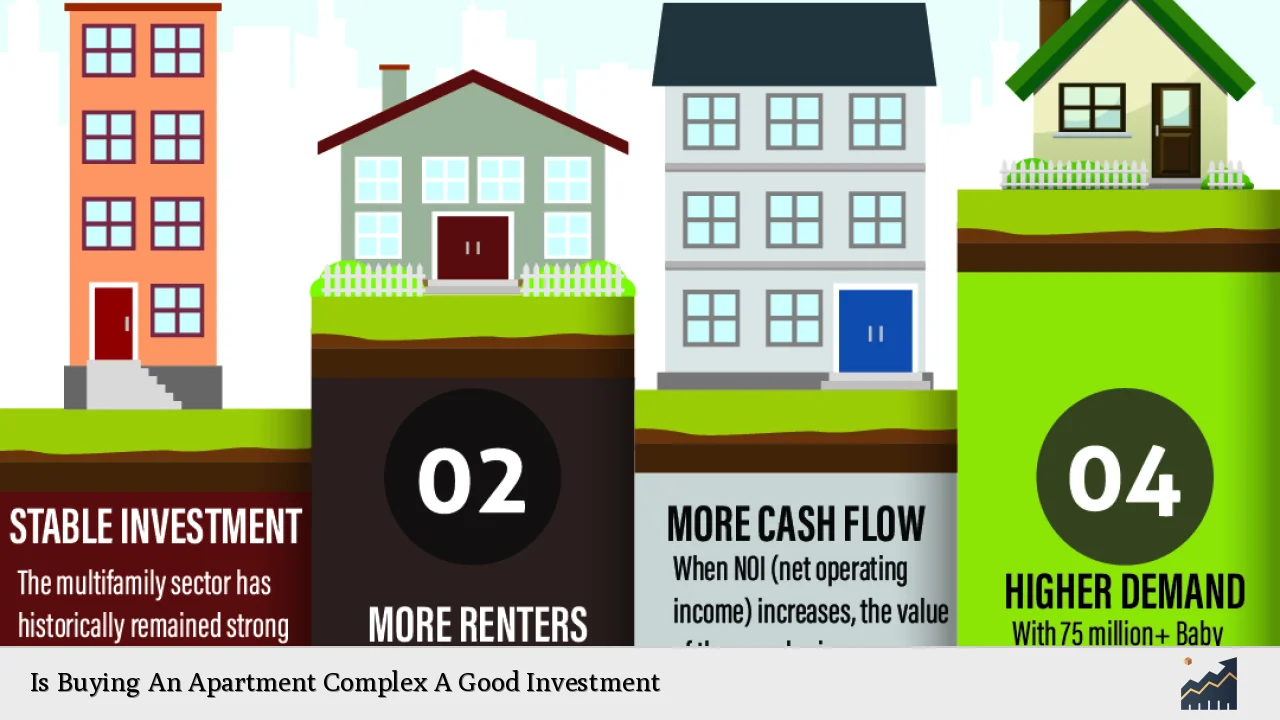

Investing in an apartment complex can be a lucrative opportunity for individual investors and finance professionals alike. With the potential for consistent cash flow, property appreciation, and various tax benefits, many view apartment complexes as a solid addition to their investment portfolios. However, like any investment, purchasing an apartment complex comes with its own set of risks and challenges. This article aims to provide a comprehensive analysis of the current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook for investing in apartment complexes.

| Key Concept | Description/Impact |

|---|---|

| Cash Flow | Apartment complexes can generate significant rental income from multiple units, providing a steady cash flow that can offset operating expenses. |

| Market Trends | Current trends indicate a rise in vacancy rates due to oversupply, but demand remains strong in certain regions, particularly in the South and West of the U.S. |

| Investment Costs | The initial investment for an apartment complex is substantial, often requiring 20-30% down payment and covering closing costs and repairs. |

| Tax Benefits | Investors can take advantage of various tax deductions related to property depreciation, mortgage interest, and operational expenses. |

| Risk Factors | Market fluctuations, tenant issues, and operational challenges can affect profitability; thorough due diligence is essential to mitigate these risks. |

Market Analysis and Trends

The multifamily housing market has shown resilience amid economic fluctuations. As of mid-2024, the national effective rent has reached approximately $2,188, reflecting a year-over-year growth of 1.9% despite rising vacancy rates anticipated to climb to 6.25% due to increased new supply in the market. The demand for apartments remains robust, particularly in regions like the South and West, where job growth continues to attract residents.

Current Market Statistics

- Vacancy Rates: Expected to rise due to oversupply; currently around 6.25%.

- Rent Growth: Projected rent growth for 2024 is modest at 1-1.5%, showing signs of stabilization after pandemic-induced fluctuations.

- New Supply: Approximately 665,000 new units are expected to be delivered in 2024—the highest level since the early 2000s.

