The CNBC Investing Club, led by renowned financial commentator Jim Cramer, offers a subscription-based service designed to provide individual investors with insights, stock recommendations, and educational resources. As the investment landscape continues to evolve, potential members often wonder whether the benefits of joining this club justify its annual fee, which ranges from $399 to $599. This article provides a comprehensive analysis of the CNBC Investing Club, exploring its offerings, market trends, implementation strategies, risks, regulatory aspects, and future outlook to help investors make informed decisions.

| Key Concept | Description/Impact |

|---|---|

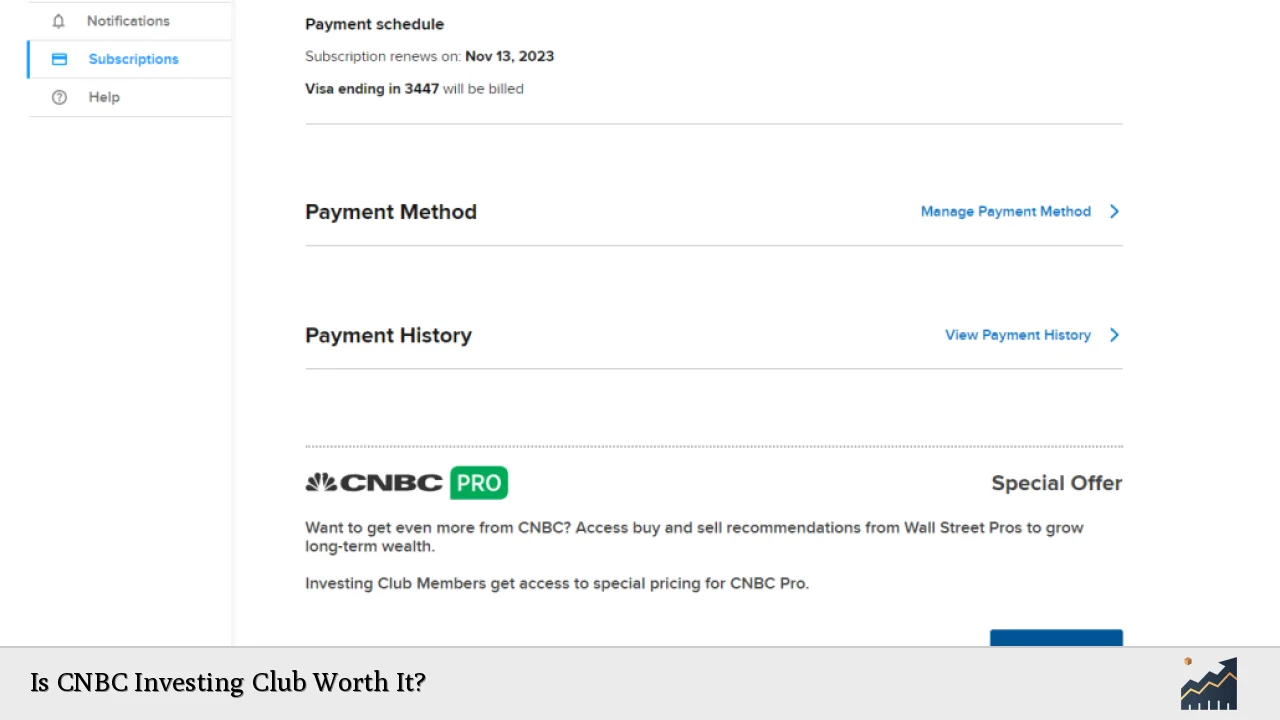

| Membership Cost | The annual subscription fee is between $399 and $599, which some consider steep for the services offered. |

| Expert Insights | Members gain access to Jim Cramer’s market analysis and stock picks, which can enhance investment strategies. |

| Real-Time Alerts | Members receive timely notifications about portfolio changes and market movements, aiding in decision-making. |

| Community Learning | The club fosters a collaborative environment where members can learn from each other and share investment strategies. |

| Charitable Trust Structure | Cramer’s Charitable Trust manages the portfolio, ensuring he has “skin in the game,” which may enhance trust in his recommendations. |

| Risk Management Education | The club provides resources on managing risk and understanding market volatility, crucial for new investors. |

Market Analysis and Trends

The investment landscape is currently characterized by a volatile market environment influenced by several factors:

- Economic Indicators: As of late 2024, inflation rates have shown signs of stabilization, but interest rates remain a concern for many investors. The Federal Reserve’s actions will continue to play a significant role in shaping market dynamics.

