Certificates of Deposit (CDs) are financial products offered by banks and credit unions that provide a fixed interest rate for a specified period. They are considered low-risk investments, making them attractive for conservative investors looking for predictable returns. With current interest rates hovering around 5% or more, many individuals are reevaluating whether investing in CDs is a wise decision given the economic climate. This article explores the benefits and drawbacks of CDs, helping you determine if they align with your financial goals.

| Feature | Description |

|---|---|

| Safety | FDIC insured up to $250,000 |

| Liquidity | Funds are locked until maturity, penalties apply for early withdrawal |

| Returns | Fixed interest rates, generally higher than savings accounts |

| Investment Strategy | Can be used in CD ladders for better liquidity |

Understanding CDs

A Certificate of Deposit is essentially a time deposit where you agree to leave your money with a bank or credit union for a predetermined period, typically ranging from a few months to several years. In return, the institution offers you a guaranteed interest rate that is often higher than traditional savings accounts. The key characteristics of CDs include:

- Fixed Interest Rates: The rate remains constant throughout the term.

- Maturity Terms: Common terms include 3 months, 6 months, 1 year, and up to 10 years.

- Early Withdrawal Penalties: Accessing funds before maturity usually incurs penalties that can erode your earned interest.

The appeal of CDs lies in their ability to provide a safe investment option with predictable returns. However, potential investors must weigh these benefits against the limitations associated with locking funds away for extended periods.

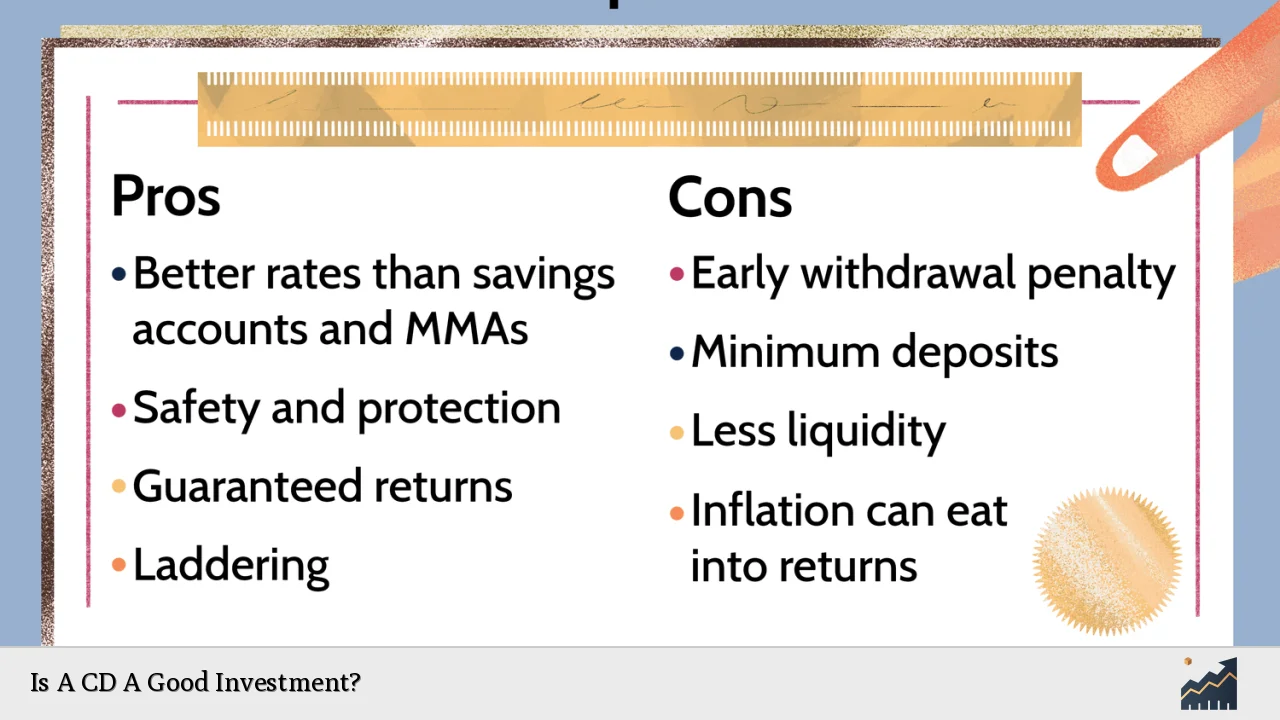

Pros of Investing in CDs

Investing in CDs comes with several advantages that can make them an attractive option for certain investors:

- Safety and Security: CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor per bank. This insurance provides peace of mind that your principal investment is protected even if the bank fails.

