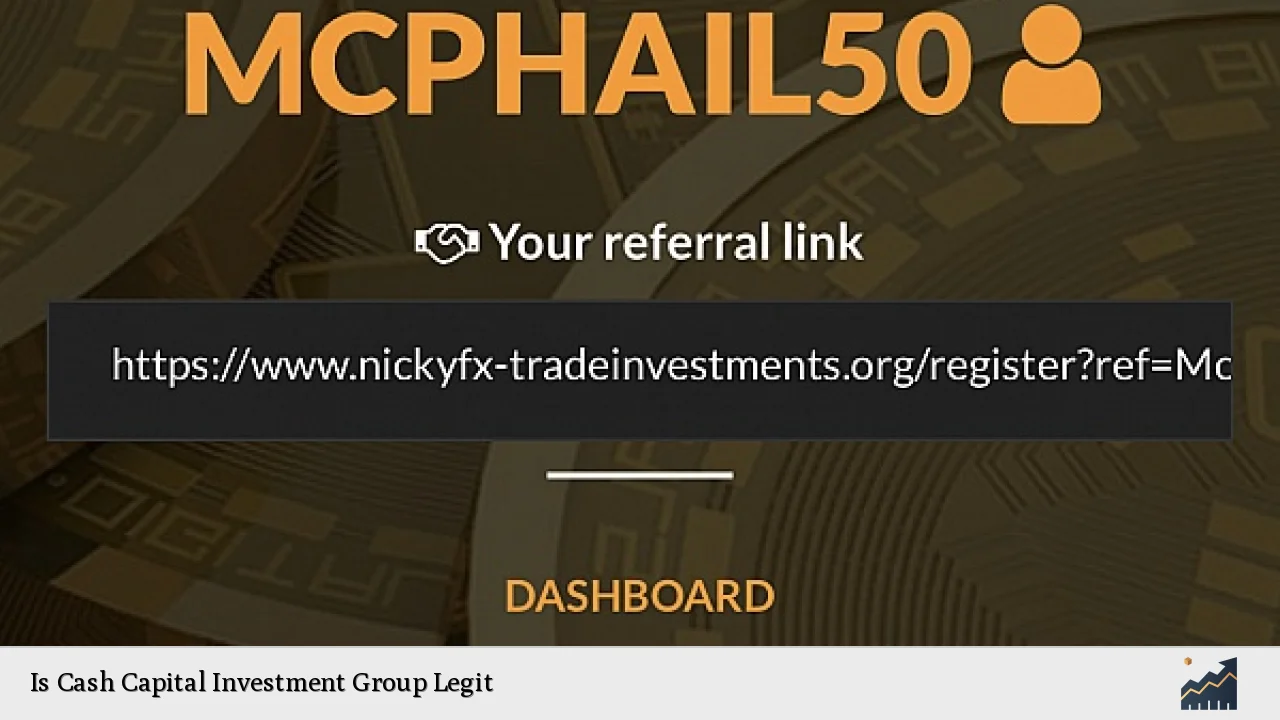

The legitimacy of Cash Capital Investment Group has come under scrutiny due to various reports and reviews highlighting significant concerns regarding its practices and regulatory compliance. As an investment group, it claims to offer high success rates and lucrative investment opportunities, but the lack of regulation and negative customer experiences raise red flags for potential investors.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Status | Cash Capital Investment Group operates without oversight from recognized financial authorities, increasing the risk of fraudulent activities. |

| Customer Reviews | Numerous reviews indicate dissatisfaction among customers, with reports of poor customer service and withdrawal issues. |

| Investment Claims | The group advertises a 95% success rate, but such claims are often unverified and may not reflect actual performance. |

| Market Positioning | It positions itself as a leader in cash management strategies, yet lacks transparency in its operations. |

| Risks Involved | Investing with unregulated firms poses significant risks, including the potential loss of capital without recourse. |

Market Analysis and Trends

The investment landscape is currently characterized by a strong inclination towards cash as a safe haven amid economic uncertainties. As of December 2023, U.S. money market funds held a record $6.3 trillion in assets, reflecting a growing preference for liquidity and stability among investors. This trend is driven by factors such as prolonged inflation, geopolitical tensions, and rising interest rates, leading many to prioritize cash investments over more volatile assets.