- Sector Performance: Technology stocks have been leading the market due to advancements in artificial intelligence (AI) and machine learning. In contrast, traditional sectors like retail are facing challenges due to changing consumer behavior.

- Investor Sentiment: Many individual investors are increasingly turning to educational platforms and investment clubs for guidance as they navigate these turbulent times. The rise of online communities underscores the demand for accessible financial education.

- Investment Strategies: Current trends suggest a shift towards diversified portfolios that include value stocks and dividend-paying equities. Investors are also exploring alternative investments as a hedge against inflation.

Implementation Strategies

Joining the CNBC Investing Club can enhance an investor’s approach through various strategies:

- Utilizing Expert Recommendations: Members can leverage Cramer’s insights to make informed decisions about stock purchases or sales. His experience as a hedge fund manager provides a unique perspective on market movements.

- Participating in Community Discussions: Engaging with fellow club members allows individuals to share insights and strategies, fostering a collaborative learning environment.

- Adapting to Market Changes: The real-time alerts provided by the club enable members to respond quickly to market shifts, potentially capitalizing on opportunities or mitigating losses.

- Educational Resources: The club offers various educational materials that cover fundamental investment principles, risk management techniques, and portfolio diversification strategies.

Risk Considerations

While the CNBC Investing Club provides numerous benefits, potential members should be aware of several risks:

- Market Dependency: Cramer’s recommendations may be influenced by short-term market trends rather than long-term fundamentals. This could lead to volatility in member portfolios.

- Cost vs. Value: The subscription fee may not be justified for all investors. It’s essential to evaluate whether the insights gained translate into actionable investment strategies that align with personal financial goals.

- Potential Bias: As a prominent media figure, Cramer’s opinions may be subject to public scrutiny. Investors should conduct their own research and not rely solely on his recommendations.

- Risk Tolerance Misalignment: The club’s focus on high-growth stocks may not suit conservative investors looking for stability. Understanding personal risk tolerance is crucial before joining.

Regulatory Aspects

Investment clubs are subject to various regulatory considerations:

- Securities Regulations: Clubs must comply with the Securities Act of 1933 and the Securities Exchange Act of 1934. This includes registering with the SEC if certain thresholds are met.

- Tax Implications: Investment clubs can be taxed as partnerships or corporations. Members should consult tax professionals to understand their obligations regarding income generated from club investments.

- Compliance Requirements: Clubs must adhere to state-specific regulations (often referred to as “blue sky laws”) governing securities sales within their jurisdiction.

Future Outlook

Looking ahead, several factors will influence the value proposition of the CNBC Investing Club:

- Evolving Market Conditions: As economic conditions change, so too will investment strategies. The ability of Cramer and his team to adapt will be critical in maintaining member trust and satisfaction.

- Technological Advancements: The integration of AI in investment analysis could enhance decision-making processes within the club. Members may benefit from tools that analyze data more efficiently.

- Growing Interest in Financial Literacy: With an increasing number of individuals seeking financial education, clubs like CNBC’s may see growth in membership as they provide valuable resources and community support.

Frequently Asked Questions About Is CNBC Investing Club Worth It?

- What does my membership include?

Membership provides access to Jim Cramer’s stock picks, real-time alerts on portfolio changes, market analysis, educational resources, and a community of fellow investors. - Is it suitable for beginners?

Yes, the club offers educational resources that can help beginners understand investing principles while providing access to expert insights. - How much does it cost?

The annual subscription fee ranges from $399 to $599 depending on the level of service chosen. - Can I trust Jim Cramer’s recommendations?

Cramer has extensive experience in investing; however, it’s essential for members to conduct their own research alongside his recommendations. - What are the risks involved?

The primary risks include market volatility, potential bias in recommendations, and alignment with personal risk tolerance. - How does this compare with other investment clubs?

The CNBC Investing Club offers unique insights from Cramer but may be more expensive than other platforms like Motley Fool or Seeking Alpha. - Is there a community aspect?

Yes, members can interact with each other through discussions and shared experiences which enhances learning opportunities. - What if I’m not satisfied with my membership?

Review the terms regarding cancellations or refunds before joining; many clubs have specific policies in place for dissatisfied members.

In conclusion, whether or not the CNBC Investing Club is worth it depends largely on individual investor goals and preferences. For those seeking expert insights combined with community support and educational resources, it can be a valuable addition to their investment strategy. However, careful consideration of costs versus benefits is crucial before committing to membership.