Cryptocurrency has emerged as a significant player in the financial landscape, attracting attention from investors and the general public alike. It represents a new form of digital currency that operates on decentralized networks, primarily using blockchain technology. The allure of cryptocurrencies like Bitcoin and Ethereum lies in their potential for high returns, unique technological features, and the promise of a decentralized financial future. However, investing in crypto is not without its challenges and risks.

As more individuals consider entering the cryptocurrency market, it is crucial to evaluate whether it is a good investment. This evaluation involves understanding the potential benefits and drawbacks associated with cryptocurrencies, analyzing market trends, and assessing personal financial goals and risk tolerance.

| Aspect | Details |

|---|---|

| Potential Returns | High volatility can lead to significant gains or losses. |

| Market Accessibility | Available 24/7, allowing for immediate trading. |

Understanding Cryptocurrency Investment

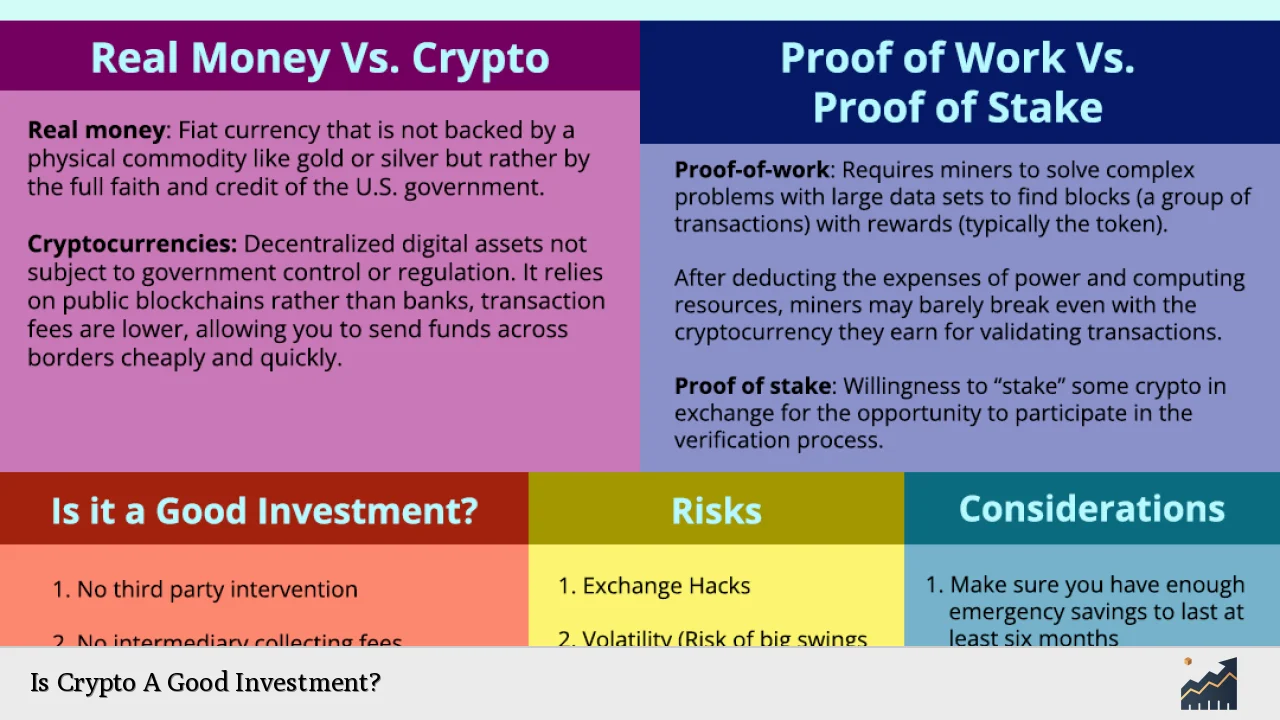

Investing in cryptocurrency is fundamentally different from traditional investments. Cryptocurrencies are digital assets that utilize blockchain technology to secure transactions and control the creation of new units. Unlike stocks or bonds, cryptocurrencies are not backed by any physical assets or government guarantees. This lack of backing contributes to their high volatility.

The cryptocurrency market operates 24/7, providing investors with continuous access to trading opportunities. This accessibility can be both an advantage and a disadvantage; while it allows for quick responses to market changes, it may also lead to impulsive trading decisions driven by fear or greed.

Investors should be aware that the cryptocurrency market is characterized by rapid price fluctuations. For example, Bitcoin’s price has seen extreme highs and lows within short periods. Such volatility can result in substantial returns but also poses a risk of significant losses.

Pros of Investing in Cryptocurrency

Investing in cryptocurrency comes with several advantages that attract both novice and experienced investors:

- High Potential Returns: Cryptocurrencies have the potential for exponential growth. Many early investors in Bitcoin and Ethereum have seen their investments multiply significantly.

