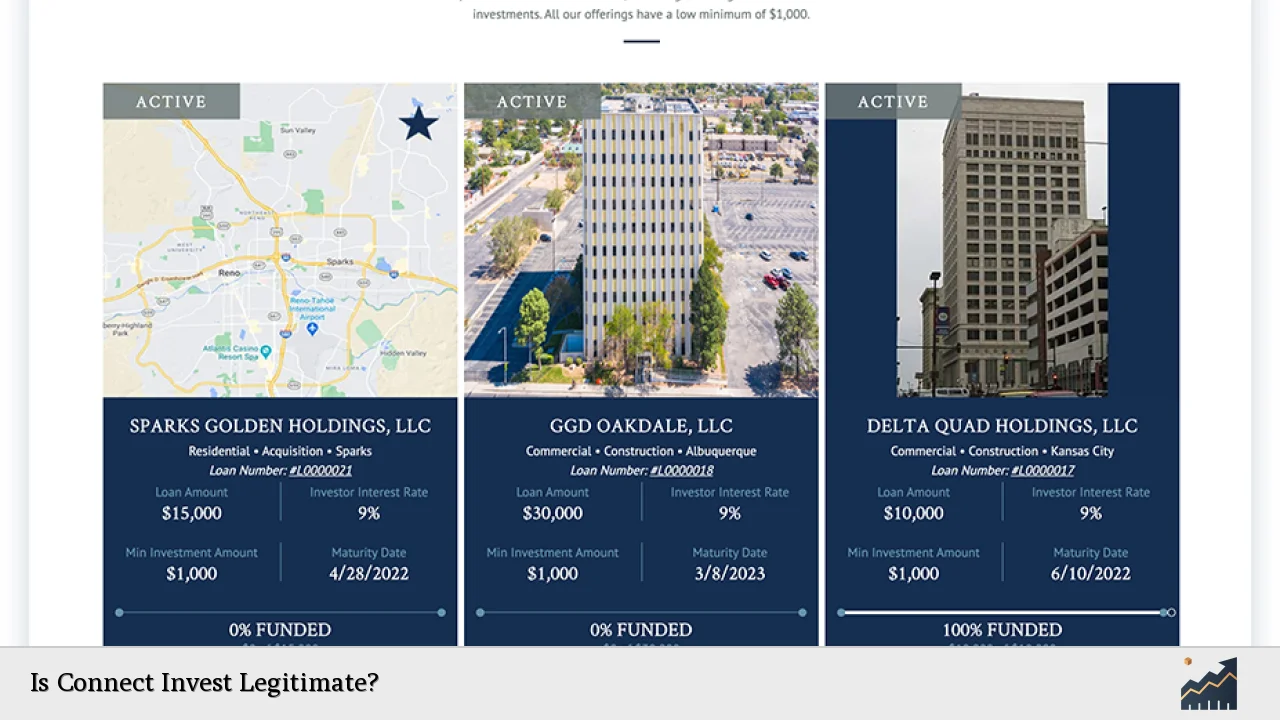

Connect Invest has emerged as a notable player in the realm of online investment platforms, particularly focusing on collateralized debt through real estate short-note investments. With a minimum investment requirement as low as $500 and interest rates ranging from 7.5% to 9%, it aims to attract both seasoned and novice investors seeking higher yields compared to traditional savings accounts. However, the legitimacy and reliability of such platforms are often scrutinized. This article delves into the operational framework of Connect Invest, examining its market position, investment strategies, regulatory standing, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Investment Model | Connect Invest specializes in collateralized debt investments through short-term real estate projects, offering defined exit dates and competitive returns. |

| Market Position | The platform positions itself as a viable alternative to traditional savings accounts, especially in a low-interest-rate environment. |

| Regulatory Compliance | Connect Invest operates without oversight from major financial regulatory bodies, raising concerns about investor protection. |

| User Experience | The platform is designed to be user-friendly, with educational resources available to assist investors in navigating their options. |

| Risk Factors | Investors face risks associated with real estate market fluctuations and the potential for project failures impacting returns. |

| Market Trends | The growing interest in alternative investments and real estate-backed securities reflects a broader trend towards diversifying portfolios amid economic uncertainty. |

Market Analysis and Trends

The current investment landscape is characterized by a significant shift towards alternative investment platforms like Connect Invest. As traditional savings accounts yield minimal returns—averaging around 0.3%—investors are increasingly seeking options that offer higher yields. Connect Invest's offerings are particularly appealing given the ongoing economic challenges, including inflation rates hovering around 7.11% which diminish the purchasing power of cash holdings.

