Berkshire Hathaway, led by the renowned investor Warren Buffett, has long been a focal point for investors seeking stability and growth. This conglomerate encompasses a diverse range of businesses, including insurance, utilities, and consumer goods. Its investment strategy is rooted in value investing, focusing on acquiring companies with strong fundamentals and sustainable competitive advantages. As we analyze whether Berkshire Hathaway is a good investment, we will explore its performance, financial health, and strategic positioning in the market.

| Aspect | Details |

|---|---|

| CEO | Warren Buffett |

| Founded | 1839 |

| Headquarters | Omaha, Nebraska |

| Market Cap | $700 billion (approx.) |

Performance Overview

Berkshire Hathaway has consistently demonstrated strong performance over the years. In 2024, it outperformed the S&P 500 index, achieving a 25.5% increase in its Class A shares compared to the S&P’s 23.3% gain. This marked the ninth consecutive year of positive returns for Berkshire Hathaway, showcasing its resilience and effective management strategies. The company’s strong operational earnings were bolstered by significant investment income and underwriting profits from its insurance subsidiary, Geico.

The impressive growth can be attributed to several factors:

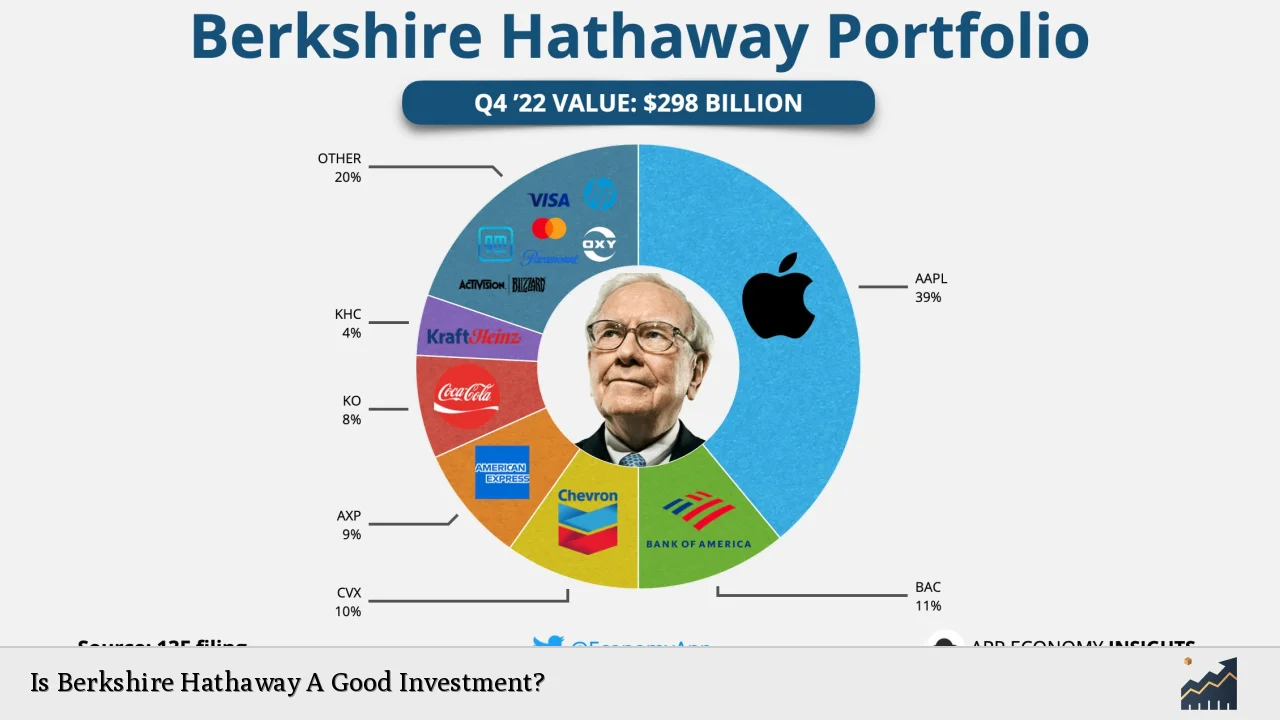

- Diverse Portfolio: Berkshire’s extensive portfolio allows it to mitigate risks associated with market volatility.

- Strong Management: Warren Buffett’s leadership has been pivotal in making sound investment decisions.