- Decentralization: Cryptocurrencies operate on decentralized networks, meaning they are not controlled by any single entity or government. This feature appeals to those seeking independence from traditional banking systems.

- Portfolio Diversification: Including cryptocurrencies in an investment portfolio can enhance diversification. Cryptocurrencies often show low correlation with traditional asset classes like stocks and bonds, potentially reducing overall portfolio risk.

- Accessibility: Cryptocurrencies can be accessed by anyone with an internet connection, making them available to individuals who may not have access to traditional banking services.

- Inflation Hedge: Some investors view cryptocurrencies as a safeguard against inflation due to their limited supply. For instance, Bitcoin has a capped supply of 21 million coins, which can protect against currency devaluation.

Cons of Investing in Cryptocurrency

Despite the potential benefits, there are significant risks associated with cryptocurrency investments:

- Extreme Volatility: The prices of cryptocurrencies can fluctuate wildly within short time frames. This volatility can lead to substantial financial losses for investors who are unprepared for sudden market changes.

- Lack of Regulation: The cryptocurrency market is largely unregulated, which can expose investors to fraud and market manipulation. Without regulatory oversight, there is little recourse for recovering lost funds due to scams or exchange failures.

- Security Risks: While blockchain technology is secure, cryptocurrencies stored on exchanges or wallets can be vulnerable to hacking. Investors must take precautions to protect their private keys and use secure storage methods.

- Complexity: Understanding how cryptocurrencies work requires time and effort. New investors may struggle with the technical aspects of blockchain technology and the mechanics of trading.

- Market Sentiment: The value of cryptocurrencies is often driven by speculation rather than intrinsic value. Prices can be influenced by social media trends or news events, making them susceptible to sudden changes based on public sentiment.

Analyzing Market Trends

To determine if investing in cryptocurrency is a good decision, it is essential to analyze current market trends. The cryptocurrency market has experienced significant growth over the past decade, with Bitcoin leading the charge as the first and most well-known digital currency.

As of late 2023, institutional interest in cryptocurrencies has surged, with numerous companies investing heavily in Bitcoin and other digital assets. This trend indicates growing acceptance of cryptocurrencies as a legitimate asset class among mainstream investors.

However, potential investors should remain cautious about market cycles. The crypto market has historically gone through boom-and-bust cycles characterized by rapid price increases followed by sharp corrections. Understanding these cycles can help investors make informed decisions about when to enter or exit the market.

Personal Financial Goals and Risk Tolerance

Before investing in cryptocurrency, individuals must assess their personal financial goals and risk tolerance. Crypto investments should align with an investor’s overall financial strategy and objectives:

- Risk Assessment: Investors should evaluate how much risk they are willing to take on based on their financial situation and investment experience. Given the high volatility associated with cryptocurrencies, it is essential to only invest what one can afford to lose.

- Investment Horizon: Cryptocurrency investments may require a long-term perspective due to their inherent volatility. Short-term traders may find it challenging to navigate price swings without incurring significant losses.

- Diversification Strategy: Investors should consider how much of their portfolio they wish to allocate to cryptocurrencies versus traditional assets like stocks or bonds. A balanced approach can help mitigate risks while still allowing for potential gains from crypto investments.

Making Informed Investment Decisions

For those considering investing in cryptocurrency, making informed decisions is crucial:

1. Research Thoroughly: Understand the specific cryptocurrencies you are interested in investing in. Research their use cases, underlying technology, team behind the project, and market trends.

2. Stay Updated: Keep abreast of news related to cryptocurrency regulations, technological advancements, and market developments that could impact your investments.

3. Utilize Secure Platforms: Choose reputable exchanges for buying and selling cryptocurrencies. Ensure that you use secure wallets for storing your digital assets safely.

4. Consider Dollar-Cost Averaging: Instead of investing a lump sum at once, consider gradually purchasing cryptocurrencies over time (dollar-cost averaging). This strategy can help reduce the impact of volatility on your investment.

5. Seek Professional Advice: If uncertain about investing in cryptocurrencies or how they fit into your financial strategy, consider consulting with a financial advisor who understands digital assets.

FAQs About Crypto Investment

- Is crypto a safe investment?

No investment is entirely safe; crypto is highly volatile and carries risks. - What are the best cryptocurrencies to invest in?

Popular options include Bitcoin (BTC) and Ethereum (ETH), but research is essential. - How much should I invest in crypto?

Invest only what you can afford to lose; consider your overall financial situation. - Can I lose all my money investing in crypto?

Yes, due to extreme volatility; it’s possible to incur significant losses. - Is it too late to invest in crypto?

No; while prices fluctuate, many believe there are still opportunities for growth.

In conclusion, whether cryptocurrency is a good investment depends on individual circumstances including risk tolerance, financial goals, and understanding of the market dynamics involved. While there are compelling reasons to consider investing in crypto due to its potential returns and innovative technology, one must also weigh these against the inherent risks involved.