Investment groups like Cash Capital Investment Group attempt to capitalize on this trend by promoting themselves as viable options for cash management. However, the absence of regulatory oversight raises concerns about their legitimacy and operational integrity.

Implementation Strategies

For individual investors considering cash investments, several strategies can enhance portfolio performance while minimizing risks:

- Diversification: Spread investments across various asset classes to reduce overall risk.

- Liquidity Management: Maintain a portion of the portfolio in highly liquid assets to ensure quick access to funds when needed.

- Regular Monitoring: Keep track of market trends and adjust investment strategies accordingly.

- Professional Guidance: Seek advice from certified financial advisors to navigate complex investment landscapes.

Investors should be cautious with groups like Cash Capital Investment Group that lack transparency and regulatory backing.

Risk Considerations

Investing with unregulated entities like Cash Capital Investment Group involves several risks:

- Fraud Potential: Without regulatory oversight, there is a higher likelihood of encountering fraudulent schemes.

- Lack of Investor Protection: Investors may have limited or no recourse in the event of losses or disputes.

- Market Volatility: Even cash investments can be affected by market fluctuations; thus, relying solely on claims of high success rates can be misleading.

It’s essential for investors to conduct thorough due diligence before committing funds to any investment group.

Regulatory Aspects

Regulatory compliance is critical in the financial services industry. The Securities and Exchange Commission (SEC) and other regulatory bodies impose strict guidelines to protect investors. Cash Capital Investment Group’s lack of registration with these authorities raises significant concerns about its operations:

- No Regulatory Oversight: The absence of regulation means that there are no checks on the group’s practices or financial health.

- Potential Legal Issues: Operating without proper licensing can lead to legal repercussions for both the firm and its investors.

Investors should prioritize working with firms that are regulated by reputable authorities to ensure their investments are protected.

Future Outlook

The future for Cash Capital Investment Group appears uncertain given its current operational practices. With increasing scrutiny from regulators and a growing number of dissatisfied customers, it may face challenges in maintaining credibility within the investment community.

Investors are advised to remain vigilant and consider alternative options that offer better transparency and regulatory compliance. As market conditions evolve, those seeking stable investment opportunities should focus on established firms with proven track records.

Frequently Asked Questions About Is Cash Capital Investment Group Legit

- What is Cash Capital Investment Group?

Cash Capital Investment Group is an investment firm that claims to offer high returns through various financial products but lacks regulatory oversight. - Is Cash Capital Investment Group regulated?

No, it operates without oversight from recognized financial authorities, raising concerns about its legitimacy. - What do customer reviews say about Cash Capital Investment Group?

Many reviews indicate dissatisfaction with customer service and withdrawal issues, suggesting potential operational problems. - What are the risks associated with investing in Cash Capital Investment Group?

The primary risks include fraud potential, lack of investor protection, and exposure to market volatility. - How can I verify if an investment group is legitimate?

Check for registration with regulatory bodies like the SEC or FCA and look for customer reviews or complaints. - What should I do if I have invested in Cash Capital Investment Group?

If you have concerns about your investment, consider consulting with a financial advisor or legal professional for guidance. - Are there safer alternatives for cash investments?

Yes, consider investing through regulated firms or established money market funds that offer better security and transparency. - Can I recover my funds if I lose money with Cash Capital Investment Group?

The lack of regulation may limit your options for recovery; seeking legal advice may be necessary.

In conclusion, while Cash Capital Investment Group presents itself as an attractive option for investors looking for cash management solutions, the lack of regulation and numerous negative reviews suggest caution is warranted. Investors should prioritize safety by opting for regulated firms that adhere to industry standards.