Key trends influencing this market include:

- Rise of Alternative Investments: The global investment market is projected to grow from approximately $4 trillion in 2023 to $4.25 trillion in 2024, driven by increased interest in sustainable investing and digital currencies.

- Real Estate Investment: With a market value reaching approximately $6.7 trillion as of mid-2024, real estate remains a favored asset class for investors looking for stability and income generation.

- Technological Integration: Platforms that leverage technology for better user experience and investment management are gaining traction. Connect Invest's user-friendly interface and educational resources cater to this demand.

Implementation Strategies

Investors considering Connect Invest can adopt several strategies to maximize their potential returns while mitigating risks:

- Diversification: By spreading investments across multiple short-note projects with varying risk profiles and terms (6, 12, or 24 months), investors can reduce exposure to any single project's failure.

- Regular Monitoring: Utilizing Connect Invest’s dashboard allows investors to track performance and receive updates on project milestones, which is crucial for informed decision-making.

- Reinvestment: Investors can roll over their earnings into new short notes upon maturity to compound returns effectively.

- Understanding Terms: Familiarizing oneself with the specific terms of each investment project is essential to align expectations with potential outcomes.

Risk Considerations

While Connect Invest presents opportunities for attractive returns, several risks must be considered:

- Lack of Regulation: The absence of oversight from reputable financial authorities raises concerns about investor protection. Potential investors should exercise caution and conduct thorough due diligence.

- Market Volatility: Real estate markets can be unpredictable; downturns may affect the performance of underlying projects, impacting investor returns.

- Liquidity Risks: Although investments can be liquidated before maturity under certain conditions, there may be restrictions that could delay access to funds.

- Economic Conditions: Broader economic factors such as rising interest rates or inflation can influence investment performance and investor sentiment.

Regulatory Aspects

Connect Invest operates in a regulatory gray area, lacking oversight from major financial regulatory bodies like the SEC or FINRA. This absence of regulation can lead to increased risks for investors since there are no guarantees regarding the safety of their capital or the transparency of operations.

Investors should be aware that platforms like Connect Invest may not provide the same level of consumer protection as more established financial institutions. It is advisable for potential users to seek platforms that adhere to stringent regulatory standards.

Future Outlook

The future of Connect Invest appears promising but fraught with challenges:

- Increased Demand for Alternatives: As more investors seek alternatives to traditional banking products, platforms like Connect Invest may see growth in user adoption.

- Regulatory Scrutiny: As alternative investment platforms gain popularity, they may attract more regulatory attention which could lead to changes in operational practices or compliance requirements.

- Economic Recovery: A recovering economy could bolster real estate markets, benefiting platforms that invest in collateralized debt through property projects.

- Technological Advancements: Continued innovation in fintech may enhance platform capabilities, improving user experience and potentially attracting more investors.

Frequently Asked Questions About Is Connect Invest Legitimate?

- What is Connect Invest?

Connect Invest is an online investment platform specializing in collateralized debt through short-term real estate projects offering competitive interest rates. - Is Connect Invest regulated?

No, Connect Invest operates without oversight from major financial regulatory bodies, which raises concerns about investor protection. - What are the minimum investment requirements?

The minimum investment amount is $500, making it accessible for various types of investors. - What kind of returns can I expect?

Investors can expect annualized returns ranging from 7.5% to 9% based on the specific terms of their investments. - Can I withdraw my funds before maturity?

You may withdraw your investment before maturity if you meet certain eligibility criteria set by the platform. - What risks are associated with investing through Connect Invest?

The primary risks include lack of regulation, market volatility affecting real estate values, and liquidity issues. - How does Connect Invest compare with traditional investments?

Connect Invest offers higher potential yields compared to traditional savings accounts but comes with higher risks due to less regulatory oversight. - What should I do if I have concerns about my investment?

If you have concerns about your investment or experience issues with withdrawals or project performance, it is advisable to contact customer support promptly.

In conclusion, while Connect Invest presents an intriguing opportunity for those seeking higher yields through real estate-backed investments, potential investors should carefully weigh the associated risks against their financial goals and risk tolerance. Conducting thorough research and possibly consulting with financial professionals is highly recommended before making any commitments.