Connect Invest is an online real estate investment platform that has gained attention for its promise of high yields and accessibility to private real estate investments. With a minimum investment requirement of just $500, it aims to democratize access to real estate investing, traditionally seen as a domain for wealthier individuals. This article explores the legitimacy of Connect Invest by analyzing market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

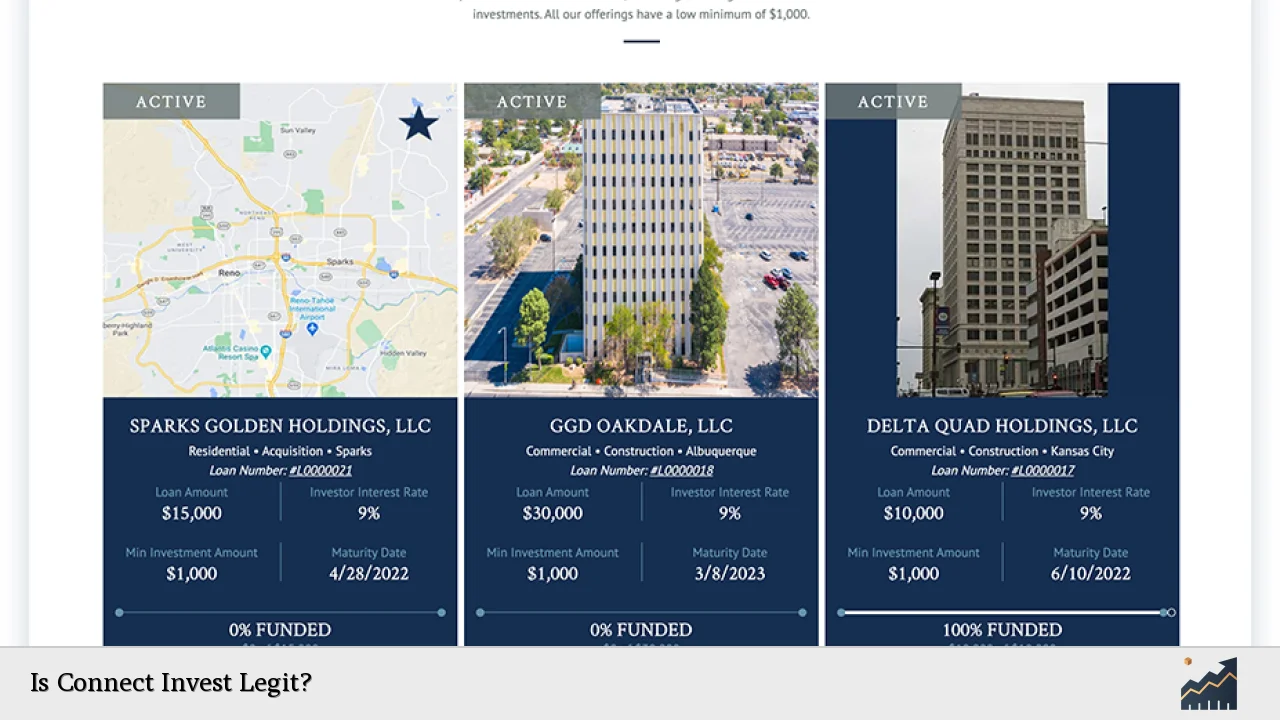

| Investment Model | Connect Invest offers Short Notes, which are real estate debt securities funding various residential and commercial projects. These notes provide fixed monthly returns, with interest rates ranging from 7.5% to 9% depending on the term length (6, 12, or 24 months). |

| Market Position | The platform positions itself as a low-cost entry point for real estate investing, appealing to both accredited and non-accredited investors. It has funded over $9 million in loans with a low default rate of 1.93%, significantly lower than the average commercial real estate default rate of 5.2%. |

| User Experience | Connect Invest boasts a user-friendly interface and responsive customer service, enhancing the overall investor experience. Users can track their investments easily and receive regular updates on project progress. |

| Regulatory Compliance | Connect Invest operates under SEC regulations as a Regulation A Tier 2 offering, ensuring that its investment products meet specific legal standards for investor protection. |

| Market Trends | The platform capitalizes on the growing trend of alternative investments in real estate, particularly during inflationary periods when traditional savings accounts yield lower returns. |

Market Analysis and Trends

The real estate investment landscape has evolved significantly in recent years, particularly with the rise of technology-driven platforms like Connect Invest. Key trends influencing this market include:

- Increased Accessibility: Platforms like Connect Invest have lowered barriers to entry for individual investors by allowing small minimum investments. This trend aligns with a broader movement towards democratizing investment opportunities.