- Investment Volume: Apartment sales volume reached $22.3 billion in Q2 2024, marking a significant recovery from previous declines.

These statistics indicate that while there are challenges such as increased competition and rising vacancies, opportunities still exist for investors who conduct thorough market research and select properties wisely.

Implementation Strategies

To successfully invest in an apartment complex, investors should consider several strategies:

Conduct Thorough Market Research

Understanding local market dynamics is crucial. Investors should assess:

- Economic indicators such as employment rates and population growth.

- Local rental demand and supply trends.

- Property values and historical performance metrics.

Financial Viability Assessment

Utilizing key financial metrics is essential for evaluating potential investments:

- Capitalization Rate (Cap Rate): This metric helps determine the expected return on investment by dividing net operating income by property value.

- Cash Flow Projections: Estimating future cash flows involves analyzing expected rental income against operating expenses.

Effective Property Management

Hiring a competent property management team can significantly enhance profitability by ensuring high occupancy rates and tenant satisfaction. Regular maintenance and prompt responses to tenant concerns are vital for retaining tenants and minimizing vacancies.

Diversification

Investing in multiple properties across different markets can mitigate risks associated with local economic downturns. This strategy helps stabilize overall portfolio performance.

Risk Considerations

While investing in apartment complexes can be profitable, it is not without risks:

Market Risks

Economic downturns can lead to decreased rental demand and increased vacancies. Investors must stay informed about local economic conditions that could impact their properties.

Operational Challenges

Managing an apartment complex involves dealing with tenant issues, maintenance requirements, and compliance with local regulations. These operational demands can be time-consuming and require expertise.

High Initial Costs

The upfront investment required for purchasing an apartment complex can be substantial. Investors need adequate capital not only for the purchase but also for ongoing maintenance and potential renovations.

Regulatory Aspects

Investors must navigate various regulatory requirements when purchasing an apartment complex:

- Zoning Laws: Understanding local zoning regulations is essential to ensure compliance when acquiring or developing properties.

- Tenant Laws: Familiarity with tenant rights and landlord obligations is crucial to avoid legal disputes.

- Financing Regulations: Investors should be aware of financing options available through government-backed entities like Fannie Mae or Freddie Mac that cater specifically to multifamily properties.

Future Outlook

The multifamily market is expected to experience continued growth over the next several years despite current challenges:

- Demand vs. Supply: While new construction may lead to short-term oversupply issues, long-term demographic trends favor multifamily housing due to urbanization and changing living preferences among younger generations.

- Technological Integration: The incorporation of technology in property management (e.g., smart home features) may enhance tenant attraction and retention.

- Sustainability Trends: Increasing emphasis on environmentally friendly building practices may influence future developments and investor preferences.

Overall, while the multifamily investment landscape presents challenges such as rising vacancies and fluctuating rents due to oversupply, strategic investments backed by thorough research can yield significant returns over time.

Frequently Asked Questions About Is Buying An Apartment Complex A Good Investment

- What are the primary benefits of investing in an apartment complex?

The primary benefits include consistent cash flow from multiple rental units, potential property appreciation over time, tax deductions on mortgage interest and depreciation, and economies of scale that reduce per-unit operating costs. - What are the risks associated with owning an apartment complex?

Risks include high initial costs, operational challenges such as tenant management and maintenance issues, market fluctuations affecting rental demand, and potential legal complications related to tenant laws. - How do I determine if an apartment complex is a good investment?

Evaluate key metrics such as cap rate, cash flow projections, location dynamics (job growth and population trends), current occupancy rates, and historical performance data. - What financing options are available for purchasing an apartment complex?

Investors can explore traditional mortgages, government-backed loans (Fannie Mae or Freddie Mac), private equity financing, or crowdfunding platforms designed for real estate investments. - How important is property management in maximizing returns?

Effective property management is crucial as it directly impacts occupancy rates, tenant satisfaction, maintenance efficiency, and overall profitability. - What should I look for when choosing a location for my investment?

Look for areas with strong economic indicators such as job growth, low vacancy rates, good schools, amenities nearby (shopping centers or parks), and limited new construction that could saturate the market. - Are there tax benefits associated with owning an apartment complex?

Yes! Owners can benefit from deductions related to mortgage interest payments, depreciation on the property value over time, operational expenses like repairs or management fees. - What trends should I watch in the multifamily housing market?

Watch for changes in occupancy rates across different regions, shifts towards sustainable building practices among developers/investors alike; also keep an eye on technological advancements impacting property management.

In conclusion, buying an apartment complex can indeed be a good investment if approached strategically with careful consideration of market conditions and operational management practices. By understanding both the opportunities presented by this asset class as well as its inherent risks—investors can position themselves effectively within this dynamic sector of real estate investment.