- Cash Reserves: The company holds approximately $325 billion in cash reserves, providing flexibility to seize new opportunities.

This combination of factors positions Berkshire Hathaway favorably for continued growth and stability.

Investment Strategy

Berkshire Hathaway’s investment strategy is characterized by a long-term buy-and-hold approach. Buffett focuses on acquiring companies that exhibit strong fundamentals and potential for long-term growth. This strategy has proven successful over decades, as evidenced by Berkshire’s average annual return exceeding that of the S&P 500 since Buffett took control in the 1960s.

Key elements of this strategy include:

- Value Investing: Identifying undervalued companies with solid business models.

- Control Investments: Preference for acquiring entire businesses rather than just stocks allows for better management oversight.

- Long-Term Perspective: Emphasis on sustainable growth rather than short-term gains.

This disciplined approach has cultivated a loyal shareholder base that values stability and long-term growth.

Financial Health

Berkshire Hathaway’s financial health is robust, evidenced by its substantial cash reserves and consistent revenue generation. The company reported a significant increase in interest income, reaching $8 billion in the first three quarters of 2024, up from $4.2 billion during the same period in the previous year. This surge can be attributed to rising interest rates and effective cash management strategies.

Moreover, Berkshire’s diversified investments across various sectors help cushion against economic downturns. The company’s insurance operations provide a steady stream of income through premiums collected, which further enhances its financial stability.

Key Financial Metrics

| Metric | Value |

|---|---|

| Cash Reserves | $325 billion |

| Class A Share Price (2024) | $700,000+ |

| Annual Return (Average) | Exceeds S&P 500 |

These metrics reflect Berkshire Hathaway’s strong financial position and its ability to navigate market fluctuations effectively.

Competitive Advantages

Berkshire Hathaway enjoys several competitive advantages that bolster its position as a leading investment firm:

- Strong Brand Reputation: The company is synonymous with reliability and ethical business practices.

- Diverse Business Model: Its operations span various industries, reducing dependency on any single sector.

- Experienced Leadership: Warren Buffett’s expertise and long-standing experience in investing provide strategic direction.

These advantages contribute to Berkshire Hathaway’s resilience against market challenges and enhance its attractiveness as an investment option.

Market Trends and Challenges

While Berkshire Hathaway has demonstrated remarkable performance, it faces certain challenges that could impact future growth:

- Market Volatility: Economic fluctuations can affect investment returns and operational performance.

- Size Limitations: As one of the largest companies globally, achieving high growth rates may become increasingly difficult.

- Interest Rate Changes: Shifts in interest rates can influence investment income and borrowing costs.

Despite these challenges, Berkshire’s diversified portfolio and strong cash position allow it to adapt to changing market conditions effectively.

Future Outlook

Looking ahead, Berkshire Hathaway’s outlook remains positive. The company’s disciplined investment strategy continues to attract investors seeking long-term value. With its substantial cash reserves, Berkshire is well-positioned to capitalize on potential market dislocations or acquisition opportunities that may arise during economic downturns.

Moreover, as global economic conditions evolve, Berkshire’s ability to adapt its portfolio will be crucial. The company’s focus on industries with strong growth potential—such as renewable energy—aligns with emerging market trends and societal shifts towards sustainability.

FAQs About Is Berkshire Hathaway A Good Investment?

- Is Berkshire Hathaway a safe investment?

Berkshire Hathaway is generally considered a safe investment due to its diversified portfolio and strong financial health. - What makes Berkshire Hathaway unique?

Berkshire Hathaway’s unique approach combines value investing with long-term ownership of companies. - How does Warren Buffett influence Berkshire’s performance?

Warren Buffett’s investment philosophy and decision-making significantly shape the company’s strategic direction. - What are the risks associated with investing in Berkshire Hathaway?

The primary risks include market volatility and potential difficulties in sustaining high growth rates due to the company’s size. - Should I invest in Berkshire Hathaway now?

This decision should be based on individual financial goals; however, many view it as a solid long-term investment choice.

In conclusion, investing in Berkshire Hathaway presents an opportunity for those seeking stability and long-term growth potential. With its robust financial health, strategic management under Warren Buffett, and diverse portfolio of businesses, it remains an attractive option for investors looking to navigate uncertain markets while aiming for consistent returns.