Investing in artificial intelligence (AI) has become a hot topic among investors, analysts, and businesses alike. As the technology continues to evolve, its applications span various sectors, promising substantial returns. However, the investment landscape for AI in 2023 presents both opportunities and challenges. Understanding whether AI is a good investment requires examining current trends, market dynamics, and potential risks.

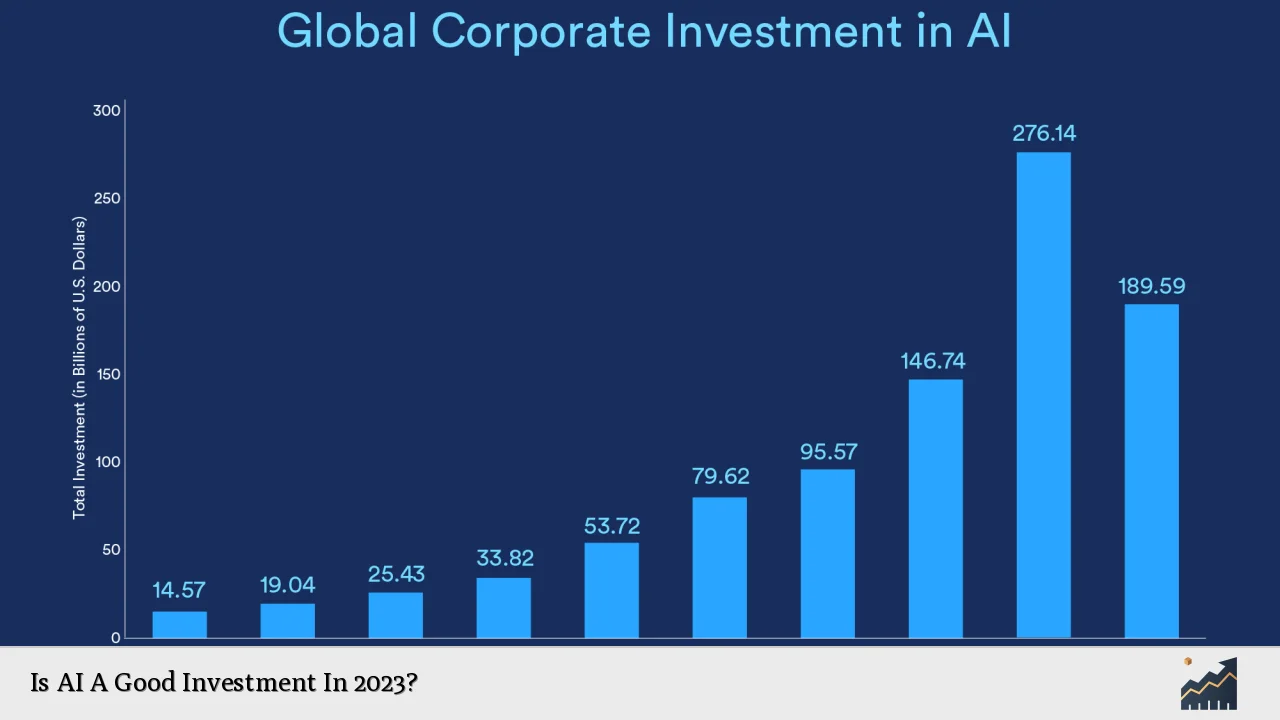

AI has garnered significant attention due to its transformative potential across industries such as healthcare, finance, manufacturing, and retail. In 2023, the global AI market was valued at approximately $142.3 billion, reflecting a robust interest from both corporate and private investors. Notably, the rise of generative AI has attracted substantial funding, with startups raising around $42.5 billion across various equity rounds.

