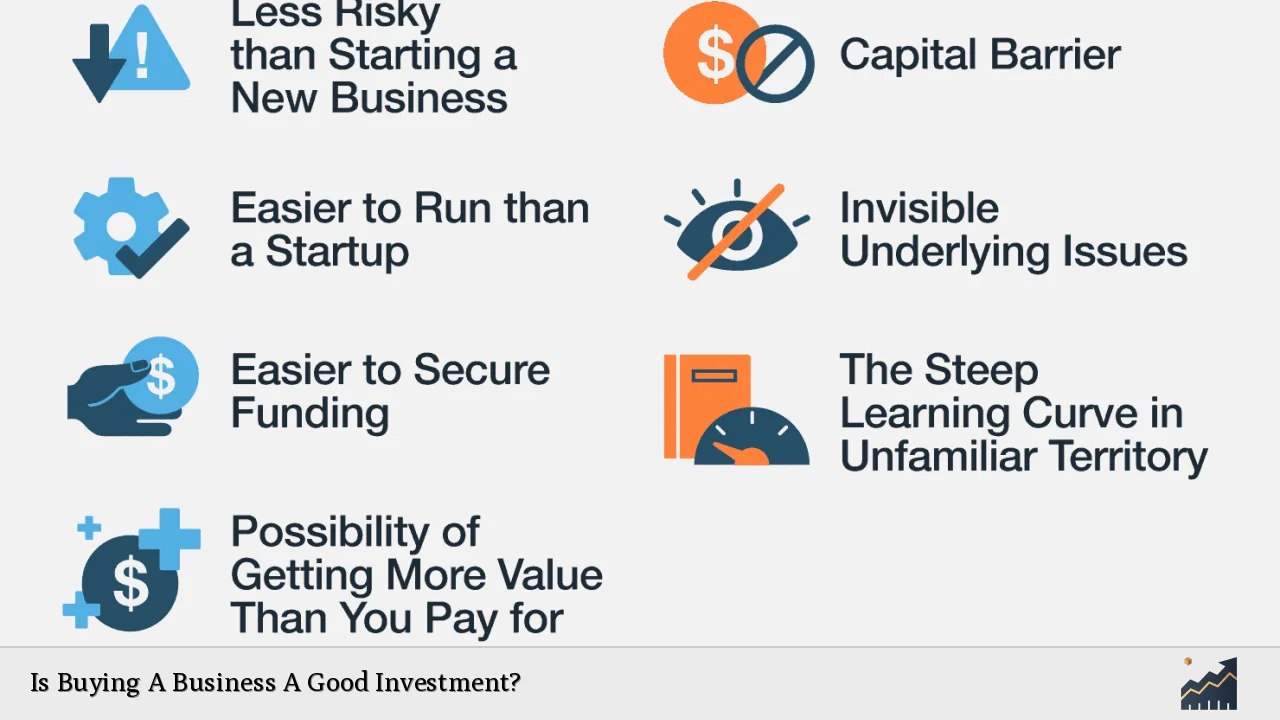

Buying a business can be an excellent investment opportunity for those looking to enter entrepreneurship or expand their portfolio. Unlike starting a company from scratch, purchasing an existing business offers immediate cash flow, established customer base, and proven operational systems. However, like any investment, it comes with its own set of risks and rewards that potential buyers must carefully consider.

Investing in an existing business can provide a higher return on investment compared to traditional investment options like stocks or real estate. It also offers the chance to be your own boss and potentially create a lasting legacy. However, the success of this investment largely depends on factors such as the business’s financial health, market conditions, and the buyer’s ability to manage and grow the company.

| Pros of Buying a Business | Cons of Buying a Business |

|---|---|

| Immediate cash flow | Higher initial investment |

| Established customer base | Potential hidden liabilities |

| Proven business model | Adapting to existing culture |

| Existing operational systems | Possible outdated practices |

Financial Benefits of Buying a Business

One of the primary advantages of purchasing an existing business is the potential for immediate financial returns. Unlike startups that may take years to become profitable, an established business can provide cash flow from day one. This can be particularly attractive for investors looking for steady income or those who want to avoid the uncertainties associated with launching a new venture.

The financial benefits extend beyond immediate cash flow. An existing business comes with tangible and intangible assets that have already been developed and refined. These may include equipment, inventory, intellectual property, and customer relationships. The value of these assets can significantly enhance the overall investment potential of the business.

Moreover, buying a business can offer tax advantages. Depending on the structure of the deal and local tax laws, buyers may be able to deduct certain acquisition costs or benefit from depreciation of assets. It’s crucial to consult with a tax professional to understand the specific tax implications of your business purchase.

Another financial benefit is the potential for higher returns compared to other investment options. While the initial investment may be substantial, the returns from a successful business can far exceed those from traditional investments like stocks or bonds. For example, a well-run business might generate annual returns of 15-30% or more, significantly outperforming average stock market returns.

