-term growth potential, DGRO has garnered significant attention. This ETF tracks the Morningstar US Dividend Growth Index, which selects stocks based on their dividend history, financial health, and growth prospects.

DGRO offers exposure to a diversified portfolio of dividend-paying companies, aiming to provide both income and capital appreciation. The fund’s strategy centers on identifying companies with strong fundamentals and a track record of increasing their dividend payouts over time. This approach can be particularly appealing for investors looking to build a stable, income-generating portfolio with potential for long-term growth.

| DGRO Key Features | Details |

|---|---|

| Expense Ratio | 0.08% |

| Number of Holdings | 415 |

| Dividend Yield | 2.47% |

| Assets Under Management | $31.3 billion |

DGRO Performance and Comparison

When evaluating whether DGRO is a good investment, it’s crucial to examine its performance relative to both its peers and broader market indices. DGRO has demonstrated solid historical returns, with a 10-year annualized return of 11.4%. This performance places it in the top 3.13% of its category, showcasing its strong track record compared to similar funds.

However, it’s important to note that DGRO’s performance has been mixed when compared to the S&P 500. While the fund has provided consistent returns, it has often trailed the broader market index. This underperformance is partly due to DGRO’s focus on dividend-paying stocks, which may not capture the full growth potential of non-dividend-paying companies that have driven significant market gains in recent years.

The fund’s dividend growth strategy has been effective in providing a steadily increasing income stream for investors. DGRO has grown its distribution at a rapid pace of 11.4% CAGR over the past 5 years, which is impressive and ranks second only to the popular SCHD (Schwab U.S. Dividend Equity ETF) in its peer group.

When comparing DGRO to other dividend-focused ETFs, it’s worth noting its relative positioning:

- DGRO offers a lower yield than some high-dividend ETFs but focuses more on dividend growth potential.

- The fund provides broader diversification with over 400 holdings, compared to more concentrated funds like SCHD with around 100 holdings.

- DGRO’s expense ratio of 0.08% is highly competitive, placing it among the least expensive options in its category.

Portfolio Composition and Strategy

DGRO’s portfolio is constructed to capture the potential of companies with strong dividend growth prospects. The fund’s strategy involves selecting stocks based on several key criteria:

- Companies must have at least five years of uninterrupted annual dividend growth.

- Stocks are screened for financial health to ensure the sustainability of dividend payments.

- The portfolio is weighted by dividend dollar value, which tends to favor larger, more established companies.