However, while there is excitement surrounding AI investments, caution is warranted. Reports indicate a decline in overall investment activity compared to previous years. Mergers and acquisitions related to AI fell significantly in 2023, indicating that investors are becoming more selective about where they allocate their capital.

| Aspect | Details |

|---|---|

| Global AI Market Value (2023) | $142.3 billion |

| Funding Raised by AI Startups (2023) | $42.5 billion |

Current Trends in AI Investment

The landscape of AI investment in 2023 is characterized by several key trends that investors should consider:

- Generative AI Dominance: Generative AI has emerged as a leading area of investment, accounting for nearly 48% of total funding in the sector. This shift highlights the growing interest in technologies that can create content and automate processes.

- Increased Funding for Established Players: Major companies like OpenAI and Anthropic have secured significant investments, with OpenAI alone raising $14 billion. This trend indicates that while new startups are emerging, established players continue to attract the bulk of investment.

- Diverse Applications: AI technologies are being integrated into various business functions, from customer service chatbots to advanced data analytics tools. This diversification presents numerous opportunities for investors looking to capitalize on different sectors.

Despite these positive trends, investors must remain vigilant about potential pitfalls.

Risks Associated with AI Investments

Investing in AI is not without its risks. Here are some critical factors to consider:

- Market Volatility: The tech sector is known for its volatility, and AI investments are no exception. Economic downturns or shifts in consumer behavior can significantly impact the performance of AI companies.

- Regulatory Scrutiny: As AI technologies become more prevalent, regulatory bodies are increasing their scrutiny of how these technologies are developed and deployed. Investors must consider the implications of potential regulations on their investments.

- Sustainability Concerns: Some investors express concerns about the sustainability of certain AI business models. If companies fail to demonstrate clear paths to profitability or if their technologies do not deliver on promises, investor confidence may wane.

Understanding these risks can help investors make informed decisions about their portfolios.

Strategies for Investing in AI

For those interested in investing in AI, several strategies can be employed:

- Direct Stock Investment: Investors can choose to buy shares of companies directly involved in AI development. Companies like Nvidia and Microsoft are leaders in this space and have shown strong growth due to their investments in AI technologies.

- Exchange-Traded Funds (ETFs): For those looking for diversified exposure to the sector without picking individual stocks, investing in ETFs focused on AI can be an effective strategy. These funds typically hold a basket of stocks from various companies involved in AI.

- Venture Capital Funds: For accredited investors willing to take on higher risk for potentially higher rewards, venture capital funds focusing on early-stage AI startups may be appealing. This approach allows investors to support innovative companies at the forefront of technology development.

Each strategy comes with its own risk profile and should align with the investor's overall financial goals.

The Future Outlook for AI Investments

Looking ahead, the outlook for AI investments remains cautiously optimistic:

- Projected Market Growth: The global market for artificial intelligence is expected to reach approximately $200 billion by 2025, indicating continued growth potential for investors willing to enter this space now.

- Technological Advancements: Ongoing advancements in machine learning and natural language processing are likely to create new opportunities within the sector as businesses seek innovative solutions to improve efficiency and productivity.

- Corporate Adoption: A significant percentage of companies are prioritizing AI integration into their business strategies. About 87% of firms plan to invest more heavily in AI technologies over the next few years.

Investors should keep an eye on these trends while also being aware of potential challenges that could arise as the market evolves.

FAQs About Is AI A Good Investment In 2023

- Is investing in AI safe?

Like any investment, there are risks involved; however, careful selection and diversification can mitigate some risks. - What sectors benefit most from AI?

Sectors such as healthcare, finance, manufacturing, and retail are seeing significant benefits from adopting AI technologies. - How can I start investing in AI?

You can start by purchasing stocks of established companies or investing in ETFs focused on AI. - What is generative AI?

Generative AI refers to algorithms that can create new content or data based on training data. - What is the future outlook for AI investments?

The future outlook remains positive with projected growth and increasing corporate adoption expected.

In conclusion, while investing in artificial intelligence offers exciting opportunities due to its rapid growth and transformative potential across industries, it is essential to approach it with caution. Understanding market dynamics, recognizing risks, and employing sound investment strategies will be crucial for those looking to capitalize on this evolving landscape.