- Higher Interest Rates: Compared to standard savings accounts, CDs typically offer higher interest rates. Current rates exceeding 5% make them an appealing choice for those looking to grow their savings without taking on significant risk.

- Predictable Returns: With fixed interest rates, you can easily calculate how much you will earn by the end of the term. This predictability can aid in financial planning.

- No Market Volatility: Unlike stocks or mutual funds, CDs are not subject to market fluctuations. This makes them suitable for risk-averse investors who prefer stability over potential high returns.

Investors can also choose different strategies to maximize their CD investments, such as building a CD ladder, which involves purchasing multiple CDs with varying maturity dates to maintain liquidity while earning higher rates.

Cons of Investing in CDs

While there are many benefits to investing in CDs, there are also notable downsides that potential investors should consider:

- Limited Liquidity: One of the most significant drawbacks is that your money is tied up until the CD matures. If you need access to your funds sooner, you may face steep penalties that could negate any interest earned.

- Inflation Risk: If inflation rises significantly during the term of your CD, the real value of your returns may diminish. For example, if your CD earns 5%, but inflation rises to 6%, your purchasing power effectively decreases.

- Lower Returns Compared to Other Investments: While CDs offer safety and predictability, they generally do not provide returns as high as riskier investment options like stocks or mutual funds. This presents an opportunity cost if better investment options become available while your money is locked in.

- Reinvestment Risk: When a CD matures, there is a chance that prevailing interest rates may be lower than when you initially invested. This could lead to reinvesting at less favorable rates.

These disadvantages highlight the importance of aligning CD investments with your overall financial strategy and liquidity needs.

Strategies for Investing in CDs

To maximize the benefits of investing in CDs while mitigating some risks, consider employing various strategies:

- CD Laddering: This strategy involves purchasing multiple CDs with staggered maturity dates. For instance, if you have $10,000 to invest, you might allocate $2,000 each into five different CDs maturing at one-year intervals. This approach allows you to access some funds annually while still benefiting from higher long-term rates.

- Short vs. Long-Term Investments: Depending on current interest rates and personal financial goals, you may choose shorter-term CDs if you anticipate needing access to cash soon or longer-term CDs if you can afford to lock away funds for higher yields.

- Monitoring Rates: Keep an eye on prevailing interest rates and shop around for competitive offers from various banks and credit unions. Rates can vary significantly between institutions.

By employing these strategies thoughtfully, you can enhance your overall return on investment while maintaining some level of liquidity.

When Are CDs a Good Investment?

CDs may be particularly suitable under certain conditions:

- Short-Term Savings Goals: If you’re saving for a specific goal within a defined timeframe—such as buying a car or funding a wedding—CDs can provide a safe place to grow those savings without market risk.

- Risk-Averse Investors: For those who prioritize capital preservation over high returns, CDs offer an excellent option due to their guaranteed returns and FDIC insurance.

- Hedging Against Inflation: In periods when inflation is rising but not yet outpacing CD rates significantly, they can serve as an effective tool for preserving purchasing power compared to traditional savings accounts.

However, if you require immediate access to your funds or are seeking higher returns through more aggressive investments, other options may be more appropriate.

FAQs About Is A CD A Good Investment?

- What is a Certificate of Deposit (CD)?

A CD is a time deposit offered by banks that pays a fixed interest rate over a specified term. - Are CDs safe investments?

Yes, they are insured by the FDIC up to $250,000 per depositor per bank. - What happens if I withdraw money from my CD early?

You will likely incur penalties that could reduce your earned interest. - How do I choose the right term for my CD?

Select a term based on your financial goals and when you’ll need access to the funds. - Can I lose money investing in CDs?

While unlikely due to FDIC insurance, early withdrawal penalties can lead to reduced returns.

In conclusion, whether investing in a Certificate of Deposit (CD) is a good choice depends largely on individual financial circumstances and goals. For those seeking safety and predictability in their investments while navigating current economic conditions marked by rising interest rates and inflation concerns, CDs present an appealing option. However, it’s essential to consider liquidity needs and potential opportunity costs associated with locking up funds for extended periods before committing to this investment strategy.