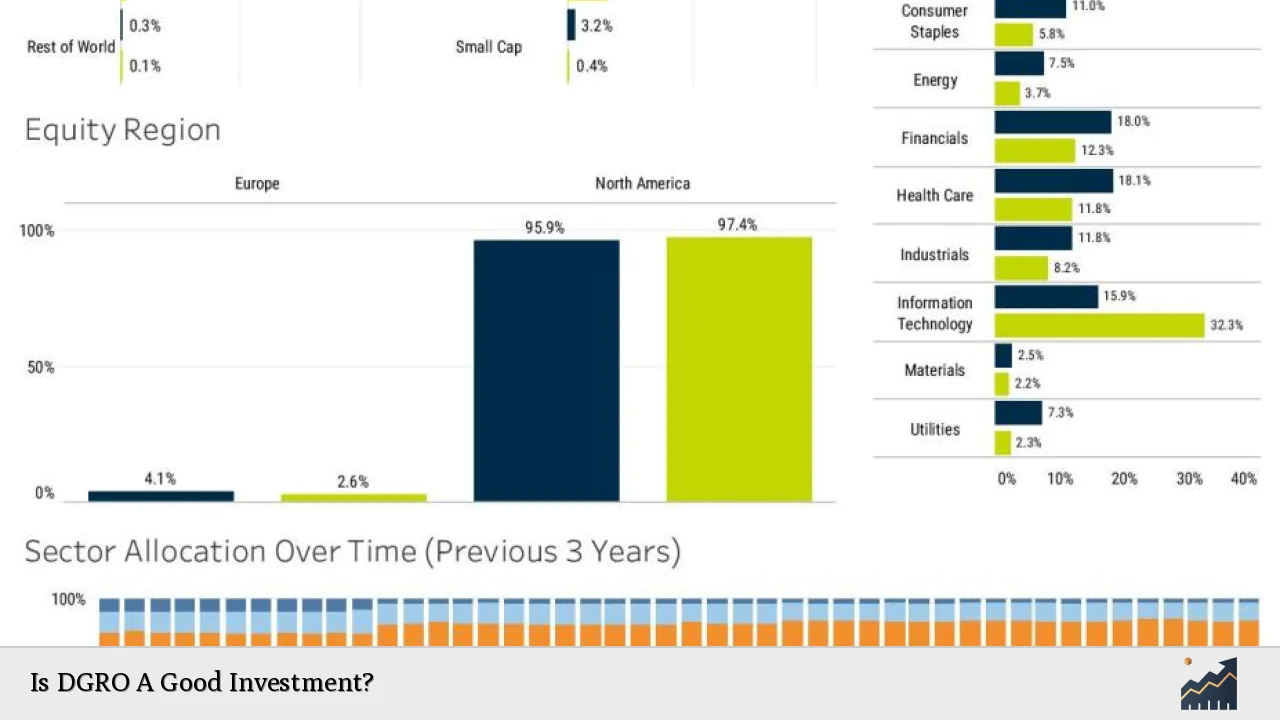

This approach results in a portfolio that is tilted towards large-cap, value-oriented stocks. The top sectors represented in DGRO include:

- Financial Services

- Technology

- Healthcare

- Industrials

- Consumer Defensive

The fund’s top holdings feature well-known blue-chip companies with strong dividend histories, such as Microsoft, Apple, ExxonMobil, and Johnson & Johnson. This composition provides investors with exposure to stable, cash-generating businesses that have demonstrated a commitment to returning value to shareholders through growing dividend payments.

Advantages of Investing in DGRO

Investing in DGRO offers several potential benefits:

- Dividend Growth Focus: The fund’s emphasis on companies with growing dividends can provide a hedge against inflation and potentially lead to higher total returns over time.

- Low Expense Ratio: With an expense ratio of just 0.08%, DGRO is one of the most cost-effective dividend growth ETFs available.

- Diversification: The fund’s broad portfolio of over 400 stocks helps mitigate company-specific risks.

- Quality Tilt: By selecting companies with consistent dividend growth, DGRO inherently focuses on businesses with strong financial health and stable cash flows.

- Tax Efficiency: As an ETF, DGRO offers potential tax advantages compared to actively managed mutual funds.

Considerations and Potential Drawbacks

While DGRO presents an attractive option for dividend-focused investors, there are some considerations to keep in mind:

- Lower Yield: DGRO’s current dividend yield of 2.47% is lower than some other dividend-focused ETFs, which may not meet the income needs of certain investors.

- Large-Cap Bias: The fund’s methodology tends to favor larger companies, potentially limiting exposure to smaller, faster-growing businesses.

- Sector Concentration: DGRO may have significant exposure to certain sectors, which could impact performance during sector-specific downturns.

- Underperformance vs. S&P 500: Historically, DGRO has slightly underperformed the broader S&P 500 index, which may be a concern for investors seeking market-beating returns.

Who Should Consider DGRO?

DGRO may be a suitable investment for:

- Long-term investors seeking a balance of income and growth potential

- Those looking for exposure to quality, dividend-paying companies

- Investors who prioritize dividend growth over high current yield

- Individuals building a diversified, low-cost portfolio

- Retirement accounts focusing on generating growing income streams

It’s important to note that while DGRO can be an excellent core holding for many portfolios, it should be considered as part of a broader investment strategy aligned with an individual’s financial goals, risk tolerance, and time horizon.

Conclusion

In conclusion, DGRO presents a compelling option for investors seeking exposure to dividend growth stocks within a low-cost, diversified ETF structure. Its focus on companies with consistent dividend increases, coupled with a competitive expense ratio and broad diversification, makes it an attractive choice for long-term investors.

However, the fund’s slightly lower yield and historical underperformance compared to the S&P 500 suggest that it may be best suited as part of a balanced portfolio rather than a standalone investment. Investors should carefully consider their income needs, growth expectations, and overall investment strategy when evaluating DGRO as a potential investment.

Ultimately, whether DGRO is a good investment depends on individual financial goals and market outlook. For those seeking a quality dividend growth strategy with the potential for long-term capital appreciation, DGRO remains a solid option worth considering in the ETF landscape.

FAQs About DGRO

- What is the dividend yield of DGRO?

DGRO currently offers a dividend yield of approximately 2.47%. - How often does DGRO pay dividends?

DGRO distributes dividends to shareholders on a quarterly basis. - Can DGRO be held in a retirement account?

Yes, DGRO can be held in various retirement accounts, including IRAs and 401(k)s. - How does DGRO compare to SCHD?

DGRO offers broader diversification with lower yield, while SCHD has fewer holdings and higher yield. - Is DGRO a good hedge against inflation?

DGRO’s focus on dividend growth can potentially provide some protection against inflation over time.