- High-Yield Alternatives: With traditional savings accounts offering minimal interest rates (around 5% as of late 2024), investors are increasingly seeking higher-yield options. Connect Invest's offerings of 7.5% to 9% annual returns are attractive compared to these lower rates.

- Real Estate Resilience: Real estate often performs well during economic downturns due to rising rental prices amid inflation. As such, investing in real estate debt securities can provide a hedge against inflationary pressures.

- Technological Integration: The use of technology in streamlining the investment process is becoming more prevalent. Connect Invest leverages this by providing an easy-to-use platform that simplifies the investment process.

Implementation Strategies

Investors looking to utilize Connect Invest should consider the following strategies:

- Diversification: By investing in multiple Short Notes across different projects, investors can spread risk and enhance potential returns.

- Reinvestment: Investors can reinvest their monthly returns into new Short Notes to compound their earnings over time.

- Term Selection: Choosing the right term length (6, 12, or 24 months) based on individual financial goals and liquidity needs is crucial for optimizing returns.

- Monitoring Performance: Regularly reviewing the performance of investments and staying updated on market conditions can help investors make informed decisions about when to withdraw or reinvest funds.

Risk Considerations

While Connect Invest presents several attractive features, potential investors should be aware of the inherent risks:

- Market Risk: Real estate markets can be volatile; economic downturns may affect property values and rental income.

- Liquidity Risk: Although Connect Invest allows early withdrawals under certain conditions, accessing funds before maturity could be challenging depending on market circumstances.

- Default Risk: While the platform reports a low default rate (1.93%), there is still a risk that borrowers may default on their loans, potentially impacting investor returns.

- Regulatory Changes: Changes in regulations affecting real estate investing could impact how platforms like Connect Invest operate and what protections are available to investors.

Regulatory Aspects

Connect Invest operates under strict regulatory oversight as a Regulation A Tier 2 offering by the SEC. This classification allows it to raise capital from both accredited and non-accredited investors while adhering to specific disclosure requirements designed to protect investors:

- Transparency: The platform conducts thorough due diligence on all projects listed for investment, ensuring that only vetted opportunities are presented to investors.

- Investor Protections: By complying with SEC regulations, Connect Invest provides a layer of security for investors regarding how their funds are managed and what recourse they have in case of issues.

Future Outlook

Looking ahead, several factors will influence the trajectory of Connect Invest and similar platforms:

- Continued Demand for Alternative Investments: As more individuals seek ways to diversify their portfolios beyond traditional stocks and bonds, platforms like Connect Invest are likely to see increased interest.

- Economic Conditions: The performance of real estate investments will be closely tied to broader economic conditions, including interest rates and housing market stability.

- Technological Advancements: Ongoing innovations in fintech may further enhance user experiences and expand investment opportunities within the real estate sector.

- Sustainability Trends: Investors are increasingly interested in sustainable investment options. Platforms that incorporate environmentally friendly projects may attract more capital as awareness grows around climate change issues.

Frequently Asked Questions About Is Connect Invest Legit?

- What is Connect Invest?

Connect Invest is an online platform that allows individuals to invest in short-term real estate debt securities known as Short Notes. - How does Connect Invest generate returns?

Investors earn fixed monthly interest payments from loans funded through their Short Notes, typically yielding between 7.5% and 9% annually. - Is my investment safe with Connect Invest?

While no investment is entirely without risk, Connect Invest has a low default rate (1.93%) and operates under SEC regulations designed to protect investors. - Can I withdraw my money before the term ends?

Yes, you can withdraw your investment before maturity under certain conditions; however, liquidity may vary based on market conditions. - What is the minimum investment required?

The minimum investment required to start investing with Connect Invest is $500. - How does customer support operate?

Connect Invest offers live customer support to assist investors with inquiries or issues they may encounter. - Are there any fees associated with investing?

No fees are charged for using the Connect Invest platform; all earnings go directly to investors. - What types of projects does Connect Invest fund?

The platform funds a diversified portfolio of residential and commercial real estate projects located in high-performing markets across the U.S.

In conclusion, while no investment comes without risks, Connect Invest appears legitimate based on its operational transparency, regulatory compliance, and positive user feedback. Its model provides an accessible way for individual investors to participate in real estate investing while potentially earning attractive returns. However, as with any financial decision, prospective investors should conduct thorough research and consider consulting financial advisors before proceeding.