Operational Advantages of Acquiring an Existing Business

When you buy an existing business, you’re not just purchasing assets; you’re acquiring a fully operational entity. This means you can hit the ground running with established processes, trained employees, and existing customer relationships. These operational advantages can significantly reduce the time and effort required to get a business up and running.

One of the most valuable aspects of buying an existing business is the established customer base. Building a loyal customer following can take years for a new business, but when you purchase an existing company, you inherit these relationships. This provides a stable revenue stream and opportunities for growth through upselling or cross-selling to existing customers.

Existing businesses also come with proven business models. The previous owner has already gone through the trial-and-error process of refining the business strategy, product offerings, and marketing approaches. This can save you considerable time and resources that would otherwise be spent on market research and product development.

Additionally, acquiring a business means inheriting its reputation and brand recognition. A positive reputation in the market can be invaluable, providing credibility and trust that would take years to build from scratch. However, it’s essential to thoroughly research the business’s reputation before purchase, as a negative image can be challenging to overcome.

Risks and Challenges of Buying a Business

While buying a business can be a lucrative investment, it’s not without risks. One of the primary challenges is the high initial investment required. Purchasing an established business typically requires more capital upfront compared to starting a new venture. This can be a significant barrier for some investors and may require securing financing or partnering with other investors.

Another risk is the potential for hidden liabilities. Despite thorough due diligence, there may be undisclosed issues such as pending lawsuits, outstanding debts, or regulatory compliance problems. These hidden liabilities can significantly impact the business’s value and future profitability. It’s crucial to work with experienced professionals, including lawyers and accountants, to uncover any potential issues before finalizing the purchase.

Buyers may also face challenges in adapting to the existing business culture. Every company has its unique culture and way of doing things. As a new owner, you may find it difficult to implement changes or align the existing culture with your vision. This can lead to resistance from employees and potential disruptions in operations.

There’s also the risk of overpaying for the business. Determining the fair value of a business can be complex, involving various valuation methods and considerations. Overpaying can strain your finances and make it difficult to achieve a satisfactory return on investment. It’s essential to conduct a thorough valuation and negotiate effectively to ensure you’re paying a fair price.

Steps to Successfully Buy a Business

To maximize the potential of buying a business as an investment, follow these key steps:

1. Identify your target industry and business type: Consider your skills, interests, and long-term goals when choosing a business to buy.

2. Conduct thorough market research: Understand the industry trends, competition, and growth potential of the business you’re considering.

3. Perform comprehensive due diligence: Examine financial records, legal documents, operational processes, and customer relationships.

4. Assemble a team of professionals: Work with lawyers, accountants, and business brokers to navigate the complexities of the purchase.

5. Secure appropriate financing: Explore options such as bank loans, SBA loans, or seller financing to fund the purchase.

6. Negotiate the purchase agreement: Clearly define the terms of the sale, including price, assets included, and any contingencies.

7. Develop a transition plan: Create a strategy for taking over operations and implementing any changes you plan to make.

8. Communicate with stakeholders: Inform employees, customers, and suppliers about the change in ownership and your vision for the future.

By following these steps and conducting thorough research, you can increase your chances of making a successful business acquisition that provides strong returns on your investment.

Maximizing Your Investment in a Purchased Business

Once you’ve acquired a business, there are several strategies you can employ to maximize your investment:

Optimize Operations

Look for ways to streamline processes and reduce costs without compromising quality. This might involve implementing new technologies, renegotiating supplier contracts, or reorganizing the workforce for greater efficiency.

Expand Market Reach

Explore opportunities to grow the business by entering new markets, launching new products or services, or targeting new customer segments. Leverage the existing brand and customer base to support expansion efforts.

Invest in Marketing and Sales

Allocate resources to enhance marketing efforts and improve sales strategies. This can help attract new customers and increase revenue from existing ones. Consider digital marketing techniques, customer relationship management systems, and sales training programs.

Focus on Customer Retention

Implement strategies to improve customer satisfaction and loyalty. This might include enhancing customer service, offering loyalty programs, or personalizing the customer experience. Retaining existing customers is often more cost-effective than acquiring new ones.

Develop a Strong Team

Invest in your employees’ development and create a positive work environment. A skilled and motivated workforce can significantly contribute to the business’s success and growth.

By focusing on these areas, you can enhance the value of your business investment and potentially achieve higher returns in the long run.

FAQs About Buying a Business as an Investment

- How much money do I need to buy a business?

The amount varies widely depending on the size and type of business, typically ranging from $50,000 to several million dollars. - What’s the average return on investment when buying a business?

ROI can vary, but successful business acquisitions often yield annual returns of 15-30% or more. - Is it better to buy a franchise or an independent business?

It depends on your goals; franchises offer proven systems but less flexibility, while independent businesses allow more control but may carry higher risks. - How long does it typically take to buy a business?

The process usually takes 3-6 months, including finding a suitable business, due diligence, negotiations, and closing the deal. - What types of financing are available for buying a business?

Options include bank loans, SBA loans, seller financing, investor capital, and using personal assets or retirement funds.